A while ago I was able to conduct an interview with Gustas Germanavičius, the co-founder of EvoEstate, and presented the platform briefly. A lot has happened since then. A secondary market has been added, many new projects and above all many new project originators were connected. Some of them are certainly known such as Brickstarter, Crowdestor or ReInvest24. Others, however are completely unknown to new investors. In this blog post I would therefore like to shed some light on these and give an EvoEstate project originators overview.

Spanish project originators

As you can see from the graph the majority of the project originators are Spanish companies. Directly followed by the Baltic project originators. This should be taken into account if you want to build a diversified portfolio at EvoEstate.

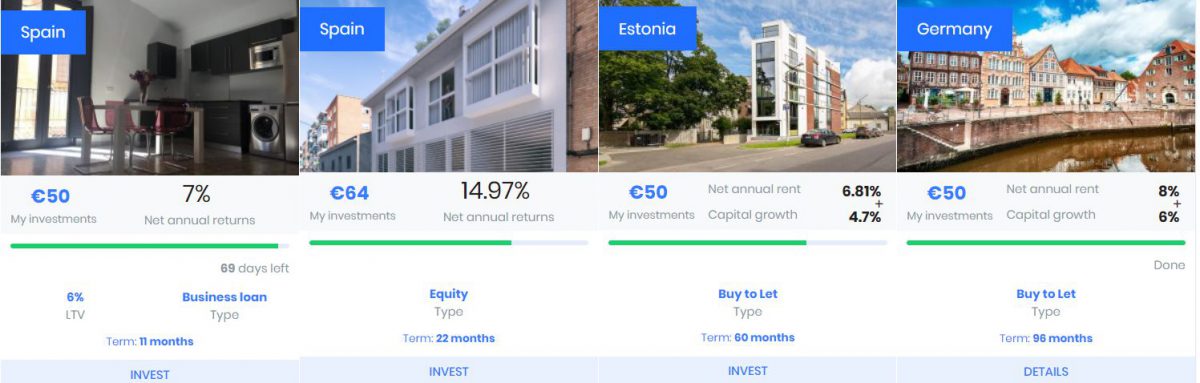

Brickbro is one of the smaller project originators based in Barcelona. Brickbro specializes in fix & flip projects in the Barcelona metropolitan area and in the madrid area in the future. The company is still relatively young and was founded in 2018 by Guillermo Preckler. If you want to invest directly via Brickbro, a project-dependent minimum investment of 50€ to 300€ is required. In addition, you have to be a Spanish citizen in order to be able to invest at all. EvoEstate offers a unique opportunity here where the Brickbro parent company offers an opportunity to invest in their private deal. Usually this investment has a 50.000€ minimum ticket, but with EvoEstate you can invest from 50€.

![]()

Brickstarter is a little more well-known, but also a relatively young company (founded in 2017). The loan volume is similar to Brickbro. Brickstarter specializes in apartments in Seville, Alicante and Malaga, which are first rented out and later flipped. Their apartments are rented out in Airbnb and Booking.com platforms and generated attractive net 5-6% annual returns, but also with these returns investors participate in capital gains which are expected to be 2-3%. At Brickstarter directly, investors can invest in projects with just 50€.

For Brickstarter 0,5% cashback is available for 90 days.

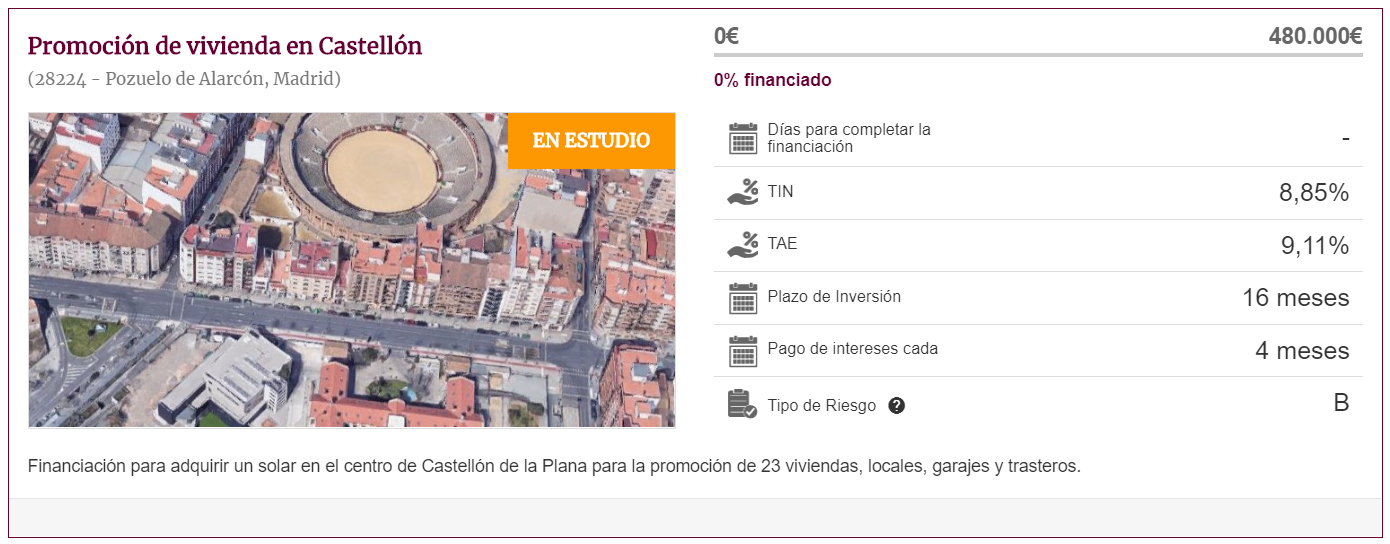

The next Spanish project originator is called Civislend . Civislend was founded like Brickstarter in 2017. The platform specialises in development projects in the Madrid and Malaga area. This project originator is also one of the smaller ones, but is regulated by the National Securities Market Commision (CNMV). The same applies to Civislend as brickbro, and you can only invest through EvoEstate if you are not a Spanish resident. Civislend is considered a quality lender and their returns might not be the highest (6-8% annualy), but they carry out a high quality research. As well if you compare it to Housers, their fees for the borrowers range between 3-4%, housers 7-9%. Which means that Civislend’s borrowers borrow for 10-12% intrest rate, while Housers for 17-20%. You see it's a different risk level.

The largest connected project developer at EvoEstate is Housers. The company was founded in 2016 and was the first real estate platform in Spain. To be precise, Housers is a marketplace. It can invest not only in Spanish loans, but also in development loans from Italy and Portugal. You can also invest with Housers from 50€.

EvoEstate lists only those Housers projects that have development licenses or are renovation projects. This has to do with the changed risk profile, because many of their projects are high risk, due to the borrowers’ interest rate explained before.

Also founded in 2016 was Inveslar – The Urban Investors. The platform has focused on the markets of Madrid, Barcelona, Valencia and the Costa Brava. On the positive side, there have been no failed projects since its inception and investors have not had any outages. At Inveslar, a minimum investment of 100€ is required. Inveslar from last month became regulated, as they are using Socilen regulatory umbrella. Inveslar as Brickstarter and Reinvest24 are directly the project owners. They have been in Catalonia’s real estate market for the last 30 years.

Propcrowd was founded in 2018 and is working with Forcadell. This company has over 60 years of experience in the Spanish real estate market. Propcrowd also requires a minimum of 100€.

At EvoEstate there was no Propcrowd deal so far. As soon as there is a project fitting the criteria, it will be offered at the platform.

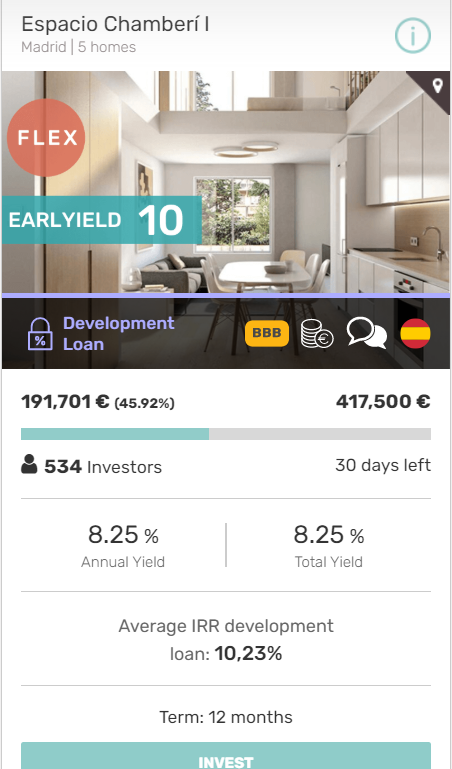

Stockcrowd is the second largest project developer at EvoEstate. The Barcelona-based company was founded in 2015. They are also directly regulated by the CNMV. They provide sort of a small platforms to real estate developers and real estate investment funds- Brickbro is one of their clients, without the technical solution, they also provide the regulatory umbrella. To invest through Stockcrowd investors shall provide NIE/NIF which is only possible if you are a Spanish resident. However, with EvoEstate you can invest from anywhere in the world. Their investments are usually fixed-interest loans in Spain- mostly in Barcelona area.

Urbanitae (founded in 2017) is a project originator that is directly regulated by the CNMV. Spanish residentship is necessary in order to be able to invest directly in Urbanitae. Urbanitae specialises in new developments in Madrid area, the form of investment is equity- meaning highest risk / highest returns. Their target returns rate is 14-15% annual returns. The minimum investment on their platform starts from 500€, while investing through EvoEstate you can do it just for 50€.

Baltic project originators

The Baltic project originators from Estonia, Latvia and Lithuania are the second largest group. Three of them are already known to many investors. The other two not, at least for me.

The Latvian platform has focused on buying whole apartments, renovating them and then selling the individual apartments. Since its foundation in 2016, Bulkestate has had no defaults and many successful projects. With as old as 50€ you can invest directly at Bulkestate, if you want to. It should be noted that almost all projects are final. In the future, however, there will also be more projects that pay monthly interest. That's the positive thing.

The negative thing is that there will be no more Bulkestate deals at EvoEstate anymore. Mainly it's because the deals doesn't fit the skin-in-the-game criteria of EvoEstate.

But a thing that has really brought to them concerns, was that Bulkestate has been financing their own deals, switching mortgages without providing the necessary documents to help investors make informed decisions.

When EvoEstate has ordered documents about their companies from the state registry they have found complicated ownership structures and they were reluctant to explain why have they chosen to do it this way. That's the reason why EvoEstate will not offere Bulkestate deals anymore.

Yes, my favorite platform Crowdestor is also represented at EvoEstate. To be precise, one could invest in the ‘Industrial business center Tvaikonis'. Gunars and Janis founded Crowdestor 2018 and the platform has a steep track of success. Not for nothing is Crowdestor the second largest platform in my portfolio after Mintos.

By the way there is a special deal with my link. 1% cashback on your investments in the first 180 days.

However, it’s important to note that EvoEstate does not take all their deals for financing, where they find too high risk or lack of documentation to make proper financial analysis.

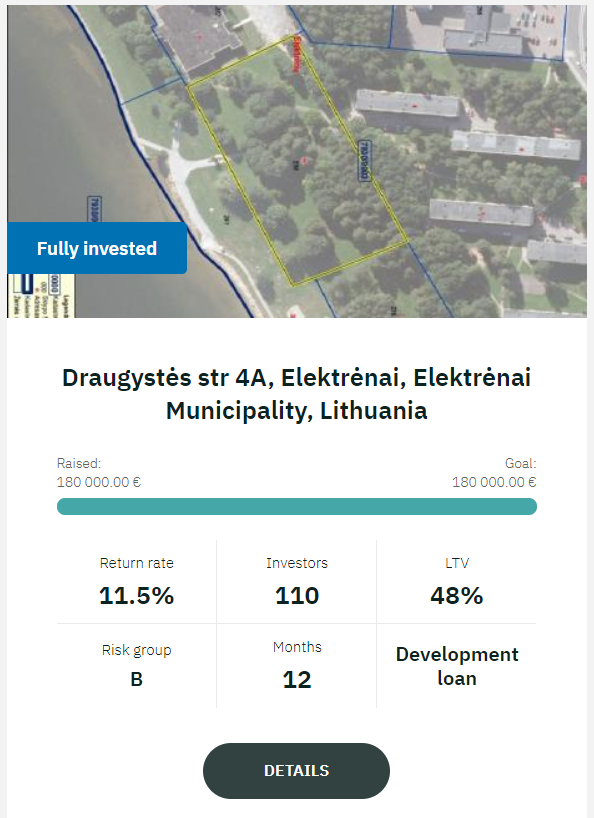

Projects from the Nordstreet project originator are more common at EvoEstate. Three projects have already been successfully repaid at EvoEstate. There are many more successful projects to be found directly on Nordstreet. The platform was founded in Lithuania in 2018 and investors can invest in real estate projects as early as 100€. Projects from Lithuania and Vilnius are mainly financed. An interesting exception, however, was a property from North Carolina, which was also listed on EvoEstate. Nordstreet is directly regulated by the central bank of Lithuania and is the 2nd largest platform in Lithuania.

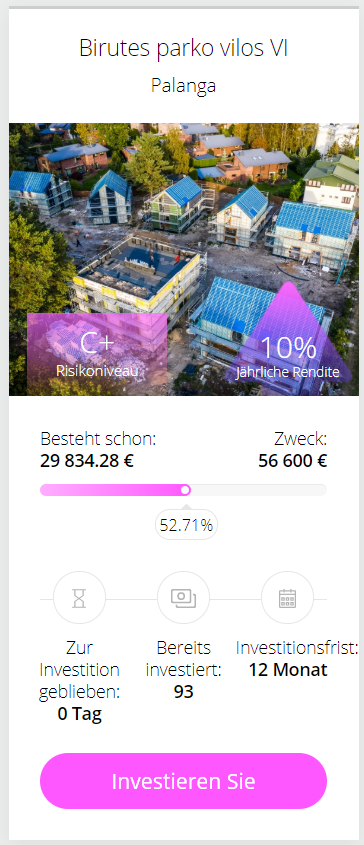

Another rather unknown project originator is Profitus. The lithuanian-based company was founded in 2017 and mainly finances projects from the Lithuanian cities of Vilnius, Kaunas and Palanga. Like Nordstreet, Profitus is regulated by the Central Bank of Lithuania.

EvoEstate will finance deals from Profitus which fit their skin-in-the-game philospohy.

If you look at the lower end of my XIRR ranking, you will also find ReInvest24 there. Responsible is the 2% fee per project. Nevertheless, the business model of the Estonian platform is, in my opinion, very good. They specialize in real estate projects, which are either renovated and then rented out or even sold through. ReInvest24 was founded in 2017, but the team has a long experience (since 2005). On the platform you have to invest at least 100€.

German project originators

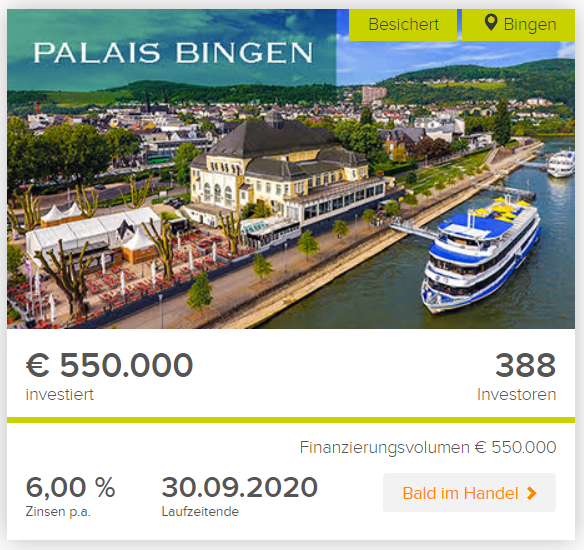

Germany and the real estate market there are also represented at EvoEstate. Although only two platforms have been used so far, this will change in the future.

One of the most famous German platforms is certainly Bergfürst. The Berlin-based company was founded in 2011 and finances projects from Germany, Austria and Spain. On EvoEstate, Bergfürst is the second largest project operator. There you can invest from 10€ by savings plan.

Rather unknown, at least for me, is iFunded. Founded in 2015, the Berlin real estate agency focuses mainly on Berlin real estate. The portfolio also includes those from Erfurt or Leipzig. Most projects are subordinated loans, but there are also loan receivables and bonds. The available projects have a return of 5-7% over a term of one to five years.

Project originators from Great Britain

The UK is also represented by EvoEstate with two platforms. What is exciting is how the whole thing will behave with Brexit. EvoEstate informed that they shall launch the UK dealflow as soon as they implement internal currency exchange tool.

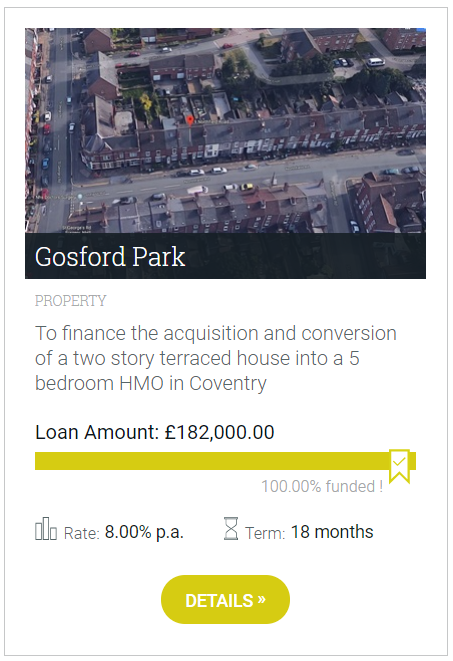

Founded in 2015, Blend specializes in growth projects with up to 15% return on investment. For this, however, investors must also put at least 1,000 Pounds on the table.

The Birmingham-based investment consultancy was founded in 2013 by current CEO Mike Bristow and is regulated by the Financial Conduct Authority (FCA). Crowdproperty has a mega track record. The minimum investment on the platform is £500.

Dutch project originators

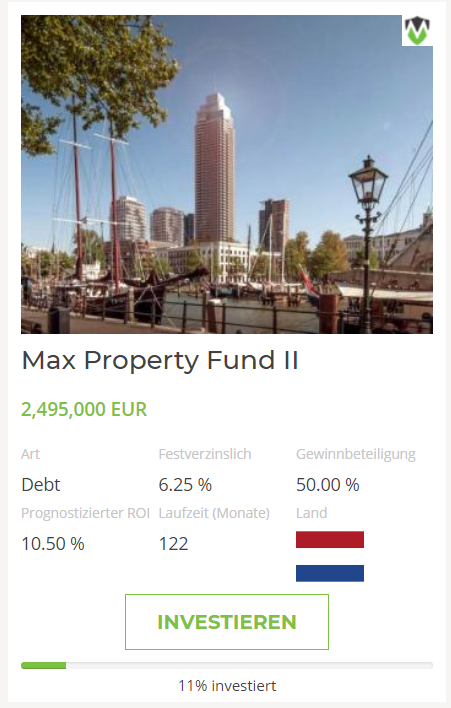

Our neighbour is also represented with a platform.

Max Crowdfund was founded in Rotterdam in 2015 and is the first Dutch crowdfunding platform for real estate in the country. The platform can already have 75,000 users, who can invest between 100€ and 1000€ depending on the project.

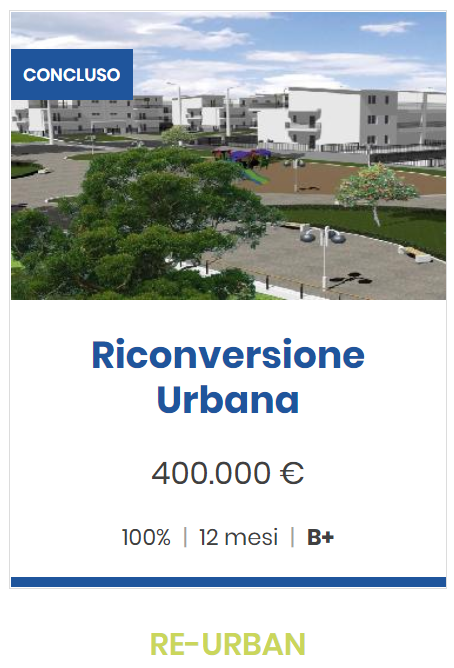

Italian project originators

The smallest project operator called Re-Lender comes from Italy (founded in 2018) and can only boast a single project of €400,000. Two more projects are expected to be added soon. However, it remains to be seen how the whole thing will develop. In the blog of EvoEstate, Re-Lender was introduced in more detail.

Facts

Let's take a look at the different types of loans. Development loans represent the largest part. There are a variety of different types of credit. Personally, I find buy-to-let, buy-to-sell and buy-to-let-then-flip the most exciting.

As with many real estate projects, there is of course a large proportion of final projects. This must, of course, be taken into account if we want to diversify sensibly. However, the proportion of projects that pay monthly or partly monthly is still quite high.

The following diagram shows project starters after the loans granted. It is striking that many Spanish project originators have rather lent smaller amounts of credit. Apart from Housers.

Summary

A total of 19 platforms are now connected via the EvoEstate aggregator platform. And to anticipate it, it won't be the last. In my opinion, EvoEstate offers above all the opportunity to invest in the southern European real estate market. But the Baltic states, Great Britain and Germany are also covered. In addition, there are 16 different types of credit. True to my motto ‘Invest diversified' nothing stands in the way of maximum diversification.

If EvoEstate is worth a look my link gives you a starting bonus of 15€.

Revolut – My account for p2p and crowdlending

Since I don't want to transfer everything from my regular bank account to the platforms, I was looking for a simpler solution. A few months ago I stumpled upon Revolut.

After being skeptical at first I'm now a big fan of the app. Transactions to the different platforms and also withdrawals are executed very fast. In addition you can with the free Revolut VISA card with max. 200€ cash limit per month at an ATM. And that without additional costs!

In addition Revolut is my faithful travel companion. Since I also work abroad from time to time I also looked for a way to simply exchange currencies. This is easily possible with the Revolut app. Also without fees (up to 6.000€ per month)!

About new projects on Twitter and Instagram

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (invest diversified) in which I invest myself. There are also a few insights into how I am invested in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!