Hi everybody! As promised, the Portfolio update September 2020 comes a tiny bit earlier. For October, it will hopefully come directly in the first week. Have fun reading!

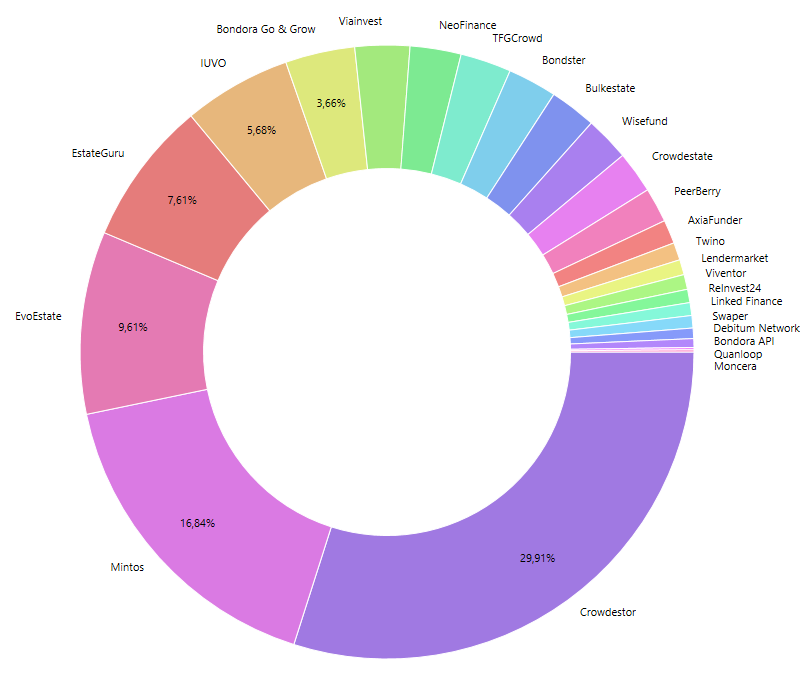

As usual, I would like to start with the IRR ranking and then take a closer look at the individual platforms. Next it's time for the problem platforms and how I define them exactly. Then comes the Portfolio Performance interest overview, my affiliate/referral income and my change(s) for the P2P/crowdlending classes. Let's get started!

Table of Contents

IRR ranking September

Platform | Initial investment | IRR (%) | Changes previous month (%) | Invested (EUR) | Changes previous month (EUR) |

|---|---|---|---|---|---|

19.07.2017 | 14,31 | -0,15 | 7399 | 112 | |

30.10.2017 | 10,87 | -0,24 | 407,09 | 18,08 | |

09.11.2017 | 6,51 | +0,01 | 1609 | 67 | |

14.05.2018 | 14,20 | +0,85 | 804 | 9 | |

31.07.2018 | 13,76 | -0,05 | 2498 | 22 | |

11.08.2018 | 12,76 | +0,53 | 286,88 | 3,38 | |

01.02.2019 | 8,37 | -0,52 | 3347 | 66 | |

14.02.2019 | 14,44 | +0,02 | 1180 | 13 | |

20.02.2019 | 12,92 | +0,47 | 307,96 | 5,99 | |

21.02.2019 | 6,92 | -4,11 | 343,50 | 2,34 | |

21.03.2019 | 8,11 | -0,20 | 13146 | 63 | |

30.03.2019 | 10,98 | -0,02 | 1135 | 9 | |

12.04.2019 | 11,75 | +0,14 | 1267 | 12 | |

17.05.2019 | 13,36 | +0,55 | 1076 | 98 | |

20.05.2019 | -16,65 | -24,36 | 969 | 504 | |

31.07.2019 | 3,25 | +0,02 | 4225 | 79 | |

12.08.2019 | 11,52 | -0,71 | 1028 | 0 | |

04.11.2019 | 22,30 | +0,21 | 1178 | 20 | |

31.01.2020 | 7,60 | +0,83 | 241,42 | 76,81 | |

15.02.2020 | 18,34 | -0,85 | 350,77 | 3,50 | |

20.02.2020 | 6,47 | +0,05 | 297,82 | 1,58 | |

04.05.2020 | 14,13 | +0,93 | 53,42 | 0,72 | |

19.05.2020 | 17,04 | +4,11 | 202,35 | 48,67 | |

29.05.2020 | -3,66 | -5,78 | 548,10 | 6,9 | |

22.07.2020 | 10,88 | +7,36 | 51 | 0,81 | |

-0,33 | -0,89 | 43951 | 164 |

Platforms

In this portfolio update from September 2020 there is a small change. Since there are always platforms where quite little happens on a monthly basis, these are collected under a common heading, but again sorted by P2P type and IRR.

Platforms with ‘problems'

As ‘platforms with problem platform' I define all platforms I'm not satisfied with as well as those where the ‘red flags' shine brighter than usual and I'm therefore on the retreat.

As announced in August, my IRR at Crowdestate has slipped heavily into the negative due to the 368,57 € write-off. The Estera project is also under insolvency proceedings. The IRR is currently -16,65% (-24,36%). Almost 969 € are still invested there. Everything that is paid back will be transferred to other platforms. I hope that the ongoing projects will still make sure that I at least stay in the positive range (or at least +/- zero). In the meantime I can say that my project selection was very bad, because I was naive at the beginning. So Crowdestate is not a bad platform. Nevertheless, I feel more comfortable with the alternatives.

I already wrote more about Wisefund in the last portfolio update. There is nothing more to say at the moment, everything that comes back somehow will be deducted. A statement about IRR doesn't make much sense anymore. But I will report when I write off the amount completely! The Action Group can be found here and the corresponding Telegram group.

As announced, I had a lot to complain about Debitum Network in September compared to the previous months. The platform has decided that it only wants to have financially strong investors. So the focus is slowly shifting towards institutional investors. As a result, the minimum investment was raised from 10 € to 50 €. In addition, a total of at least 500 € must be invested. Fair enough! But it's not way you say, it's how you say (or write in this case) it, especially to those who have invested less than 500 €. I consider it as a disgrace. A deadline was set, with several reminders, and they were asked (or forced) to increase to 500 €. All loans of Mikro Kapital will be paid back on the deadline day, if I didn't top up my balance. For all other loans I have to wait for the repayment.

My goal on platforms are actually always to reach 100 loans/projects, which at 50 € per loan would be 5.000 € in total. That would completely ruin my diversification. So I have stopped the auto invest and withdraw all repayments. At the end of September 241,24€ were invested with an IRR of 7,60% (-0,40%).

Platforms with news

P2P (Buy-back)

At Viventor things did not really move forward in the end. In September, a calculation error occurred, so that interest I already received had to be paid back… Big show! 343,50 € (-2,34 €) are invested with an IRR 6,92% (-4,11%). By the way, the IRR also goes back, because I only take into account the interest that I actually received. There is much more ‘In transit' as Viventor calls it. But I can't buy any of that at the moment.

As of the end of September, exactly 48,15% of my capital is questionable, because of the money invested in Aforti Finance/Factor loans and pending payments.

If you want to invest in Viventor*, there is unfortunately no bonus or cashback I can offer. Only I as a publisher receive 1% cashback for 30, 60 and 90 days.

Crowdlending

Let's start with the numbers. Interest rate in September was once again lower than in August. Therefore, the IRR continues to fall to now 8,11% (-0,09%) with a total investment of 13.147 €! The release ‘Investor Cabinet' was hasty let's say, but there were already many bug fixes. So it is getting slow. The script mentioned in the last portfolio update is actually no longer necessary. Furthermore, almost 30% of the projects are delayed, updates are available for most of them. I'm still slightly optimistic, even if the whole thing is a tough story. By the way, there is a secondary market and there are indeed some bargains to be found.

Still, I put 50% of the capital as ‘questionable' (regardless of the ~30% late projects) because of the corona pandemic which will have a massive effect on tourism and restaurants.

With my link* there is 1% on top for 180 days on your investment! I'm rewarded with 1% too.

P2B (Real estate)

At the beginning of September the 2nd housing unit of the Tallin's tech hub project was paid back and after a long time I invested the money in a new rental project. The IRR is now at 12,92% p.a. (%) with invested 307,96€. You can find a review together with an interview with Viktorija Bondarjonoka here.

I consider 10% of my investment as questionable, as ReInvest24 is still a young platform.

If someone wants to invest directly over ReInvest24* there is a 10€ bonus (for me as well). I switched to the referral link.

![]()

In September, I could finally invest money in time and invested in two new projects. 1.076 € are invested in 20 projects. The IRR increases to 13,36% (+0,55%). The delayed Aleksandra Apartments I project will be refinanced after all, at least that is the plan. In the case of the Briežu Street II project there was no feedback from borrowers. Legal actions will be taken.

I think about 9% of the capital is questionable, because of the two delayed projects and because I do not know how well the recovery is working.

If you use my link* I'll receive 1% cashback for 180 days and one-time 5€.

Platforms without relevant changes

P2P (Buy-back)

Nothing to report on Lendermarket itself in September. However, there were reports about Creditstar, whose loans can be found there. Kristaps Mors denounced the missing audit in his blog post, reads quite interesting! The IRR is 17,49% (-0,85%). Lendermarket itself shows me 13,88% with 350,77 € investment.

Because the platform is new and I only invested 50€ I won't put capital as questionable for now.

Last call! On the platform there is a 2% cashback on all deposits until the end of October if you are using my link*. In total up to 16%! My reward is 5€ onetime + 1,5%.

A bit I transferred back to Mintos. In the medium term I plan to make the 10.000 € full. 7.399 € were invested at the end of September with an IRR of 14,31% (-0,15%). Since the interest rates are lower now, the IRR will decrease to about 12% in the near time.

I can only recommend taking a look at the official Mintos blog now and then and also taking into account the ExploreP2P loan originator rankings when selecting them.

Even if Mintos is one of my largest platforms, still have 20% are questionable, because some loan initiators are now under pressure and I sometimes have smaller positions here.

Mintos* stopped the cashback for investors. Only publishers like me receive onetime 5€ + 1% for 60 days.

IUVO continued to run on autopilot in September with an investment of 2.498 € at an IRR of 13,76% (-0,05%). There is nothing more to report.

Marking 10% of the capital as questionable seems to be appropriate because of the amount of HR loans.

- For IUVO there are two different offers. Unfortunately the referral program is extremely unattractive since a few days. For the first you can contact me because unfortunately it has to be done manually and I have to invite you. You get 20€ to 150€ depending on your investments. 1% are available for an investment of >2.000€, 1,5% for >3.500€.

- With the 2nd offer (click on the banner) I get 5€ and had the idea to share my bonus of 200€ if you invest at least 2.500€ within 30 days. Investment, not deposit 🙂 Unfortunately I cannot offer sharing the bonus any longer, to put it politely because some people making life difficult for me.

PeerBerry also continues to run without problems. Interest rates are still at the lower end of the scale at around 10%, but stability is much more important to me now. The IRR in September is 14,20% (+0,85%) with invested 804€.

Also, very solid platform which I have in my portfolio for over two years. Due to the additional group guarantee, I don't think my investment is questionable as of today.

A while ago PeerBerry introduced a loyalty bonus, but with high requirements

- 0,5% for 10.000€

- 0,75% for 25.000€

- 1% for 40.000€

If you use my PeerBerry* link, I'll receive 5€ + 1% from investments for 60 days.

![]()

In September Swaper increased again. 286,88€ is the total investment with an IRR of12,76% (+0,53%).

Because I just have a few Euros invested I won't put it as questionable for now.

If you use my link* my reward is onetime 5€ + 2% cashback for 90 days.

At Viainvest, too, I have hardly had to intervene in the last few months. The IRR in September was 11,75% (+0,15%) with invested 1.267€ and is still approaching the 12%.

In my opinion Viainvest is quite solid and so 0% of my capital is questionable.

For the start at Viainvest* there is a 15€ bonus. For this only 50€ need to be invested. I'm also rewarded with 15€ if you register with my link.

Another platform where no intervention was necessary in September is Twino. Here, 10,87% (-0.24%) of the invested 407,09€ are booked.

Because I just have a few Euros invested I won't put it as questionable for now.

Here* you can register. If you invest 100€ we both are rewarded with a bonus of 15€.

The number of my Polish loans from Mikrokasa with 60+ days delay remains almost unchanged in September. However, repayments continue to come, albeit very small. 1.135€ are invested at the end of September with an IRR of 10,98% (-0,02%).

Bondster is a young platform, so I'll put 30% of the capital as questionable as well, because of the loans from Poland.

There is a 1% cashback after 30, 60 and 90 days at Bondster*. I receive 1,5% + 5€

Crowdlending

TFGCrowd projects were also repaid in September and the free funds were immediately reinvested. 1.178€ are currently invested and the IRR is 22,30% (+0,21%). In October, the plan is to withdraw a little money again and shift it to other platforms.

Still, I see it as a high risk investment. So 90% of my investment are questionable.

However, if you want to test the platform you can use my link. I get 20€ + 2% after 90 days as a reward if you invest at least 100€.

P2B

![]()

In the case of the Irish SME financing platform Linked Finance, projects continue to pay back diligently, both interest and principal. Portfolio Performance shows me an IRR of 6,427% (+0,05%) at the end of September for a total investment of 297,82€.

Like Debitum it's a new platform for me and you invest in business loans as well. So I put 30% as questionable.

Linked Finance has no affiliate or referral program. At least I don't know about it.

P2B (Real estate)

Also, at EstateGuru the delays are increasing a little bit. But I am not worried here, because the recovery works excellent so far. My account shows 3.347€ in September with an IRR of 8,37% (-0,52%). The interest payments are rising well in the last 1-2 months, so there is a steady cash flow here.

I don't consider my invested capital to be ‘questionable'. So far EstateGuru has always ensured recovery.

At EstateGuru* there is a 0,5% cashback for 3 months. I also receive the cashback and in addition 5€.

At EvoEstate I try to reach the 100 projects step by step. 4.225€ are currently invested in 62 projects with an IRR of 3,25% (+0,02%). I expect interest payments to increase accordingly in the coming months. One project, in which I was unfortunately not invested, was repaid with >28,5%!!! instead of the expected 12%.

Although EvoEstate is still one of the younger platforms. Interest payments on some rental projects have also started again in some cases. Therefore I do not (any longer) consider my capital to be questionable.

For EvoEstate there is a 0,5% cashback for 6 months with this link*. I get 0,5% too and one-time 5€.

P2P

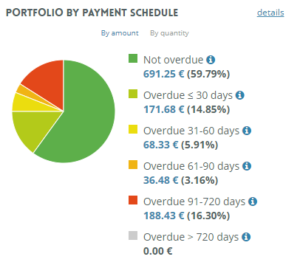

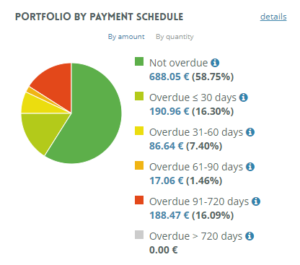

With NeoFinance, things are also running smoothly so far, the red credits are at least no longer being used. At the end of September 1.180€ are invested in NeoFinance and the IRR is 14,44% (+0,02%). I do not count the red credits as defaults so far, since they do make a payment from time to time. The manually selected loans have very strict criteria. I try to check in 1-2 months whether this change is crowned with success. The following screenshots show a comparison of August and September.

The return calculated by the platform is now 13,53% after an adjustment of the calculation. There is a deduction of 15% withholding tax (can be reduced to 10% by the way).

At least the 91-270 days overdue loans I have to mark as questionable even though some of them might pay in the future. I think 30% of the capital is questionable in the current situation.

NeoFinance* changed and lowered their offer too. There is 1% cashback for you and me for 90 days.

P2P (Short-term)

![]() Go & Grow

Go & Grow

Go & Grow I mainly use for a small part of my cash and will also use it for my side hustle and savings for insurance payments. Because of the withdrawals from time to time and the fee of 1€ IRR is at 6,51%. However, I do not want to miss the liquidity available here. The total investment is 1.609€.

I don't think my investment here is in question. Bondora has enough leverage.

5€ are available for you at Bondora* right after registration. If someone wants to invest a larger amount, just send me a message because I get 5% of your investments and I share my bonus (2,5% for you).

Testballons

![]()

Strictly speaking, I added Quanloop to my portfolio as a test balloon in April. Also, I did an interview with them. I'm only invested with 53,42€ and the IRR was 14,13% (+0,93%) September. My AI is set up to 13-14%.

If you are interested in the platform, you can use my link* to get a 5€ bonus. I'm rewarded with 2,5% cashback.

![]() API

API

With my 3rd test balloon, which I started in May I want to test it again and try to invest with very strict criteria via the Bondora API. For this I had a virtual sub-account created so that I could track the results. Currently, 202,53€ are invested there with an IRR of 17,04% (+4,11%).

5€ are available for you at Bondora* right after registration. If someone wants to invest a larger amount, just send me a message because I get 5% of your investments and I share my bonus (2,5% for you).

I recently introduced the platform and was also able to conduct an interview with CEO Dmitri Pavlov. Due to the close relationship with the Placet Group, only loans from this provider are listed there. The Placet Group is also available as a loan provider for Mintos, but today it has 2% less interest. In September51€ are invested on the platform with an IRR of 10,88% (+7,36%).

There is a 25€ bonus until November 30, 2020 if you use my Moncera link*. To get the bonus you have to enter the code FB34OG3 during registration! And there are a few more requirements which you can find here. I will receive 1% on all deposits made by you in the first 60 days. This also supports my blog, so I want to say thank you in advance!

The British platform AxiaFunder offers investing in an area I haven't seen before because they offer investing in litigation cases. You can find an interview with CEO Cormac Leech at explorerp2p.com. Very worth reading! My investment is £500. Yes, that's the minimum investment and a lot. You have to bring some capital with you in order to have proper diversification. The same is also possible for a total loss and even a loss of more than the invested money. On the positive side returns of 20-30% p.a. are possible. So it's a high risk test balloon! In September again negative due to currency effects.

If AxiaFunder is an interesting platform for you, I would be happy if you use my link*. My reward is 20€ + 3% of the investment.

Portfolio performance income

This is the earnings view of Portfolio Performance. 285,66€ in interest was paid in September. But unfortunately I have to add the write-off of 368,57€ on Crowdestate, which I booked as a ‘fee'. Correctly my ‘income' is therefore -82,91€.

This is the earnings view of Portfolio Performance. 285,66€ in interest was paid in September. But unfortunately I have to add the write-off of 368,57€ on Crowdestate, which I booked as a ‘fee'. Correctly my ‘income' is therefore -82,91€.

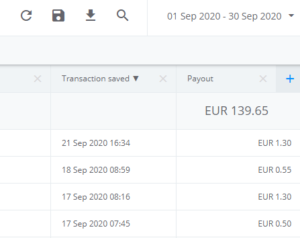

Affiliate/referral income

I mentioned that I'll be more transparent regarding income of affiliate sources. You have seen that I write down what I get in return if you're using my links. Furthermore, I will update you here about my affiliate income in September. I haven't received it yet, under normal conditions I get it in the following months. But in total it's 139,65€ distributed over I don't know how many platforms. By the way, I didn't see one penny from TFGCrowd, except on the dashboard. I'm curious when this will be paid out.

Referral income I received from the following platforms:

- Twino*: 15 €

- ReInvest24*: 1,98 €

Summary

Unfortunately the interest income was well below my desired 300€ mark. Thanks go out to Crowdestate! Not very nice, but that's how it is sometimes. Many other bloggers would probably just let something like that fall by the wayside! With Wisefund the next write-off is incoming. The goal is to get back to the 300€ interest income WITHOUT depreciation. My affiliate income is still higher than usual (on the paper), but I haven't received too much. At Crowdestor I am cautiously optimistic, it will probably be a longer story. But I mentioned in the last portfolio update that my time horizon is >10 years.

Distribution by P2P/Crowlending classes

Below you can find my distribution between the individual P2P / crowdlending classes for September.

- 33,09% (+0,57%) P2P (Buy-back)

- 34,92% (+0,14%) Crowdlending

- 1,35% (-0,17%) P2B

- 22,58% (-0,62%) P2B (Real estate)

- 3,15% (+0,14%) P2P

- 3,66% (0,15%) P2P (Short-term)

- 1,25% (+0,01%) Misc. (AxiaFunder)

I hope you found my summary interesting as always. I am always open for constructive criticism and suggestions. Follow me on Instagram. There I post not only about P2P and crowdlending, but also about stocks, dividends and options. So have a look! We will read about the next portfolio update in November.

Revolut – My account for p2p and crowdlending

Since I don't want to transfer everything from my regular bank account to the platforms, I was looking for a simpler solution. A few months ago I stumbled upon Revolut*. Since then, I use the app for all financial transactions in the area of p2p/crowdlending and also in business context as freelancer with Revolut for Business*.

After being skeptical at first I'm now a big fan of the app. The execution of transactions to the different platforms and also withdrawals is very fast. In addition you can with the free Revolut VISA card with max. 200€ cash limit per month at an ATM. And that without additional costs!

In addition, Revolut is my faithful travel companion. Since I also work abroad from time to time I also looked for a way to simply exchange currencies. This is easily possible with the Revolut app. Also, without fees (up to 6.000€ per month)!

Using my links for Revolut I get nothing at the moment. Previously I got reward of £2.00-3.00 for a standard card order. For Revolut for Business I'd get up to 66,35€. Reason is that Revolut pausing their affiliate programs.

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (investdiversified) in which I invest myself. Also on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!