Hi there! From time to time I present new platforms on my blog. There are different reasons for that. First it's for sure personal interest. On the other hand platforms want to be ‘promoted' by bloggers. Therefore, I did an interview with Quanloop. What? Again an Estonian P2P platform? Not exactly!

There is always a small contribution for such a presentation or review. Making things short, Quanloop wrote me if I want to do a review of their platform. That's nothing outrageous. I agreed with the condition that I'll do a rough presentation with a small interview, because I have no experience with the platform.

Table of Contents

Due Diligence

Before Quanloop answered the questions in the interview I did some research myself. Because the platform is located in Estonia I had a look on teatmik.ee to see what we can find there about the platform.

If you search for ‘Quanloop' you find the Quanloop Usaldusfond as well as the Quanloop Group OÜ. The first one is an investment fund or trust. Due to the business purpose the OÜ is responsible for operative tasks. CEO is Valentin Ivanov (LinkedIn), who is Management Board Member in several other companies. Just in March the company was renamed, before the name was Bondkick Credit Fund Usaldufsfond. Here I asked directly.

Interview

With this interview I wanted to find out if Quanloop is another P2P platform or if it's even scam suspicious. First, there are a few standard questions and answers. In the second part, however, I continued to investigate. Quite interesting to read.

Standard questions and answers

What is the story behind Quanloop?

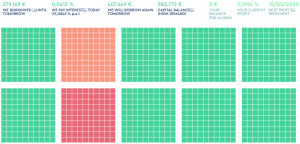

Quanloop is an investment fund dedicated to wholesale funding. We attract capital from investors like you and lend it through our partners – leasing and factoring companies, and even crowdfunding platforms.

Driven by automation, Quanloop is suitable for investors with short-term strategies. We apply a unique business model by sourcing money for only 24 hours and splitting the capital in need into a myriad of tiny credit agreements, each valued at 1€.

We accept investors from the whole world, while our functional currency today is the euro.

The author of Quanloop idea is Estonian fund manager Valentin Ivanov.‘The solution of continuous capital sourcing for the only 24h is what investors were asking for.

Liquidity, stability and control – I'm happy that our team has been able to solve this riddle full of

algorithms, math, law and technology. It is called Quanloop.' – says Valentin.Quanloop earns money from borrowing the tiny amounts from individual investors, then merging and lending it further at a higher interest rate.

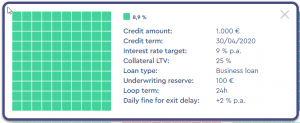

We source new capital every day, so taking the borrowing risk by ourselves. We put even more of our skin in the game by offering an underwriting reserve to each loan we finance. Then we allocate this money to our bank account for investors willing to exit early while no new investors would join by that time. The liquidity delay for investors who won't be covered by this reserve will earn an extra 2% on top of what they make from financing the loan otherwise.

You mentioned the name Valentin Ivanov a found and creative head. What can you tell us about him?

The author of the Quanloop idea, its co-founder and fund manager is a seasoned CEO and a recognised financial expert, Valentin Ivanov.

Powered by the synergic experience in financials, business operations and information technology Valentin has been the advisor and fund manager to a list of well-known professional

and retail investors and families as well as participated in different international IT and Fintech projects. Since 2014, Valentin leads the syndicated capital distribution company Bondkick and is a lead fund manager to a list of quality funds, including Quanloop. You can follow Valentin's profile on LinkedIn.

So Quanloop is just another P2P platform?

While Quanloop first is for private and small corporate investors, rather than professional ones, we are assuredly not ‘just another p2p platform'. What makes us stand out is that Quanloop is itself the debt originator – while borrowing money, we guarantee a solid return to

our investors.

So can you say then Quanloop is more a crowdfunding platform or an investment fund?

Practically speaking, Quanloop may seem like a crowdfunding platform, though acting as an investment fund. Quanloop pools tiny capital amounts from many investors to finance its partners. The partners seek wholesale funding to earn from consumer-oriented loans or other business projects, which in reverse secure the primary short-term loans originated by Quanloop. Taking the above said as the basis, Quanloop is an investment fund committed to issuing commercial debt and lending capital further at a higher rate – so making a profit on the rate spread. Unlike crowdfunding and P2P platforms, Quanloop is the sole borrower, offering all its assets as collateral.

But you can say that Quanloop just offers a smart auto invest?

Somewhat yes than no. Quanloop offers a way to make a return without manual transactions. Since we borrow money ourselves and for just a single day, the only thing our investor needs to do is to set up their portfolio by choosing an interest rate for each of the low-risk, medium-risk and high-risk plans. Every midnight we borrow money from our investors, put it to work and repay one second before the following midnight. The investor needs to set up their risk portfolio and top-up their balance by transferring money to Quanloop clients' bank account.

What are the risks for investors?

Quanloop investors are secured. However, even though investors should keep in mind that all the money they invest always carries a risk of loss. We limit our investors from placing all their money under the high-risk plan, but a maximum of

one-third of it. Also, we don't let to invest all their money under the medium-risk plan, but only half of it. Placing all of their capital or less under the low-risk plan is in the opposite, allowed. We help our investors to diversify their portfolio and massively reduce the risk of losing all their money at once.Quanloop is an investment fund registered in Estonia (EU). The assets of the fund are not insured. However, your money is guaranteed by the total assets of the fund, first – by the loan

you have financed and second – by the other investments and rights Quanloop has. It's essential to keep in mind that you or your company lend money to Quanloop, and we owe this money to you. Quanloop is not a P2P nor a crowdfunding platform, which would just introduce you to a borrower, but is the borrower by itself – that means you're much more secure. We do our best to invest the money you lend to us responsively. However, we strongly advise you not to lend to us from your family budget, which you would use to pay your regular spends and other expenses, nor from your company working capital that may be needed back instantly. Although we keep a reserve to support the liquidity of our fund, we may temporarily lack sufficient funds to support your withdrawals on the same day.

Who are the investors of Quanloop? Can you tell us a bit more about the ‘typical' investor.

‘The' Quanloop investor is a natural person over 18 or a legal person, and whose capital is transferred from a European bank or valid payment institution. We accept both non-accredited and accredited investors. The minimum investment amount is 1€.

Are there any restrictions to who can invest and how

much?

Initially, every investor is limited to 15.000€. However, they can lift that limit by contacting us and passing the extended KYC process. To start limitless investing, the investor needs to do the following:

- Raise their current capital to 15.000€

- Then contact us about raising the limit

Quanloop compliance team will contact the investor and help to go through an additional verification (a video call or meeting us in person will be required).

What's the promise to investors?

Quanloop is a responsive enterprise committed to the fair business. We preserve a distinct line between making choices for financial gain and making choices that will not unfavourably affect others.

We understand that investor may not consider all the risks and help them to diversify their portfolio. High-risk investments are limited to one-third of the total capital, and the medium-risk

investments are limited to half of the money. By limiting our investors, we give them the power to restrict us from taking too high risks.

I understand the basic business model. Nonetheless maybe you can give a short explanation how everything works for the blog readers?

We apply a unique business model by sourcing money for only 24 hours and splitting the capital in need into a myriad of tiny credit agreements, each of 1€ value. Every day, our partners source capital from Quanloop by introducing prospects (loans or other assets) they wish to finance. Following strict filtering, we accept the candidates for wholesale funding and prepare to pool funds from our investors. The projects financed by Quanloop secure the money borrowed from you and other investors. To avoid complex legal structures for collateral management, Quanloop pledges its capital to investors — so each euro you invest is covered by a weighty portfolio which is under our supervision.

To put it simply, we borrow 1€ from you, combine it with other investors' money and lend it to our partner. Next day, we take 1€ from your fellow investors and refinance yours. Each time we borrow money to finance a project, we add an underwriting reserve of our own money. That adds an extra liquidity layer to avoid you being unable to exit the next day. Although it should be impossible, in case we lack liquid funds to refinance your euro, you earn an extra 2% for staying longer. Quanloop is an excellent alternative to a piggy bank deposit, being able to add >15% annual profit to your money.

How does the ‘1€ for 24 hours' model work?

In practice, you top-up your account and set up your portfolio. Our partners provide us with a list of loans to finance. We take the first loan in the queue and start pooling money based on its

LTV. If the loan LTV is 50%, such an investment is considered ‘low-risk' and is valid for the low-risk cash. We list all the investors who wish to lend us money under the low-risk plan and take 1€ from each of them one after another. If you are part of this list, you compete with the other investors – if your interest rate is cheaper than your fellow investor's one, we will take your money first and might come to take theirs on the next round.

Sometimes, we may not have enough liquid capital to fund a particular risk-level loan. In that case, we use the money from the higher risk-plans and at higher interest rates. So the funds meant to work in the more top risk scenarios would be secured much better and bring far better yields.

We have an underwriting reserve. Every time we pool together a loan, we add 10% on top and keep it at our bank account to secure quick exits. It means that we can easily guarantee the withdrawals of the first 10 of each €100.

It's true, sometimes, we may lack liquidity. If this is the case, we pay a premium fee to our investors for each full day of delay. The premium is 2% p.a. on top of what an investor is earning

while trying to exit. Because each loan agreement between investor and Quanloop is of 1€, even the delayed exits still go quickly and smoothly.

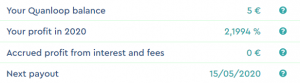

We receive our interest return at the beginning of each month. And we pay the interest return to

our investors each 15th calendar day of the following month. So even though an investor would

withdraw all their money at some point of the previous month, they will receive interest in the

middle of the next month.

How does Quanloop choose his partners?

Our partners are financially independent and proven European firms. We work with leasing and factoring companies, as well as participate in the crowdfunding projects both on the initial

offering stage and the secondary-market. Quanloop is committed to fair business by preserving a distinct line between making choices for financial gain and making choices that will not unfavourably affect others.

And how exactly does Quanloop make money?

Every day, our partners source capital from Quanloop by introducing prospects (loans or other assets) they wish to finance. The investments funded by Quanloop secure the money borrowed from the investors.

So Quanloop doesn't make direct investments?

Never! Quanloop invests through professional partners only. We don't work straight with the consumers nor invest directly. Quanloop participates in the proven deals by lending money to its partners for further financing against the loan agreement and additional guarantees.

I guess that there is an average term for such a partner loan, right?

We finance our partners for the minimum term of 1 week and the maximum duration of 5 years. Today, we don't have any loan agreements for longer than twelve months, but Quanloop

algorithm has been tested and is ready for such long terms.

Are there plans to add other currencies than the Euro?

Yes, we are working on it. One of the first foreign currencies we will start operating will be the British Pound.

Especially in times of COVID-19 and the hunger for liquidity a buyback guarantee isn't the best ‘feature' a platform can offer to its investors. Do you have such a guarantee?

No, Quanloop does not offer a buyback guarantee, as it could have been classified in the ‘traditional' P2P platforms. And we don't need to. Quanloop business model is based on investment loops, where each loan agreement is given for a term of 24h and is of 1€ value, then refinanced for another 24h or repaid.

After we clarified how Quanloop earns money, how do I earn money with you?

Making money with Quanloop is pretty straightforward. We offer to borrow money from you for one day, at an interest rate proposed by you. The amount is only 1€, although you can invest several times at once. You need to open an account for yourself or your company and set up your portfolio. The default portfolio preset is based on the statistical average for low-risk only investments on our platform. You will need to choose your risk scenario by sharing your money between the low, medium and high-risk plans. By setting your risk-plans based portfolio, you fine-tune the Quanloop global investment plan; thus, helping us to diversify our overall portfolio more productively. Each day we borrow money from you at midnight (EET) and repay it a moment before the next midnight; then repeat it if you haven't withdrawn your cash. Every 15th calendar day of the following month, we pay you interest return, either to your bank account or back to your Quanloop balance, as you prefer.

So we do all the investing work and take full responsibility for the upshot. You help us to pool money together and normalise our global risks. We earn money from lending money to our

partners on top of yours and other investors' average interest rate. So this is cooperation from the very beginning.

We could read several times in the answers that the minimum investment is only 1€?

We could read several times in the answers that the minimum investment is only 1€?

Yes, it's also the loan principal. If you invest more than 1€, you

enter in several loan contracts, each of 1€ value.

How long would it take to earn a good return?

You set the rate of return. If it is competitive, your money will always work and earn you profit. The interest rate is annualized, so to estimate a daily performance, you should divide the annual interest rate by 365. Quanloop repays interest to your account once a month, on the 15th of the following month.

What about tax? Are there specific tax reports or do you withhold tax?

Quanloop deals with tax reporting as follows:

The companies from whichever country always receive their interest return without any deduction and pay taxes according to their local country legislation. Same applies to the foreign

natural persons, who are not the tax residents in Estonia, Quanloop transfers the brute amount and leaves the tax reporting to the investor. Though, Estonian natural persons receive a net amount, while tax is paid on their behalf.Direct affiliate programs are taxed differently. Companies receive a brute amount, including the VAT (if applicable). The natural persons receive money without any deduction; Quanloop will report and pay the income-tax for Estonian natural persons but will leave the responsibility to report the foreigner's tax, if any, to the foreign customer, depending on their regional legislation.

When we give a gift to an Estonian tax resident, we will report and pay the income tax on their behalf. There will be no deduction; we will pay the income-tax on top of what they get.

Cashback is a compensation for the inflation loss. Foreigners and companies will receive it without a deduction. However, Estonian natural persons will receive 20% less of the amount due as we will report and pay this amount as income tax on their behalf.

Digging deeper

The first thing I noticed was the unconventional login. You get an email for every login. Is that on purpose or what's the matter?

Indeed, there is no (visible) password on our website. You're right. That is an excellent trend to avoid passwords, as many people keep forgetting or losing them. We issue a new one-time password each time our investors wish to log in, or even no password if they have our app. We think it's more convenient and secure.

I found that the legal name of the fund was changed from BONDKICK CREDIT FUND to Quanloop. Can you comment?

Our fund manager Bondkick had a registered limited partnership fund, which never operated before, and we bought it to win time on registration and to start from. So we changed the legal name and the management structure in August 2019 and moved on.

One modification that took place on the 7th of April 2020 was the exchange of the general partner from Nival Capital OÜ (the owner of Bondkick) to Quanloop Group OÜ. It was a purely regulatory shift.

The fund opened in public beta back in autumn 2019, then went public at the end of February 2020.

Are there annual reports for 2018/2019?

The annual report for 2018 was null, and the next one is the same. It is because the fund was registered, but never operated. The new annual report will be next year, although we plan to publish interim ones as we grow.

Who are the partners exactly you mentioned several times. Can you tell the names?

We have a few partners in the Baltic and Scandinavian countries, one in France, two in Spain and currently having discussions with new partners in Romania, Hungary and the UK. We don't share the names of our partners in public.

I noticed that Quanloop pays out the loss by inflation as cashback? Pure marketing or how do you get such an idea?

The market demands a cashback, so we had to conform. But the nature of the cashback is vital, and it has to bring actual value.

Our business is pure wealth tech. We think this can only perform through the collaborative value building. The investor comes to Quanloop to become wealthier, and our job is to make it happen. We face our role in this process also by securing the investor from losing money; that covers the security of the loans they finance, and the money they lose with inflation. Every 25th, we pay back the loss our investor made due to inflation during the previous month. If the loss by inflation in their country was lower than the general one across 19 European countries having EUR, they would get their cash back at the European rate.

Also, the referral program is kind of generous. Normally there is for example 1% for 60 days. But on Quanloop it's for eternity. How are you able to afford that?

We pay you 2.5% of the profit of the investor you bring to us. They earn – you earn – we earn. While you help us keep your referred investors interested, we should be, and we are thankful for this. We want to pay even more, but then it won't work mathematically; so far everything is fine.

The Quanloop fund management team is rather small; also, it should not be, nor should it become too large. We are spread out between several countries, including Estonia (our headquarters), Finland, Spain and our recent development, Romania. We currently work on building teams in Italy and the UK, although the general situation caused by the coronavirus decease COVID-19 pandemic is a huge plan breaker.

Speaking of countries. What's about the languages. Which ones do you support or plan to support?

We opened our site in Romanian recently. The Spanish updated version is coming out soon, and the next one is German.

We have approx. 7.000 verified investors, as of today, but most of them are rather passive. The main traffic is from Finland, Belgium and Poland. Our goal is much higher.

Summary

- Quanloop is not a classic P2P platform due to its business model

- Overall, the business model looks interesting. But I have to admit that I haven't thought too deeply yet

- The yields are very interesting at 8-15%

- Due to the 1€ loans, the own portfolio is quite diversified

- Since Quanloop is the borrower, you know who you have to kick in the door 🙂

- The platform is (still) somewhat opaque. Who exactly are the partners, what is invested in detail, etc.?

Do I plan to invest?

I will transfer some play money (50€) and watch the whole thing for a longer time. After a year, I might be able to draw a conclusion. Quanloop also has to grow out of its infancy during this time. This will certainly not be easy due to the general loss of trust in P2P/P2B and especially Corona. Still, I can only wish them the best of luck!

Bonus

Yes there is a bonus at Quanloop. But with good reason this can only be found at this point at the end of the blog post. As I said, the whole thing is a small test balloon and nothing more. If someone wants to test the platform, please feel free to use my link. You will receive a start bonus of 5€ and I will be rewarded with 2.5% of your investment.

Revolut – My account for p2p and crowdlending

Since I don't want to transfer everything from my regular bank account to the platforms, I was looking for a simpler solution. A few months ago I stumbled upon Revolut*. Since then I use the app for all financial transactions in the area of p2p/crowdlending and also in business context as freelancer with Revolut for Business*.

After being sceptical at first I'm now a big fan of the app. The execution of transactions to the different platforms and also withdrawals is very fast. In addition you can with the free Revolut* VISA card with max. 200€ cash limit per month at an ATM. And that without additional costs!

In addition Revolut* is my faithful travel companion. Since I also work abroad from time to time I also looked for a way to simply exchange currencies. This is easily possible with the Revolut* app. Also without fees (up to 6.000€ per month)!

Using my links for Revolut I get a reward of £2.00-3.00 for a standard card order. For Revolut for Business I get up to 66,35€.

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (investdiversified) in which I invest myself. Also on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!

great post, thanks for the info. i will use your link to start and i will also test it with the amount of 50euro.

great post, thanks for the info. i will use your link to start and i will also test it with the amount of 50euro.

After envestio scam, it is hard to trust new p2p sites especially from Estonia. Is there any “proof” of qualoop being any different from envestio (before they vanished)

Hi Malay,

I wouldn’t say Estonian platforms are the problem but maybe Latvians are 😉 No there is no proof. As I tried to make it clear it’s a new platform and I did as much due diligence as I could as a private investor and shared it with you. The platform is officially registered and so on. But yes the same was in the past for other platforms and for sure can’t be seen as proof. I suggest I’ll reach out to Mr Ivanov. Maybe he can give you a better feeling.

Thanks for the great review! I will be watching them, too.

Let me just say as an affiliate that their commission scheme is the only logical and fair one. What the others are offering: 1-2% of the investments in the first 30-60-90 days is just illogical and insultingly small. I will never agree to advertise anyone with these terms. Every investor will start with a small sum and increase it after gaining confidence in the platform. The commissions should be lifetime.

Thank you! Also for your opinion on the platform 🙂

Hai

Anul feedback about quanloop after furat year?

It’s a safe platforma?

Thanks

Hi,

‘safe’ is not the first word came into my mind to describe Quanloop. Because it’s too intransparent.

Nonetheless, the platform does what it should do.

Best regards,

Philipp

Hey,

Been investing in Quanloop and so far so good, did you receive any update from them or did you do a followup? I haven’t been able to find much information about them

Thanks

Hi,

indeed I didn‘t publish an update so far. It‘s still a total blackbox and I have invested only a few Euros. If I find the time I‘ll try to find out More.

Hi,

I’ve been investing in Quanloop for about a year and so far it has been according to the expectations.

I understand your concern about the “blackbox”, but the investors lend to Quanloop, which in turn lends to several borrowers.

So, if a borrower defaults, it would be dealt with Quanloop, while the investors would barely notice anything, since their money have been spread over to several borrowers, hence the diversity.

Quanloop has also 10% skin in the game plus certain collateral LTV.

The issue would arise if a large amount of borrowers defaulted simultaneously due to a global economic meltdown, which would also affect other financial platforms and institutions.

So yes, a risk exists, but I think it’s rather unlikely.

Best regards,

Adam

Hey,

of course there are some let’s say points to the pro side. Anyway, investors have no idea to which kind of borrowers Quanloop lend the money 🙂

Sure, knowing whom Quanloop lends the money to can be kind of reassuring.

But let me tell you a little story:

I invested in Lendermarket some months ago and since I didn’t know much about their details, I opted for “Auto invest”, so they chose a known Loan Originator (Creditstar Spain) for a term of 30 days, as I wanted to withdraw the money soon and test their system.

Little did I know that Creditstar Group can extend the duration of a loan by six extensions, 30 days per extension, resulting in that I’m still waiting to be able to withdraw my funds since 2nd Dec 2022.

Well, the money is not lost yet, but it has been stuck far longer than I could imagine.

The details matter, that’s everywhere the same. And especially in the P2P industry you have to read the fine print (if available) 🙂

As of today 2023-08-29, I still have my funds (invested for a term of 30 days in 2022-12-02) locked as “Pending Payment” in my Lendermarket account.

Following is what is written on their FAQ:

“Lendermarket will release Pending Payments to your Available Balance as soon as it receives funds (settlement payments) from Loan Originators.

This process cannot be sped up by Investor Support as it is dependent on receipt of settlement payments from Loan Originators. You can monitor Pending Payments and your Available Balance on your account summary page.

Transfers of Settlement Payments are not instant.

Timeframes can be influenced by the terms of the Loan Originator, Financial Institutions and market conditions.

It is typical to observe an increase in Pending Payments during times of decreased demand caused by events such as the COVID-19 pandemic, the war in Ukraine, sanctions on Russia and economic downturn.”

What they basically say is that there’s no time limit to how long one may wait for getting the invested funds back.

Hi again,

Since I kept researching about Quanloop, I stumbled upon the link below, which reports some concerning details about Bondkick (Quanloops’ predecessor fund platform), which might be of interest:

https://www.aripaev.ee/uudised/2019/01/31/tipparimeestega-seotud-fond-jattis-investorid-teadmatusse

The site is in Estonian language, but can easily be translated using Edge or Chrome browsers.

Apparently, the Quanloop fund management team is not the same as the former Bondkick, but they may share the same mindset…