Hello everybody! 🙂 Welcome to my portfolio update in November 2019. Yeah I know it's already mid December but end of the year is a very busy time in my full time job. In November I could increase my total portfolio slightly. Still there is a lot shifting around between platforms. This time I want to change things a bit and start with the last place of the IRR ranking. Also I try to be more transparent and tell you what I got from affiliate income in November. Here we go!

Table of Contents

XIRR Table

Platform | IRR | Change in % to previous month | Invested | Change in € to previous month |

|---|---|---|---|---|

-2,62% | - 2,95% | 346€ | 9€ | |

0,00% | - | 114€ | 14€ | |

0,46% | + 0,77% | 1.395€ | 180€ | |

1,26% | + 0,18% | 490€ | - | |

1,61% | - 0,38% | 1.005€ | - | |

5,90% | -0,03% | 358€ | 532€ | |

6,23% | + 2,85% | 1.586€ | 9€ | |

8,67% | - 0,75% | 1.580€ | 5€ | |

8,99% | - 0,51% | 5.508€ | 748€ | |

10,62% | + 0,16% | 1.065€ | 10€ | |

11,59% | + 0,56% | 1.055€ | 10€ | |

11,62% | - 0,05% | 787€ | 132€ | |

11,67% | - 0,02% | 640€ | 25€ | |

11,82% | - 0,12% | 1.134€ | 39€ | |

12,91% | + 12,76% | 1.293€ | 78€ | |

13,13% | + 0,27% | 5.166€ | 66€ | |

Grupeer | 13,16% | + 0,06% | 1.789€ | 19€ |

13,85% | + 2,23% | 80€ | 50€ | |

Envestio | 17,26% | + 0,42% | 1.983€ | 153€ |

Kuetzal | 18,78% | - | 1.730€ | - |

20,05% | - | 101,31€ | 1,31€ | |

Monethera | 20,22% | - 0,61% | 1.241€ | 41€ |

22,20% | - 2,81% | 1.225€ | 95€ | |

~10,92% | ~31.671€ | 966,31€ |

Platforms

For me the loan portfolio at Bondora* consists only of red loans, I sold all other loans after 4 years of investing. Through the recovery process I hope that something remains. Of course I could sell them with high discount, but I'm not reliant on the ~346€. Therefore, the money stays where it is for the time being. If you want to know why IRR is negative I count the not payed money as interest charge within Portfolio Performance.

I can't really recommend Portfolio Pro. If you stop putting in more money, the return drops very quickly into the basement. Although Bondora's* recovery process is one of the best in the p2p industry, there are plenty of alternatives.

Boldyield* is one of my new added platforms. For now there are two real estate projects available with 14/15%. The 3rd project will be one I'm really looking for – a maritime transportation project. Hopefully it will be live in 2019. I'm invested with 217€ at the platform. If you want to know more about Boldyield* there is an interview on my blog.

There is a 0,5% cashback offer for 6 months at Boldyield* if you use my links. My reward is 1%.

The next platform is EvoEstate*. Again I added some money (180€) to the platform and now 1.395€ are invested in 27 projects. As the first interest payments have alread arrived IRR is now 0,46%. The payments are all from rental projects, almost all equity and development projects pay at project completion. Some weeks ago I published a blog post in which I take a closer look at all project originators connected via EvoEstate. Also the website is shown in a fresh design now. And still there are more features incoming like the mentionend margin trading.

EvoEstate* offers you 15€ for a good start on the platform. The bonus will be there after the 1st investment. I'm also rewarded with 15€.

1,26% is the IRR in November at ReInvest24*. Still 490€ are still invested. The increase came from monthly payments of two projects. And I'm waiting for the payment of another two which are (partly) sold already. Also a new project will come this or next week. Finally! As I mentioned several times I will invest over EvoEstate in the future.

If you want to invest directly through ReInvest24* the platform offers a nice cashback promotion with 1% cashback (for me too) in the first year!

The next payment should come end of the year. 1.000€ are still invested and IRR is currently at 1,61%.

Unfortunately this investment posibility is only for investors from Germany, Austria, France, Hungary, Ireland, Luxembourg and Switzerland (yet). I'm invested in a stock property (an existing building which is already rented) at Exporo* with 1.000€. The expected return is 4,5% and payments come in every quarter.

Exporo* does also offers real estate development projects. Here everybody can invest. Maybe for diversification it’s interesting for you.

By the way, Exporo offers you 100€ as promo code for your first investment directly after registration. If you invest I receive also a 100€ promo code.

Go & Grow

Go & Grow

The better product at Bondora* despite a cap of 6,75% is Go & Grow*. I mainly use it for a small part of my cash and will also use it for my side hustle and savings for insurence payments. Because of the withdrawals from time to time IRR is at 5,90%. However, I do not want to miss the liquidity available here.

5€ are available for you at Bondora* right after registration. If someone wants to invest a larger amount, just send me a message because I get 5% of your investments and I share my bonus.

IRR increased to 6,23% at Crowdestate* mainly because of selling on the secondary market. 1.586€ are invested in loans with 13,5-17%. Again I withdrew the interests. This could happen more often in the future. As mentioned in my last portfolio update the payments for the Baltic Forest X are stopped until summer 2020. Furthermore, the project can no longer be traded on the secondary market. Also other projects had some troubles. It seems the Crowdestate* have been sleeping in case of due diligence. My other projects have paid the interest as planned. Just for your information Crowdestate* also offers now projects from Romania.

Unfortunately there is no referral link with cashback I can forward to you. I'll get up 17€ + 0,5% cashback for 60 days if you are using my link.

In November two new projects were added and I'm now invested in 28 projects at EstateGuru*. The IRR decreased slightly to 8,67%. As many projects pay the interest at project completion IRR will jump later on. For now I'm very satisfied because I have no defaults so far (knock on wood!).

At EstateGuru* there is 0,5% cashback for 3 months which I also get plus 5€.

I added 748€ to Crowdestor* in November and invested 500€ in a single project (Consumer Loan Portfolio Acquisition) with 24% for 12 months.

Because of that IRR is now at 8,99% but will jump for sure to 17% soon.

Finally the new UI design is live! Here are some impressions.

Why is the XIRR that low? Now often the new projects have a slightly different structure, e.g. that the interests are accumulated and only payed after 6 months and so on.

Why did I increase the investment even further (compared to October)? My trust in the platform is really high and regarding the consolidation of platforms I would like to increase the share of crowdlending platforms. If you want to know more about Crowdestor, I recommend my interview. On the other hand, I would like to refer once again to the blog post by Georg from Crowdlendingrocks.eu. He has a very interesting Q&A with Janis and Gunars from Crowdestor with great insights on his blog.

With this link* you can get 1% on top for 180 days (1% for me aswell) on your investment!

The IRR at Viainvest* also increased slightly to 10,62% and is moving closer to 11%. As a platform for diversification I can clearly recommend Viainvest and I will continue to invest here. Especially because you cannot find that much Swedish loans. In November Viainvest* introduced a fresh design.

For the start at Viainvest* there is a 15€ bonus. For this only 50€ need to be invested. I'm also rewarded with 15€ if you are register with my link.

IRR at NeoFinance* increased again to now 11,59% (+0,56%). I'm still happy with NeoFinance*, but it's now clear that there will be definitely some defaults. To be exact there are red loans but I won't count it as defaults for now because I've seen that they are paying from time to time.

The return calculated by the platform is now 18,44%. The deduction of 15% withholding tax is already incluced (can be reduced to 10% by the way).

The return calculated by the platform is now 18,44%. The deduction of 15% withholding tax is already incluced (can be reduced to 10% by the way).

NeoFinance* has a 25€ bonus for new investors. If you invest with my link I'll get 5€ + 2% cashback for 2 months.

I added 132€ to Bondster* and now 787€ are invested. As a result IRR dropped slightly to 11,62% (- 0,05%). I have planned to increase to a total of 1.000€ in December. In times of the 10/11% loans on Mintos, Bondster is an excellent alternative because it offers a variety of loans up to 14% from at the moment 12 loan originators. Some of the are also known from Mintos or Grupeer.

Similar to Mintos there is a 1% cashback for you after 30, 60 and 90 days at Bondster*. I'm also getting 1%!

11,69% (+0,55%) is the IRR on PeerBerry. All short-term loans have now expired and only long-term loans are left in the portfolio. These are then transferred bit by bit elsewhere, so that sooner or later I withdraw completely from PeerBerry. As mentioned above the divestment is mainly (but not only) due to the consolidation of my platforms. Also the interest level on PeerBerry is around 11,5% at the moment so there are plenty of alternatives. Maybe I come back next year, who knows?!

PeerBerry* has introduced a loyalty bonus even if the requirements are very high:

- 0,5% for 10.000€

- 0,75% for 25.000€

- 1% for 40.000€

Using my PeerBerry* link I get rewarded with 5€ + 1% from investments for 60 days.

IUVO comes to 11,82% (-0,12%) at 1.134€ investment. IUVO or the loan originators do not pay interest on late loans. Therefore, there is a difference between the XIRR and the return displayed in the dashboard (14,13%). Furthermore, everything is nicely reinvested.

- For IUVO there are two different offers. For the first you can contact me because unfortunately it has to be done manually. You get up to 90€ for the start on the platform. 30€ are available for an investment of 1.000€, another 60€ for 2.500€.

- With the 2nd offer (click on the banner) I would like to share my bonus of 200€ if you invest at least 1.500€ within 30 days and give away 90€. So if you're interested just send me a short message.

Bulkestate* made a huge jump to now 12,91% (1.293€). The reason was the early repayment of the Marijas Street project which should normally end mid March 2020. I received 77,32€ in interest. I will move the not invested money to other platforms but I don't know which one yet.

I'm not going to increase my investment in Bulkestate for the time being. Initially, I had considered investing in Bulkestate projects through EvoEstate. But that doesn't work out, which is why I leave my investment that way. So what is the reason? You can read about this in the EvoEstate – project originator overview blog post.

There is no bonus or cashback for new investors. Only I'll receive 2% cashback within 120 days if you invest through my link

Mintos‘* IRR climbs to 13,13% and 5.166€ are invested on the platform. In November I didn't withdraw any money. That's the good thing.

The bad news is that more loan originators are in trouble now. For Rápido finance the secondary market activities were suspended. The Aforti story still isn't over. On top of that the loans in Kosovo of the loan originators Iutecredit and Monego have no licence anymore!

Nonetheless Mintos is the biggest platform even if the have to be better in communicating such topics. What did I do? I adjusted my auto invests and excluded many loan originators and also won't add new originators like Creditter right away.

If you want to invest on Mintos* there is an offer where you get a 1% bonus on the average investment at the start on the platform. This will be charged after 30, 60 and 90 days. I'll get 12€ and also 1%.

I have 1.789€ invested at Grupeer* with an IRR of 13,13% (+0,03%). My funds were invested in some loans of the new originators. You can find the last month introduced originator rating here. Also there is stage 3 of the Impersky development project available and also a Swedish one. The Grupeer Santa is also a new campaign.

80€ are left on Viventor*. To be exact eight loans from Aforti IRR therefore jumped in November to 13,85% (+2,23%). I moved the money to Bondster and EvoEstate. You may think why I leave. Mainly it's because of the communication in the Aforti case. It's not really about the platform itself because the return is nice!

I you want to invest on Viventor* unfortunately there is only a bonus of 5€ and 1% for 30, 60 and 90 days for me as publisher.

Now we come to one of the problematic platforms in November – Envestio*. First of all I have to say until now every project pays on time. Always there were some projects which are somehow shady if I digged deeper, but in most of them I just didn't invest.

In November there was a bigger change. The platform was acquired by the German business man Arkadi Ganzin. The Former COO Evgeniy Kukin is now general advisor and as new COO Eduard Ritsmann was introduced. You can read the official statement on the Envestio blog.

Digging deeper on the mentioned persons I have my concerns and I will now observing the situation on the platform. I'm not panicking and withdraw my money but I will not invest in new projects until things are clarified.

On the brighter side the raw numbers of Envestio look great. IRR increased to 17,26% (+0,42%) and I'm invested now with 1.983€. So I invested in two projects (before the acquisition was announced).

5€ are available as a bonus* at the start (100€ minimum investment) and also 0,5% cashback during the first 270 days. For me it's 5€ + 2,5%.

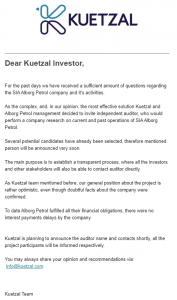

The 2nd even more problematic platform is Kuetzal. So I won't share my referral link until further notice.

Kuetzal's raw numbers look great, too. Still an IRR of 18,78% with 1.730€ invested. Like Envestio the team change significantly and the now former CEO Alberts Cevers was replaced by Maksims Reutovs. Upon request Alberts had a job offer he had to accept. Also some some other members vanished from the team site. I asked the new CEO and he answered that they are involved in a separate project but still working with Kuetzal.

As I'm writing this blog post ExploreP2P did again a great job and published this article about the Kuetzal project Alborg Petrol. To summarize it the company looks like a fake company and now the question is how could that be possible. Did Kuetzal do any due diligence? Other critical points Jørgen Wolf described in his blog post which you should really read before investing. At least Kuetzal will now invite an independent auditor to have a deeper look in it.

Also in November I added TFGCrowd* as a new crowdlending platform. It's for a longer period on my watchlist and finally I found time to made an account and invest into the first project. I also have a short review and interview with TFGCrowd which you might find interesting.

I already got the first interest payments for my project so the IRR jumps fresh of the start to 20,05%. I'm invested with 100€ in this project.

If you want to test out the platform you can use my link. I will receive 20€ as a bonus if you invest at least 100€.

Monethera stays at 2nd place with an IRR of 20,22% (-0,3%). My total investment is 1,241€. In an interview with CEO Andis Tauber you can get more information about Monethera.

Same No. 1 like in October with an IRR of 22,02%. It will certainly decrease to 18-19%. I'm invested in all available projects with a total of 1.225€. For more information about the platform there is the interview with CMO Ingus Linkevics. I have high hopes in the platform and will increase my investments there in the next month.

Right now you cannot deposit money on the platform because they want to implement automatic payments. In the beginning it shouldn't take that long but there will be more features coming with that update which caused the delay. As I spoke with Ingus he explained me the situation. Wisefund is not happy about the delay but in the end there are several nice features for the investors. An official update will come soon.

Affiliate income

As I mentioned that I'll be more transparent regarding income of affiliate sources. You have seen that I write down what I get in return if you using my links. Furthermore I will update you here about my affiliate income in November. I haven't received it yet. But in total it's 272,68€ distributed over 9 platforms.

Outlook & Summary

Puh…it was a memorable November I think with all the problems of the different loan originators, platforms and projects.

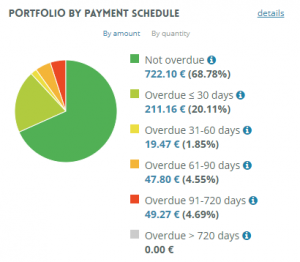

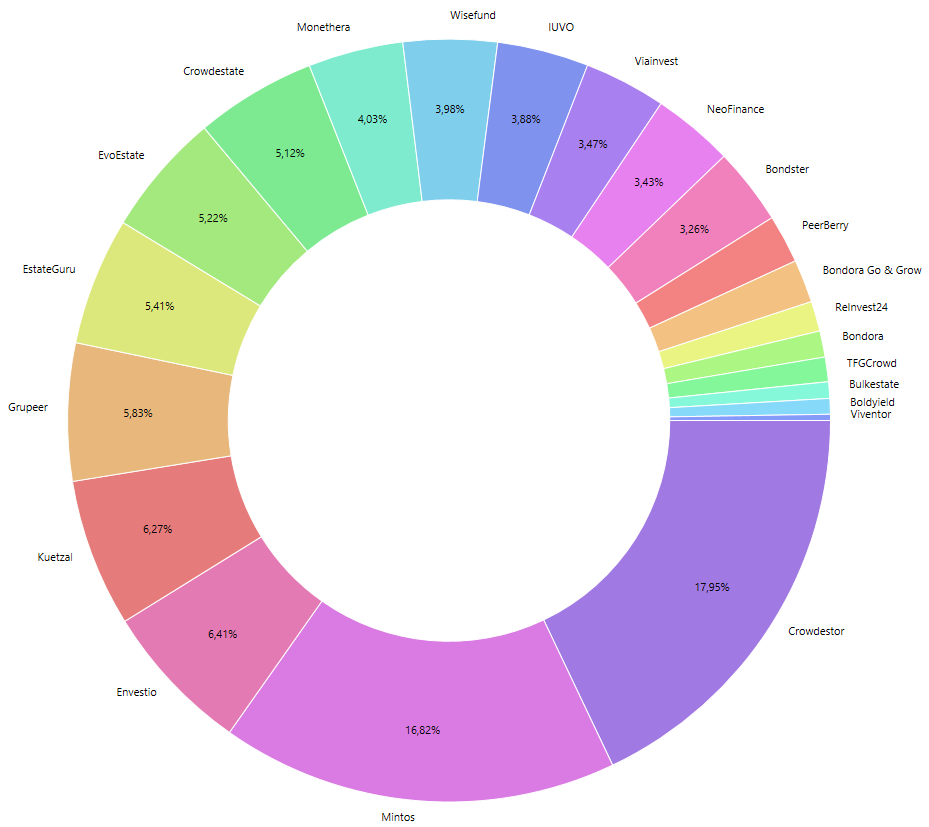

So buy-back p2p decreased slightly and crowdlending increased again a lot. Overall, the distribution now looks like this in November:

- 35,94% (-0,37%) P2P (Buy-back)

- 40,34% (+4.70%) Crowdlending

- 17,73% (-2.94%) P2B (Real estate)

- 4,54% (-0,20%) P2P

- 1,830% (-1,19%) P2P (Short-term)

As seen in the IRR ranking the crowdlending platforms are of course at the top. And Crowdestor* will also line up there. I haven't thought it through completely but I think I will try to lower the share of consumer loans and invest more in the direction of asset-backed loans. So to be exact I plan to increase the share of real estate p2b in the next month with bigger investments in EstateGuru* and EvoEstate*. Let's see if I can do this like planned.

I hope you find my summary interesting. I'm always open to constructive criticism and proposals. See you in January!

Revolut – My account for p2p and crowdlending

Since I don't want to transfer everything from my regular bank account to the platforms, I was looking for a simpler solution. A few months ago I stumpled upon Revolut.

After being skeptical at first I'm now a big fan of the app. The execution of transactions to the different platforms and also withdrawals is very fast. In addition you can with the free Revolut VISA card with max. 200€ cash limit per month at an ATM. And that without additional costs!

In addition Revolut is my faithful travel companion. Since I also work abroad from time to time I also looked for a way to simply exchange currencies. This is easily possible with the Revolut app. Also without fees (up to 6.000€ per month)!

About new projects on Twitter and Instagram

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (invest diversified) in which I invest myself. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!

Hello Philipp,

1- What are your concerns about the new CEO of Envestio?

2- Willl you withdraw your money from Kuetzal? or will you wait for a strong explanation from the CEO?

3- Do you recommend Boldyield and TFG crowd?

Thank you

Hi Marcus,

1) first of all I didn’t know him. Until the official statement of Envestio he hasn’t introduced himself and didn’t make clear what his plans are with the platform. Furthermore all available information about him an the new COO hasn’t verified yet.

2) Somehow both but the latter. I withdraw the interests I receive and wait what comes next.

3) I won’t recommend anything 🙂 My personal opinion is that Boldyield, which is even younger than TFGCrowd, has a bright future if they can win more investors. More patience is needed her. I like both but as they are so fresh I have to see what will come out in the end.