Hello there, interest enthusiasts! Today, we've got another P2P portfolio update July 2023, letting you in on the latest happenings in the world of P2P lending. Surprisingly, July brought in a bit more cash flow than expected. In the following blog post, we'll dive into the reasons behind this. Enjoy the read!

‘Strategy'

In total, I still have around 45.000 EUR invested across various platforms. Since I'm continuing to build up equity for a property, I'm withdrawing the interest from most platforms. For a few of them, it's not worth it due to fees. Over the past few months, I've reduced my involvement with some platforms and am in the process of exiting completely. As part of a portfolio consolidation, a few more platforms might follow suit.

As usual, I'll provide an overall overview with the IRR ranking before diving into specific platforms. However, there won't be a table this time, as it's too cumbersome to update every month. I won't mention the categories “Will continue (re)investing” and “Withdrawal phase” anymore, as interest is deducted from all platforms from time to time. I'll only continue to mention “Investment is expiring” to keep you informed about the respective platforms.

IRR ranking July 2023

I've selected the 01.07.2017 as a start, as this is where I started tracking my P2P investments.

- Lendermarket 18,28%

- Quanloop 18,05% ***

- hive5 14,82% ***

- Esketit 12,93%

- Afranga 12,85%

- NeoFinance 12,62%

- Robocash 11,85%

- Viainvest 11,81%

- Income Marketplace 11,70%

- Bondster 11,30%

- Twino 10,85%

- IUVO 10,67%

- PeerBerry 10,62%

- Lande 10,39%

- Mintos 10,28% **

- ReInvest24 9,19% **

- EstateGuru 8,92%

- Debitum Network 8,50%

- Crowdestor 7,96% **

- Linked Finance 7,55%

- Bulkestate 7,26% *

- InRento 7,01% **

- Go & Grow 6,58%

- EvoEstate 6,23% */**

- AxiaFunder (GBP) 1,56% */****

- Bullride 0,09% **/***

Bondora API 19,99%Swaper 13,41%Moncera 9,22%Crowdestate -6,99%

The * and colors have the following meanings:

- * Investment (temporarily) paused

- ** Fees (on primary or secondary market)

- *** Test balloon

- **** Currency fluctuations

xxxxInvestment stopped/finished successfully- Green Yield in line or above expectations

- Yellow Yield could be better

- Red Platform underperforms

Platforms

P2P (Buy-Back)

![]()

Lendermarket saw further gains in terms of returns in July. However, it's important to note that more loans are overdue here compared to other platforms, primarily due to Creditstar pushing the limits. This might not sit well with everyone, especially new P2P investors. The XIRR at the end of July stood at 18,28% with an investment of 1.653 EUR. Recently, Conor Gibney was introduced as the new CEO with ambitious plans.

Since I have ‘only' invested a little over 1.000 EUR in Lendermarket, my investment doesn't feel as exposed as the rest.

If you use my link*, you can get up to 5% cashback through the current Summer Cashback campaign when you invest 1.000 EUR or more. This offer has been extended until September 4, 2023! I receive a one-time €5 + 1.5%. You can find the exact terms here.

![]()

At Robocash, I had invested 776,78 EUR at the end of June, and the IRR was 11,85%. The goal here is to reach 1.000 EUR in investments.

Due to the still relatively low investment amount, I don't see my investment as questionable. Additionally, Robocash has a long track record, which adds to my confidence in the platform.

If you are interested in Robocash, you can use my link*. As compensation, I get 1% cashback after 90 days and a one-time 5€.

The IRR at Mintos was 10,28% at the end of July, with an investment of 5.960 EUR. I have been investing manually and selectively on the platform for a long time, especially focusing on loans from the following loan originators:

- DelfinGroup

- Eleving Group

- IuteCredit

- Credifiel

- Everest Finanse

- Sun Finance

Mintos is one of my largest platforms. Nothing has changed with the questionable investments; they still account for around 38% of my portfolio, specifically those under “in Recovery.

Mintos* offers until August 31, 2023 a 50 EUR bonus for an investment of at least 1.000 EUR and on top 1% cashback for 90 days. I receive 50 EUR, too.

The IRR at IUVO was 10,67% at the end of July, with around 1.565 EUR invested.

At IUVO, 27% of my investments are questionable due to the Polish CBC loans.

By registering by clicking on the banner above, I will receive a one-time 5€ upon registration and 2% of the investment of the first 30 days and 3% for investments from day 31-90.

Twino boasts an IRR of 10,85% with 1.229 EUR invested at the end of July. Twino is one of the platforms I'm considering expanding my investment in over the medium term. Recently, Twino has also started offering investments in rental properties, although the minimum investment here is higher, at 100 EUR. Returns are expected to be 6-8%. To kickstart these investments, there's a 5% cashback offer at the beginning! More details can be found here.

The platform has been running solidly for almost 4 years, and I don't consider my investment questionable (anymore). However, all Russian loans are logically considered questionable.

You can register for Twino* using my link, which offers a much better deal for you. If you invest 500€, we both receive a bonus of 20€. For investments in rental properties, there's a great offer running until September 8, 2023 – 5% cashback!

At the end of July, I had 684,34 EUR invested in Afranga, with an IRR of 12,85%. There's not much more to say.

As I haven't invested a significant amount, I don't consider my investment questionable. Sooner or later, I will increase my investment on the platform.

If you are interested in Afranga, you are welcome to use my link* and support my blog. Unfortunately, only I receive 1% cashback. Prerequisite for this, you invest >500 EUR.

At Esketit, I had 628,70 EUR invested at the end of July, with an IRR of 12,93%. The new loan originator, Aksioma 24, has recently become part of the “Diversified” Auto-Invest strategy, so you might want to adjust your settings if you have them in place.

Similar to Afranga, I consider my investment at Esketit as non-questionable. The platform has established itself, and due to the small investment amount, I don't see it as exposed. In a few months, I plan to increase my investment.

For the curious, Esketit offers 1% cashback on the investment for the first 90 days at Esketit with my link*. I also receive this as compensation + one-time 5€.

Income Marketplace had 562,25 EUR invested at the end of July, with an IRR of 11,70%. The platform is currently facing an issue – there are hardly any new loans available, which is always a risky sign.

Income Marketplace is now established, but the situation with ClickCash needs to be monitored. Nonetheless, I don't consider my investment questionable.

If you want to test the platform there is 1% cashback for you if you use my link* and use the code CLHOFU during registration. I receive 1% too + one-time 20€.

![]()

PeerBerry recently reported that within the last 18 months, they've managed to recover a whopping 89% (€44.58 million) of loans at risk due to war! My IRR was at 10,62% at the end of July, with 1.125 EUR invested.

PeerBerry also occasionally deals with “cash drag,” but this is mainly due to the implementation of the auto-invest feature. Lars has provided some details about this in his YouTube video!

For over three years, one of the most solid platforms! However, a war is still a worst-case scenario, which is why about 22.3% of my portfolio is questionable, despite the previous repayments.

A while ago PeerBerry introduced a loyalty bonus, but with high requirements:

- 0,5% for 10.000€

- 0,75% for 25.000€

- 1% for 40.000€

If you use my PeerBerry* link, I'll receive 5€ + 1% from investments for 60 days.

![]()

I often mention Viainvest together with Twino. In my last P2P portfolio update, I expressed my criticism about the reporting. This time, it's more about expanding my investment because I would like to increase it at Viainvest in the medium term. My IRR at the end of the month was 11,81% with an investment of 1.662 EUR.

In my opinion, Viainvest is quite reliable, and therefore, I do not consider my investment questionable.

If you register at Viainvest* I will get 10€ one-time and 1% cashback for 90 days.

P2P

![]()

NeoFinance was one of the platforms where I had reduced my investment overall. Currently, there is still 1.116 EUR invested there with an IRR of 12,62%.

The platform's calculated return is 13,83%, with a deduction of 15% withholding tax (which can be reduced to 10%).

At least the loans that are more than 90 days overdue need to be considered questionable, even though they might pay in the future. Therefore, approximately 21% of the total investments are considered questionable.

NeoFinance* changed and lowered their offer too. There is 1% cashback for you and me for 90 days.

P2B (Real estate)

![]()

The IRR at Reinvest24 was 9,19% at the end of July with an investment of 2.586 EUR. Recently, a new strategic partner, Shojin, was announced. I will not be increasing my investment at Reinvest24 for the time being as I want to see how the currently delayed loans perform.

Reinvest24 is already over 5 years old! As of today, my Moldovan projects are considered questionable.

If you want to invest on ReInvest24*, there is a bonus of 10 EUR running for new investors! I receive 1% cashback.

At InRento, interest and repayments are automatically transferred to the platform every month from EvoEstate, and I invest as soon as the minimum investment sum of 100 EUR is reached or withdraw available funds. The IRR at the end of July was 7,01% with an investment of 1.100 EUR. So, my goal of 1.000 EUR has already been achieved, and for now, I prefer to withdraw incoming funds from EvoEstate. InRento could also improve in terms of reporting!

I don't consider my investment of just over 1k as questionable so far.

You can register via my InRento* link, for this you will receive a 20€ bonus, while I will receive 20€, too.

![]()

At the end of July, there were 3.318 EUR invested in EstateGuru, with an IRR of 8,92%. So, free funds were withdrawn here as well.

About 40% of my invested capital, everything that is “In default,” I consider questionable. So far, I have not experienced any capital losses with EstateGuru. I am optimistic that it will stay that way.

At EstateGuru* there is a 0,5% cashback for 3 months. I also receive the cashback and in addition 5€.

P2B

![]()

I recently got back into Debitum, and I have discussed the reasons in a blog post. I have invested 100 EUR, and I have already received the first interest. The current IRR is 8,50%.

I re-entered with 100 EUR and will gradually increase my investment. Due to the small amount, I do not consider the investment questionable.

If you want to invest in Debitum Network*, there is an exclusive offer for you. If you register through my link*, you will receive a 1% bonus when you invest from 10 EUR in ABS with a minimum maturity of 90 days. If you invest in Sandbox Funding, you will get 2% cashback! I will receive a one-time 10 EUR and 2% cashback for 90 days on the investment.

With hive5, I added another platform to my portfolio at the end of September. In the interview with CEO Ričardas Vandzinskas you can learn more about the Lithuanian platform based in Croatia. Currently, I can report an IRR of 14,82% with an investment of 224,70 EUR.

I initially consider new platforms as test ballon for about a year. After that, I decide whether to increase the investment or not.

If you use my link*, I will receive a one-time 10€ and 2% cashback.

![]()

Quanloop had an investment of 82,86 EUR by the end of June, with an IRR of 18,05%. Even though it has been more than a year since the initial investment, I still treat Quanloop as a test pilot because it is essentially a black box. Currently, I am researching for a deep dive into it.

The experiment will continue, but without further investments.

If you still want to take the increased risk with Quanloop, you will receive a 5€ bonus with my link*. I receive 2.5% cashback.

![]()

LinkedFinance has an IRR of 7,55% by now. The investment stands at 532,98 EUR.

So far, I have only had paying or already repaid projects. Therefore, I do not consider my investment questionable.

Linked Finance doesn't have an affiliate program, so there's nothing for you or me. Nevertheless, you can register here if you like.

P2P (Short-term)

![]() Go & Grow

Go & Grow

Go & Grow I mainly use for a small part of my cash and will also use it for my side hustle and savings for insurance payments. Because of the withdrawals from time to time and the fee of 1 EUR IRR is at 6,58%. In July there are still about 18 EUR left on the account.

I do not consider an investment in Bondora to be questionable.

A 5€ bonus is available for you at Bondora* right after registration.

Crowdlending

![]()

At Lande, I currently have an investment of 284,17 EUR with an IRR of 10,39%. The platform, with investment opportunities in land, machinery, and seeds, provides good diversification, and I plan to gradually increase my investment to around 1.000 EUR.

If you are interested in Lande, you can use my link* and get 1% cashback for 180 days. I will receive 10 € for the successful registration and also 1% cashback for 180 days.

Misc.

![]()

I have been invested in Bullride for over a year now. In the April 2022 portfolio update, I introduced the platform. As of now, the whole investment is definitely NOT a good one. Including the write-offs, my IRR is 0,09%. We will see if this turns around, but that's exactly why this is an experiment, even with more investment than usual.

For a test balloon, this is a very high amount, and it is 100% questionable until the first results come in.

If you register with my link* you will get 10€ and 1% cashback for 90 days.

Investment expires

As soon as I start complaining about Crowdestor, as usual, there are higher interest payments. In July, I received a whopping 197.36 EUR. Of course, in the grand scheme of things, this is still just a drop in the bucket. My key indicator, late projects, has continued to rise compared to the last portfolio update, now at 68%. This was also due to some projects being repaid this time. At the end of the month, the investment still amounted to 11.845 EUR with an IRR of 7,96%.

Due to the platform and project risks, 50% of my investment is questionable (independent of the ~68% late projects).

If you really want to register, you can do so via the platform's website. I can't recommend Crowdestor!

Last year, I expressed my dissatisfaction with Bondster regarding the Mikrokasa loans (which are still not officially considered defaulted) and mentioned that I might take action. Since then, I have indeed reduced my investment from around 1.200 EUR to the current 659,23 EUR. If possible, I will withdraw everything. The IRR at the end of the month was 11,30%.

Due to the “defaulted” Polish loans, I consider 30% of the investment questionable

EvoEstate had 4.079 EUR invested by the end of June with an IRR of 6,23%. The calculated return differs significantly from the “Net Annual Returns” of 10,78% due to the end-of-term projects.

All returns from EvoEstate are initially automated to be transferred to InRento. When there are new projects there, I invest, and excess funds are withdrawn.

![]()

The British platform AxiaFunder offers investing in an area I haven't seen before because they offer investing in litigation cases. You can find an interview with CEO Cormac Leech at explorerp2p.com. Very worth reading!

My initial investment was £500. Yes, that's the minimum investment and a lot. You have to bring some capital with you in order to have proper diversification. The same is also possible for a total loss, and even a loss of more than the invested money. My test project is still floating in the air (I'm not allowed to give more details). On the positive side returns of 20-30% p.a. are possible. So it's a high risk test balloon! In July the IRR is 1,56% due to currency effects.

I'm therefore letting my investment expire (if possible), because you need a lot of capital for a reasonable diversification. I don't have that and I'm not willing to invest that much there either.

If AxiaFunder is an interesting platform for you, I would be happy if you use my link*. My reward is 17,50€ and 3% Cashback.

Since November 2022, there have been no further repayments at Crowdestate. The complete exit is still ongoing. The IRR was -6,99%, and there are still 150,05 EUR in the account.

![]()

At the end of July, there were 826,10 EUR invested in Bulkestate, with an IRR of 7,26%. There are hardly any repayments anymore, and information is also somewhat scarce. Regarding withdrawals, you often have to send emails to ensure they are actually carried out. In fact, after my last email, all withdrawals arrived in my account within 1-2 days.

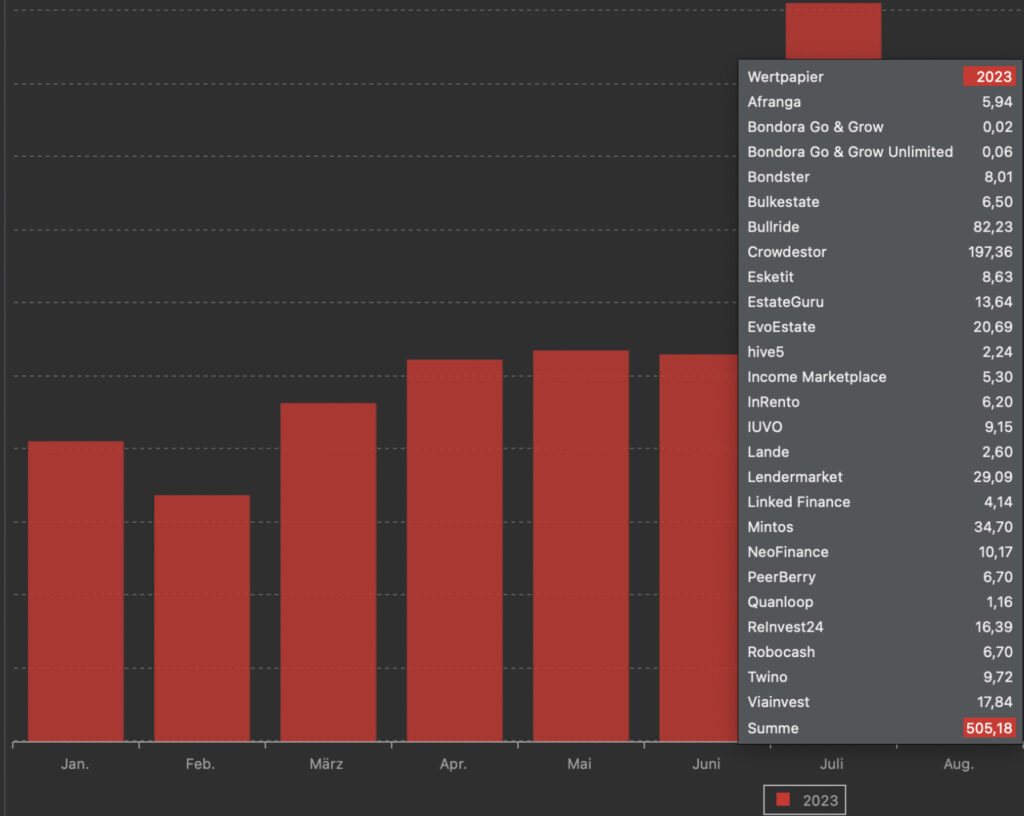

Portfolio performance – interest

Due to the higher interest rates at Crowdestor and Bullride, a whopping 505,18 EUR in interest accrued in July.

Note: Each month includes an interest charge of 45,83 EUR due to the write-off (for tax reasons) of the two Bullride e-scooters.

In the screenshot above, you can see the interest income from my P2P portfolio in recent months, as well as the amounts for each platform for July. I haven't been able to reach my comfort threshold of 300 EUR for a long time, and it will likely be rather challenging in the foreseeable future. July was most likely just an exception.

Distribution by P2P/Crowlending classes

To conclude, I will show you the distribution of my investments in various P2P/Crowdlending classes in July.

- 37,32% (P2P (Buy-back)

- 26,65% Crowdlending

- 1,61% P2B

- 26,98% P2B (Real estate)

- 2,50% P2P

- 0,04% P2P (Short-term)

- 4,88% Misc. (Bullride, AxiaFunder)

Affiliate/referral income

I would say that I am one of the most transparent bloggers when it comes to affiliate and referral income. Therefore, I provide complete transparency for July as well.

Affiliate Income:

- 580 EUR from four platforms

Referral Income:

- Quanloop* 24,37 EUR

My P2P tools

- P2P Platform Rating Premium from Lars Wrobbel*

Since more than two years Lars regularly publishes his platform rating. This is now available in a free version as well as a premium version. Advantage of this is the data access to ALL platforms! The table is constantly updated, update via Telegram when there are changes in the rating and there are extended comments and sources. The whole thing runs 12 months for 59 € (no subscription!). If you use my link*, you get a bonus month!

About new projects on Twitter, Instagram and Facebook

I hope you found my summary interesting as always. I'm always open for constructive criticism and suggestions. Follow me on Instagram (or Twitter and Facebook). There I post not only about P2P and crowdlending, but also about stocks, dividends and options. So have a look! That's it for today's post, see you again at the P2P portfolio update for October. Bye!

Feel free to let me know in the comments how your P2P investments are going or which platforms you have worries and concerns about!

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!