Hi everybody! I hope you all are safe and sound! It's now mid/end of May and so it's time again for a small retrospective of the portfolio update April 2020. After I took advantage of the (supposed) opportunities on the stock market in March and invested more money than ever before, I actually thought my P2P /crowdlending portfolio has a break. But far from it, there was also some growth. Why exactly you can find out in the following blog post.

This time I would like to start with information about Grupeer and Monethera. As usual, the IRR ranking follows. Here is a small note along the side. Of course, I sorted the whole thing according to IRR. I added another column for a better assessment, which shows the date of the first investment.

Table of Contents

Grupeer

After nothing happens except delaying tactics on the part of Grupeer and after the last blog post in about two years! the money can be expected, there are efforts to take legal actions. For more information I suggest you to join the following Telegram group:

Ido from colminey.com created the website Grupeer Armada for more transparency. I suggest you have a closer look.

Monethera

There have already been two rounds in which, like me, you can participate in a lawsuit. The third round is open until tomorrow, Sunday, May 24. So if you want to participate be quick! You can find this under this link. The following Telegram group is also available for further information:

IRR-Ranking April

Platform | Initial Investment | IRR (%) | Changes previous month (%) | Invested (EUR) | Changes previous month (EUR) |

|---|---|---|---|---|---|

19.07.2017 | 15,51 | +0,46 | 7102 | 96 | |

30.10.2017 | 9,81 | +9,81 | 262,24 | 2,16 | |

09.11.2017 | 5,64 | +0,31 | 888 | 5 | |

14.05.2018 | 12,14 | +0,09 | 642 | 7 | |

31.07.2018 | 14,38 | +1,48 | 2382 | 40 | |

11.08.2018 | 3,34 | +3,34 | 270,29 | 0,29 | |

01.02.2019 | 8,07 | +0,20 | 3154 | 326 | |

14.02.2019 | 12,97 | +0,38 | 1115 | 14 | |

20.02.2019 | 6,45 | +1,18 | 397,70 | 1,14 | |

21.02.2019 | 18,63 | +1,80 | 158,80 | 78,10 | |

21.03.2019 | 8,28 | -1,57 | 11574 | 3101 | |

30.03.2019 | 10,22 | -0,62 | 1083 | 4 | |

12.04.2019 | 11,09 | +0,31 | 1112 | 9 | |

17.05.2019 | 11,55 | -0,83 | 724 | 100 | |

20.05.2019 | 5,76 | -0,19 | 1763 | 198 | |

31.07.2019 | 2,37 | -0,33 | 3747 | 135 | |

12.08.2019 | 17,61 | -2,06 | 1029 | 43 | |

04.11.2019 | 22,02 | -0,55 | 913 | 202 | |

31.01.2020 | 5,04 | +1,18 | 111,28 | 10,84 | |

15.02.2020 | 11,32 | +8,43 | 325,88 | 3,61 | |

20.02.2020 | 4,84 | -4,47 | 200,98 | 51,52 | |

Grupeer | 09.10.2018 | -100 | -100 | 0 | 2025 |

Monethera | 23.06.2019 | -100 | -100 | 0 | 1522 |

-1,68 | +0,62 | 38754 | 777 |

Platforms

In this portfolio update from April 2020, I sorted the reports on the platforms according to the P2P type. This time again there is the assessment based on Sterlings (from p2p-millionaire.com) approach how much of the investment on a platform can be described as ‘questionable'. This should make you aware once again that we are in the high-risk area. I can't say that enough!

P2P (Buy-back)

Nothing happened in April. I was too focused on the stock market for that. Over the next few weeks and months, I will certainly increase my investment at Viventor*. The plan is 1.000 to 1.500€. 159€ are still invested with an IRR of 18,63% (+ 1,80%).

As of the end of April, 50% of my capital is still in questionable, as there are around 80€ in Aforti Finance/Factor loans.

If you want to invest in Viventor*, there is unfortunately nothing I can offer. Only I as a publisher receive a 5€ bonus and 1% cashback for 30, 60 and 90 days.

Mintos* is still my second largest platform. In April, I invested again approx. 300€ and now have a total investment of 7.101€ with an IRR of 15,51% (+0,46%). Another big leap, which, as in the previous month, can be attributed to my secondary market activities. If you take a look on the SM today, you will find significantly fewer discounted loans. So the panic seems to be over more or less.

In April Mintos fueled its investors with new blog posts every day, so I can only recommend taking a look at the official Mintos blog now and then and also taking into account the ExploreP2P loan originator rankings when selecting them.

Even if Mintos is one of my largest platforms, still have 20% are questionable, because some loan initiators are now under pressure and I sometimes have smaller positions here.

Mintos* stopped the cashback for investors. Only publishers like me receive onetime 5€ + 1% for 90 days.

I invested approx. 1.000€ on IUVO last month to benefit from the discounts on the secondary market. It also worked quite well. As with Mintos, large discounts can no longer be found here. A total of 2.382€ has now been invested. The IRR rose again significantly to 14,83% (+1,48%).

Marking 10% of the capital as questionable seems to be appropriate because of the amount of HR loans.

- For IUVO there are two different offers. Unfortunately the referral program is extremely unattractive since a few days. For the first you can contact me because unfortunately it has to be done manually and I have to invite you. You get 20€ to 150€ depending on your investments. 1% are available for an investment of >2.000€, 1,5% for >3.500€.

- With the 2nd offer (click on the banner) I get 5€ and had the idea to share my bonus of 200€ if you invest at least 2.500€ within 30 days. Investment, not deposit 🙂 Unfortunately I cannot offer sharing the bonus any longer, to put it politely because some people making life difficult for me.

PeerBerry* showed an IRR of 12,14% (+ 0,09%) at the end of April with an investment of 642€. Peerberry also keeps investors up-to-date. An email that some other investors have also received was interesting. The platform has added +1,5% to my current loans and future investments, fixed for one year. So 15,5% loan turns into a crazy 17%. Nice move!

Also, very solid. Due to the additional group guarantee, I don't think my investment is questionable as of today.

A while ago PeerBerry* introduced a loyalty bonus, but with high requirements

- 0,5% for 10.000€

- 0,75% for 25.000€

- 1% for 40.000€

If you use my PeerBerry* link, I'll receive 5€ + 1% from investments for 60 days.

In April there were no new deposits on Lendermarket*. However, IRR increased to 11,32% because of regular interest payments. 325,88€ is the total investment.

In April there were no new deposits on Lendermarket*. However, IRR increased to 11,32% because of regular interest payments. 325,88€ is the total investment.

Because the platform is new and I only invested 50€ I won't put capital as questionable for now.

The April cashback was extrend until end of May and there is a cashback of 2% for every deposit. On top there is a 1% cashback for 60 days if you are using my link*. In total 17%! My reward is 5€ onetime + 1,5%.

For Viainvest* also interests were paid. 1.112€ is the total investment with an IRR of 11,09%. Since some days ago there is a flat 12% interest rate for all loans!

In my opinion Viainvest is quite solid and so 0% of my capital is questionable.

For the start at Viainvest* there is a 15€ bonus. For this only 50€ need to be invested. I'm also rewarded with 15€ if you register with my link.

At Bondster*, I only received about 50% of the interest in April through interest moratoriums in the countries of the loan originators (but it looks much better in May!). CEO Jana Mücková kept the investors up-to-date in a regular newsletter. At the end of April, the total investment is 1.083€ with an IRR of 10,22% (-0,62%).

Bondster is a young platform, so I'll put 30% of the capital as questionable as well.

There is a 1% cashback after 30, 60 and 90 days at Bondster*. I receive 1% as well.

Like Swaper* I added Twino* again to my portfolio in March. I made a small mistake. It was initially a deposit of 260€ instead of 270€ 🙂 At the end of April, 262,24€ are invested. This corresponds to an IRR of 9,81%.

Like Swaper* I added Twino* again to my portfolio in March. I made a small mistake. It was initially a deposit of 260€ instead of 270€ 🙂 At the end of April, 262,24€ are invested. This corresponds to an IRR of 9,81%.

Because I just have a few Euros invested I won't put it as questionable for now.

Here* you can register. If you invest 100€ we both are rewarded with a bonus of 20€.

I added 270€ on Swaper* in the previous month. Compared to other newly added platforms, it's still a little sluggish. Total interest in April were 0,29€. IRR is therefore 3,34%.

Because I just have a few Euros invested I won't put it as questionable.

If you use my link* my reward is onetime 5€ + 2% cashback for 90 days.

Crowdlending

At the end of April, the account balance at TFGCrowd was 913€ and the IRR was 22,02% (-0,55%). So I couldn't help it and invested again in two short-term projects. Incidentally, the platform has introduced a new type of loan, namely invoice financing.

Still, I see it as a high risk investment. So 90% of my investment are questionable.

However, if you want to test the platform you can use my link. I get 20€ + 2% after 90 days as a reward if you invest at least 100€.

At Wisefund*, IRR in April was 17,61% (-2,06%) with a total investment of 1.029€. Here as well, I invested a little bit in another project. Most projects were extended by three months until end of June, according to an investors survey. Interest came from only one project. The platform also has to clarify some important questions. That is exactly why I will not invest further for now!

Of course, as always, there has been an effort to take legal actions immediately. Based on my experience with other platforms, I personally think that this is premature.

Because of the loan extension and the flow of information I think 90% (previously 75%) of my investment can be considered as questionable.

Wisefund* offers 0,5% cashback for your investments within the first 270 days!

A lot has happened at Crowdestor* in the past month. My investment is now 11.574€! Paused interest payments further reduces the IRR to 8,28% (-1.57%). However, many projects have already agreed to pay accrued interest along with the next payment. That should help the IRR up again.

You might ask why I did invest that much?

Crowdestor has started several equity rounds. With the fresh capital, the platform wants to expand into new markets and automate the lending process as much as possible and focus on SMEs. These equity rounds are presented as normal projects, meaning I give Crowdestor a loan at 26% interest for 12 months. The minimum investment of 1.000€ is significantly higher than the usual 50€. If a total of at least 5.000€ is invested, you have the option of converting the whole into shares of the Crowdestor company. However, there are some conditions for this (such as an application letter). Unfortunately I cannot give more details. Registered investors can download the detailed white paper on the project page of the equity round(s).

And that's exactly what I plan to do 🙂 I am currently investing in two rounds, so three are still missing.

Still, I put 50% of the capital as ‘questionable' because of the corona pandemic which will have a massive effect on tourism and restaurants.

With my link* there is 1% on top for 180 days on your investment! I'm rewarded with 1% too. There were problems with the links of Circlewise in combination with ad blockers. Now this should be fixed.

P2B

Debitum Network* was one of my latest additions to the portfolio. The platform only offers secured business loans. Interest rates are somewhat ‘lower' (7-8%) but can increase significantly due to additional penalty fees (4.5-10%). In addition to my 100€ initial investment, I received a 10€ bonus. A total of 111,28€ was invested with interest at the end of April. The IRR rose slightly to 5,04% (+ 1,18%). On Debitum, I would like to gradually increase my investment in the next time.

Because it's a new platform for me and the platform offer investment in business loans (doesn't matter if's asset-backed or not) I put 30% of the capital as questionable.

If you also want to try out Debitum Network* you can use my link*. If you invest 100€ I get a reward of 10€ and 2% cashback for 90 days.

I started Linked Finance in March as a small test balloon with 50€ after Thomas from p2p-game.com always raved about it: P. The platform finances only SMEs in Ireland. In April, I invested another 150€. With interest already received, the total investment on the Irish platform is 200,98€ with an IRR of 4,84%.

Like Debitum it's a new platform for me and you invest in business loans as well. So I put 30% as questionable.

Linked Finance has no affiliate or referral program. At least I don't know about it.

P2B (Real estate)

On Bulkestate* I invested 305€ in March as I wrote in the last portfolio update. In April another 100€ were added. In total 724€. IRR decreased slightly to 11,55% (-0,83%). My plan is to invest the minimal amount of 50€ in every new project. As of today there were no problems on the Latvian platform.

I put 10% of my investments as questionable.

Unfortunately there is no bonus or cashback for new investors. I'll receive 1% cashback for 180 days if you use my link*.

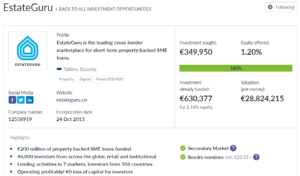

A lot of deposits were also made at EstateGuru* in March, and so in April. My account now shows 3.154€ (+326€) with an IRR of 8,07% (+0,20%).

In addition, EstateGuru has also launched an equity campaign to collect enough funds for further expansion. The whole thing runs on the known platform Seedrs* and as you can see is much in demand. I've secured 43 shares of 23,33€ each (so 1003,19€).

5% of the capital is questionable because I think EstateGuru is one of the safest platforms around.

At EstateGuru* there is a 0,5% cashback for 3 months. I also receive the cashback and in addition 5€. If you want to invest on Seedrs*, you get £25 after an investment of min. £150 within 30 day. Then I get £25 too.

At Crowdestate* there were two projects in April that I found very interesting, so I invested in them. The account shows 1.763€ investment at the end of April, with an IRR of 5,76% (-0,19%). I actually wanted to take a closer look at Crowdestate's secondary market, but the platform has introduced a 2% fee for selling loans. So active trading is anything but lucrative.

Approx. 15% of my capital I put as questionable because of the Baltic Forest X project.

Unfortunately there is no affiliate link with cashback which I could forward to you. If you use my link*, I receive up to 5€ + 1% cashback for 60 days.

The IRR at ReInvest24* continues to rise and is now 6,45% (+ 1,18%) at 397,70€ on the account. I really like ReInvest24′* business model, even though it takes longer to finance than other platforms. To reduce the effort for me a little, I invest in ReInvest24* projects via EvoEstate. Two projects are currently still open for investment. In addition, a new one just started. This time it's no buy-to-let one.

I put 10% of the capital as questionable. Why? Forgot to mention it the last time. ReInvest24 is still a very young platform. That's the only reason.

If someone wants to invest directly over ReInvest24* there is a 1% cashback (for me as well) in the first year. In addition, you get a 2% Cashback (so no fees!) if you invest at least 500€ in a single project in May.

In April, I continued to keep an eye on the secondary market at EvoEstate. As on other platforms, however, I noticed that there are no longer that many discounted projects. I added again almost 135€ and therefore have a total investment of 3.747€. The IRR fell slightly to 2,37% (-0,33%).

Furthermore, there was the Q1 update for investors in April, in which a bit more information about the current situation can be found. There was also another blog post, for everyone who has wondered why there are no more skin-in-the-game projects.

I put 10% of the capital as questionable because of the buy-to-let project.

There are two different offers from EvoEstate:

P2P

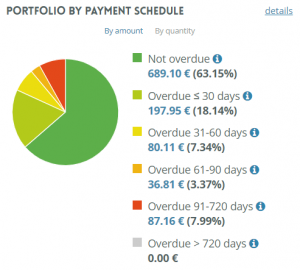

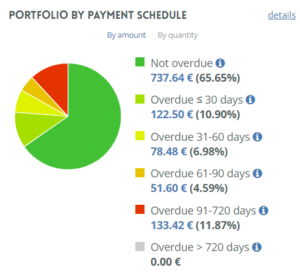

At the end of April, 1.115€ were invested in NeoFinance* and the IRR was 12,97% (+ 0,38%). The red credits are slowly increasing. However, I do not count them as defaults until now, because they make a payment from time to time. My criteria are now much stricter. So it remains to be seen how my portfolio will develop on NeoFinance. In the following screenshots a comparison of March and April.

The platform calculated IRR dropped down to 11,46%.

At least the 91-270 days overdue loans I have to mark as questionable even though some of them might pay in the future. I think 30% of the capital is questionable in the current situation.

At NeoFinance* there is bonus of 25€. If you use my link I get 5€ and 2% cashback for 2 months as a reward.

P2P (Short-term)

Go & Grow* I mainly use for a small part of my cash and will also use it for my side hustle and savings for insurance payments. Because of the withdrawals from time to time and the fee of 1€ IRR is at 5,64%. However, I do not want to miss the liquidity available here. In total 888€ are invested.

I put nothing of my capital as questionable.

5€ are available for you at Bondora* right after registration. If someone wants to invest a larger amount, just send me a message because I get 5% of your investments and I share my bonus (2,5% for you).

Affiliate/referral income

As I mentioned that I'll be more transparent regarding income of affiliate sources. You have seen that I write down what I get in return if you're using my links. Furthermore, I will update you here about my affiliate income in April. I haven't received it yet, under normal conditions I get it in the following months. But in total it's 49,91€ distributed over 10 platforms. I see a trend here that the ‘income' from my hobby gets less and less. You will also find a few new names here, such as AxiaFunder*, Profitus* or Quanloop*, which I take a closer look at.

Referral income I received from the following platforms:

- Bondora: -871€ (Reclaim from Bondora)

- Crowdestor: 2€

Summary

Many platforms or their loan originators have responded to COVID-19 by extending borrowers' schedules. Investors were sometimes involved in decision-making, but mostly not. The extension of loans is actually not something new, because many loan originators have already implemented this and used it in places. Looking at my portfolio, monthly interest payments decreased compared to January/February, but not that much. I was able to compensate this especially last month with purchases on the secondary market. This income was almost completely lost in April.

My opinion

But already in my opinion you can see a ‘recovery'. I call it ‘recovery' because I don't quite believe that's it. The 2nd quarter will certainly be interesting here.

Nevertheless, we had all been wondering how P2P asserts itself in a real crisis? Certainly you can not draw a final conclusion as there is still a lot of money in the fire. Nevertheless, the income remains surprisingly constant. This is certainly also due to the diversification that some other bloggers and investors have now demonized.

So we're excited to see how things go in the coming months!

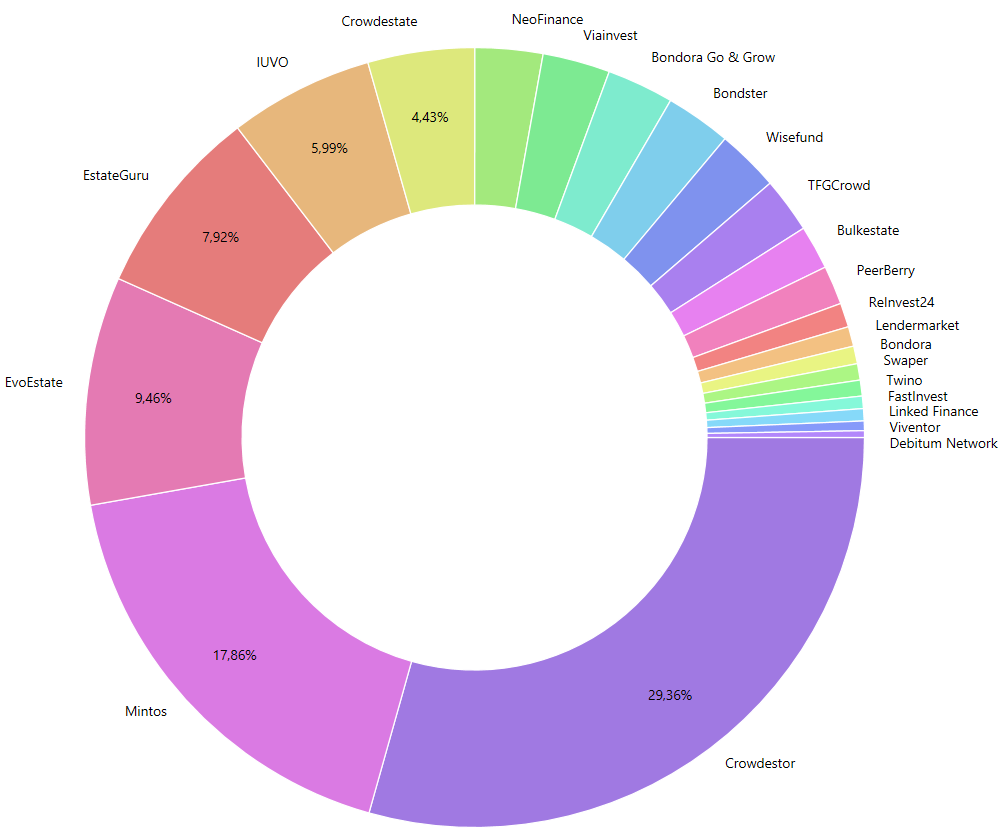

Distribution by P2P/Crowlending classes

Below you can find my distribution between the individual P2P / crowdlending classes for April.

- 33,66% (+0,02%) P2P (Buy-back)

- 35,28% (+4,82%) Crowdlending

- 1,01% (-4,69%) P2B

- 23,92% (+0,40%) P2B (Real estate)

- 3,42% (-0,24%) P2P

- 2,69% (+0,39%) P2P (Short-term)

I hope you find my summary interesting. I'm always open to constructive criticism and proposals. See you in May for the next portfolio update and some other blog posts!

Revolut – My account for p2p and crowdlending

Since I don't want to transfer everything from my regular bank account to the platforms, I was looking for a simpler solution. A few months ago I stumbled upon Revolut*. Since then I use the app for all financial transactions in the area of p2p/crowdlending and also in business context as freelancer with Revolut for Business*.

After being sceptical at first I'm now a big fan of the app. The execution of transactions to the different platforms and also withdrawals is very fast. In addition you can with the free Revolut VISA card with max. 200€ cash limit per month at an ATM. And that without additional costs!

In addition Revolut is my faithful travel companion. Since I also work abroad from time to time I also looked for a way to simply exchange currencies. This is easily possible with the Revolut app. Also without fees (up to 6.000€ per month)!

Using my links for Revolut I get nothing at the moment. Previously I got reward of £2.00-3.00 for a standard card order. For Revolut for Business I'd get up to 66,35€. Reason is that Revolut pausing their affiliate programs.

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (investdiversified) in which I invest myself. Also on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!