Hello dear blog readers! It's time again for a portfolio update February 2020. After the recent losses because of my naive investments an event occurred pretended far away from Europe and Germany were I'm based. I think you all know what I'm writing about – the corona virus or COVID-19. What seems to be a problem far away has no arrived in our everyday life with massive impacts, restrictions etc. And it's a black swan in my opinion. Because of that stay healthy has the highest priority and I think everyone of you can and have to contribute to that by staying at home and keeping (social) distance and so save other people which are no that healthy anymore.

Nonetheless my blog is about P2P and crowdlending and you might want to know how I'm dealing with the current situation. Below I want to describe everything and also sharing my thoughts at the end.

Table of Contents

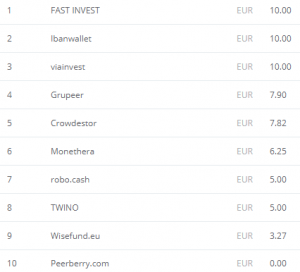

IRR-Ranking February

Platform | IRR (%) | Changes to previous month (%) | Invested (EUR) | Changes to previous month (EUR) |

|---|---|---|---|---|

23,63 | + 2,64 | 812 | 103 | |

21,09 | 0 | 1064 | 70 | |

14,00 | + 0,29 | 80,70 | 0,10 | |

13,71 | + 0,56 | 6341 | 67 | |

13,03 | + 0,27 | 319 | 0 | |

12,44 | + 0,29 | 1091 | 12 | |

12,13 | + 0,12 | 629 | 35 | |

11,58 | + 0,07 | 1289 | 12 | |

11,09 | + 0,05 | 8170 | 205 | |

10,84 | + 0,20 | 1094 | 10 | |

10,78 | + 0,58 | 1069 | 11 | |

8,08 | - 0,39 | 2413 | 303 | |

6,44 | - 0,98 | 1584 | 108 | |

5,37 | - 0,43 | 1678 | 701 | |

5,11 | + 1,31 | 395,42 | 1,42 | |

4,36 | + 4,36 | 100,34 | 0,34 | |

2,06 | + 0,26 | 3598 | 416 | |

1,57 | - 0,21 | 1000 | 0 | |

0,00 | 0 | 50 | 50 | |

0,00 | 0 | 50 | 50 | |

Grupeer | 13,43 | +0,16 | 2020 | 191 |

Monethera | 17,36 | -3,99 | 1617 | 26 |

Kuetzal | -105 | - 105 | 0 | 1957 |

Envestio | -95,16 | - 95,16 | 0 | 1563 |

-3,39 | + 1,38 | 36464 | 2155 |

IRR-Ranking March

Platform | IRR (%) | Changes previous month (%) | Invested (EUR) | Changes previous month (EUR) |

|---|---|---|---|---|

22,57 | -1,06 | 711 | 101 | |

19,67 | -1,42 | 986 | 78 | |

16,83 | + 2,83 | 80,70 | 79,20 | |

15,05 | + 1,34 | 7006 | 665 | |

12,90 | + 1,32 | 2342 | 1053 | |

12,59 | + 0,15 | 1103 | 12 | |

12,38 | -0,65 | 624 | 305 | |

12,05 | -0,08 | 635 | 6 | |

10,84 | + 0,06 | 1079 | 10 | |

10,78 | - 0,06 | 1103 | 9 | |

9,85 | - 0,24 | 8473 | 303 | |

9,31 | + 9,31 | 50,49 | 0,49 | |

7,87 | - 0,21 | 2828 | 415 | |

5,95 | - 0,49 | 1565 | 19 | |

5,33 | - 0,04 | 883 | 795 | |

5,27 | + 0,16 | 396,56 | 1,14 | |

3,86 | -0,50 | 100,34 | 0,34 | |

2,89 | + 2,89 | 322,27 | 272,27 | |

2,70 | + 0,64 | 3612 | 14 | |

1,57 | - 0,21 | 1000 | 1000 | |

0,00 | 0 | 270 | 270 | |

0,00 | 0 | 260,08 | 260 | |

Grupeer | 13,38 | -0,05 | 2025 | 5 |

Monethera | 17,45 | +0,11 | 1522 | -95 |

Kuetzal | -105 | - 105 | 0 | 1957 |

Envestio | -95,16 | - 95,16 | 0 | 1563 |

-2,30 | + 1,09 | 37977 | 1533 |

Platforms

I also want to start to mark capital as ‘questionable' where I think it is. Sterling of p2p-millionaire.com started this two months ago and it's more transparent for you and me as well. Also it becomes more important because of the corona pandemic which will definitely have an impact on the P2P/crowdlending platforms.

So I'll start with the platforms where the ‘questionable' capital is higher than on other platforms. Every deposit/withdrawal comes/goes from/to my Revolut* account as central instance.

I know as I publish this blog post it's late March and I will address some things which happened mainly in March, the numbers however are the numbers from February 29, 2020! In the first week of April I'll publish an update of the IRR-table, so you see also the ‘current' numbers. On top I'll publish in a separate blog post my thoughts in more detail and also describe then what I'll change in the upcoming month.

Questionable capital >50%

Monethera has a total account value in February of 1.617€ with an IRR of 17,36% (-3,99%). I didn't invest in any new project in February. Monethera had and have huge problems with their bank(s) and changed to a financial service provider called Trustcom. Here you can read more about the situation. For whatever reason the processing of withdrawals is done manually. So a withdrawal request from February 14th I got at March 9th. Two other withdrawal request from March 10./11. still are not on my bank account.

I thought Monethera can turn the corner but It seems I was wrong in this matter. A few days ago (March 27th) the platform announced a ‘temporary complete cessation'.

On March 31, my balance unfortunately shows still 1.522€ invested.

Because the banking issues occurred before the effects of COVID-19 and Monethera so far didn't give information about the status of the projects and now with this statement I can't put my capital as questionable but I have to write it off completely.

There is a Monethera Discussion Action Group on Telegram. Here you can find a form for the preparation of possible legal actions. Have a look at the pinned post in the group.

Because of the current situation I deleted the affiliate links for Monethera in the beginning of February.

I stuck to my plan and increased my investment at Grupeer. Now 2.020€ is the total investment (+191€) with an IRR of 13,43% (+0,16%).

Grupeer added portfolio statistics to their dashboard and now it's finally possible to see the (non-)diversification over loan originators.

In the last days the Austrian investor and youtuber Bernhard Hummel published on his channel videos from his trip and interviews with Grupeer's co-founder Alla Kisika. You should watch it! To get straight to the point I really don't like the answers in the interview. Bernhard did a good job in asking critical questions.

As I'm writing the blog post the situation got worse and worse. It seems the loan originators Epic Cash and Lion Lender are fake and there are more contradictions regarding real estate projects. Thx again to @RPeerduck for digging deeper and deeper! The only reaction of Grupeer was this piece of art…

On March 31, my balance unfortunately shows still 2.025€ invested, pending withdrawals included.

Therefore I stopped my auto invest and will withdraw the repayments if possible. Also I put 100% of my capital at Grupeer as questionable but not write if off completely for now.

There is a Grupeer discussion group on Telegram with a lot interesting and also worrying information. Feel free to join the group.

After watching Bernhard's videos I deleted all my affiliate and referral links for Grupeer.

The 80€ from November are still ‘invested' in February at Viventor*. IRR increased to 14,00%, because I had a few cents left and bought a discounted loan at the secondary market. In the current situation the communication is much better than before. The CEO Andrius Bolšaitis had a difficult start and even though I dislike the communication regarding Aforti (I mentioned it in every portfolio update I think) I changed my mind and think about increase my investment here again.

Nonetheless I put 100% of the capital as questionable because all 80€ are Aforti Finance/Factor loans.

In March I invested 79€ ans increased the investemnet as planned. Total investment is now 159€ with an IRR of 16,83% (+2,83%).

If you want to invest at Viventor* unfortunately there is only a bonus of 5€ and 1% cashback for 30, 60 and 90 days for me as publisher.

For TFGCrowd* the picture looks slightly better. You can find my short review/interview here. My investment at the platform is ~812€. with an IRR of 23,36% (-2,64%). In February I invested only in one project. The project EDELAND Gmbh Logistics on the other hand wasn't fully funded and I withdrew the 100€ plus the interests of February on March 5th.

Also in February TFGCrowd presented their development roadmap until 2022 on their blog. On March 27, 2020 TFGCrowd wrote in a newsletter all projects and payments should work like scheduled. Let's see a few days if that's true.

I can't imagine that the corona pandemic was on their radar back then as the published the roadmap. This, the red flags and the types of projects I'm invested in are the reason I put 90% of the money as ‘questionable'.

On March 31 my balance showed 711€ invested with an IRR of 22,57% (-1,06%).

However if you want to test the platform you can use my link. I get 20€ + 2% after 90 days as a reward if you invest at least 100€.

Wisefund* has an IRR of 21,09% (same as the month before) with 1.064€ (+70€) total investment. I invested 55€ in this project. It's without buy-back guarantee. Also there are two open projects.

I had several conversations with Ingus Linkevics, who is now the owner of Wisefund, regarding status of the projects and what's the best for all participants (platform/projects/investors). He has some good ideas how to steer the ship through the storm but I cannot foresee what will happen in the end

Another interesting news Ingus mentioned is that Wisefund launches an easy funding program for COVID-19 affected companies. It offers loans from 10.000€ to 250.000€ for companies which have suffered sales decreases of 25% or more. The following steps will be in the place for companies which apply to the program:

- Priority review (2-3 days)

- No commission on review

- Offering lower commissions for successfully funded applications

- Listing as project for support with additional marketing and promotion on the projects

- Loan for max. 18 months

- Fixed rate 10-13%

- No early repayment option

Due to Ingus the main incentive is here to filter out businesses that in other conditions were working flawlessly and being a good part of the economy, and now are going to struggle, but have clear path of recovery with certain financial support. To investors the following will be offered:

- Fixed rates of return 10-13%

- Full transparency of the business

- Securities like commercial pledges, mortgages, personal guarantees (depending on each case)

- Most importantly, possibility to support our own economy, support SMEs who are the heart of what we do (activity based businesses), where we spend time (places, restaurants, leisure spots), what we use (utility stores, apps, family owned businesses)

So it's a similar approach to what Linked Finance for example announced a few days ago but with some more restrictions. I like the idea but I don't know if it will be successful. Due to my information a few businesses have applied by now and some of them look promising.

Nonetheless because there is still a major risk and the platform is young I put 75% of the capital as questionable.

A good thing was the introduction of a secondary market where as of today two projects are tradeable. Here you can see two things:

1. People invested crazy amounts in single projects

2. People are so in panic mode that they want to sell with discounts of up to 31%. Really crazy shit.

At the end of March the IRR is 19,67% (-1,42%) with 986€ invested.

Wisefund* offers 0,5% cashback for your investments within the first 270 days!

8.170€ total account value is it on Crowdestor* in February. This means I invested 205€. IRR almost didn't move and is now 11,09% (+0,05%). The average interest rate for my projects shown in the dashboard is 17,41%.

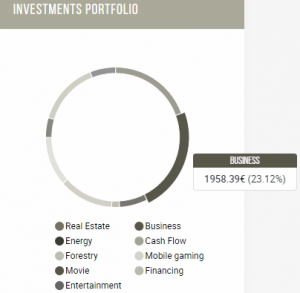

Regarding the risk of the platform and the projects I put 50% of the capital as ‘questionable'. Especially because of the corona pandemic which will have a massive effect on tourism and restaurants. In the screenshot below you see that I'm invested with almost 2.000€ in business loans and there are several holiday resorts, restaurants and so on.

As I said multiple times before I don't invest in every project and focus more on the high-yield short-term projects. But because of the current situation I try to choose the projects even more selective. Anyway in February I invested in the following projects:

- Consumer loan portfolio acquisition (II) (24%, 12 months)

- Working capital for a chain of Pet Food and Pet Accessories (17,5%, 15 months)

- Fertilizer Export Financing (III) (21%, 3 months)

As I'm writing this blog post Crowdestor posted a reaction. In my opinion it's the right way to deal with the situation. Below you can see the statement.

Dear investors,

We would kindly like to address the current situation in the world with the recent global challenges, how this reflects to economy in general, CROWDESTOR investors and borrowers. Therefore, we turn to you with the following statement.

Regarding global economic downturn caused by the outbreak of the novel coronavirus COVID-19. Starting from 31 December 2019 when the first case of infection with COVID-19 was reported to the World Health Organization by China, the world has experienced a very sudden, unprecedent and unexpected economic and public health crisis.

Almost every country in the world and every business sector has been affected. The travel, relocation and gathering bans imposed has almost completely stopped airline, hospitality, restaurant, educational, cultural and entertainment sectors, real estate, car manufacturers, production worldwide and the transportation industry; these are all those that with every passing day experience a complete market disruption. Consequently, these industries and companies now face serious threat to their existence. Many countries have declared a state of emergency.

Due to these reasons it is certain that current circumstances can be qualified as exceptional, border-lining force majeure events.

National governments and European Commission understand the severity of the situation and, under threat of mass layoffs, are considering measures to alleviate the situation. Governments are planning to introduce recovery packages. Financial institutions are encouraged by governments and regulators to review existing payment deadlines and allow borrowers to have a time to recover once the outbreak is over.

We live in a fundamentally connected world, we all get to experience some direct or indirect affect sooner or later and our industry is no exception to that. Even though we are inclined to recognize this situation as force majeure, we want to assure you, we keep CROWDESTOR investors best interests at heart, maintaining a reasonable and humane attitude towards economy and society and therefore, we want to act in a responsible and proactive manner addressing this situation.

At CROWDESTOR we recognize the extensive trust and loyalty we have received from our investors and borrowers throughout all this time, which is precisely why we want to be fully transparent with you now, not to promise scenarios which cannot be delivered, leave you in the dark or lose your confidence in our platform.

As you might have noticed, there are borrowers currently experiencing significant difficulties. There are restaurants closed, private educational companies without students, hotels are facing 99-100% cancellations and real estate deals are put on hold for an unknown period. We have strongly believed in our projects beforehand and we do not intend to stop doing it now, we believe it is just a timely setback.

We are completely certain that to default any of the business projects today is not an answer or in the best interests for anyone. Especially, in the current conditions where market is almost nonexistent, where it is almost impossible to sell the assets or entities for a reasonable price, or to be able to refinance them. We trust and have full confidence in our borrowers. Our borrowers fully respect their liabilities and they have no intention in not repaying their loans.

At CROWDESTOR we have evaluated to look at the bigger picture and we sincerely invite our investors to support us with this. Therefore, we have decided to set a ‘Recovery period’ on all ongoing investments for a period of 3 months.

We strongly believe defaulting projects today is not an option as it would result in big losses for all – investors, borrowers and CROWDESTOR, hereby giving 3 months to borrowers could make a significant difference – borrowers would have the time to adapt to new market conditions, to set proper recovery plans in place for repayments and to apply for State recovery aid if possible; which is in the interests of CROWDESTOR and investors.

Consequently, CROWDESTOR has decided on the following actions:

- To introduce a leniency period towards the borrowers till end of June 2020; during this time CROWDESTOR will defer any loan repayments and will not affect any liens or other securities that CROWDESTOR holds;

- In the best interests of investors, CROWDESTOR reserves rights to reconsider this decision and to effect liens it holds, this will be done in situations where CROWDESTOR will decide that the best course of action is in the best interests of investors is immediate action to enforce repayment of the debt;

- After Recovery period CROWDESTOR will use its rights in full amount in the context of loan repayments and recoveries.

Nonetheless, also during this time our platform will operate as usual, our business activities will proceed undisturbed and with no problem to preform them remotely when necessary. In case of any questions, our team will be reachable at timely manner and glad to respond.

We kindly like to remind you that CROWDESTOR is still one of the few platforms that offer you to invest in highly diverse projects from various industries, so you can build a portfolio that corresponds to your values and risk appetite.

Do not forget – markets recover, they just need time.

This is a time for smarter due diligence, diversification, trust and patience in the process for the longer term welfare, both in matters of financial standing, as well as, prosperous health.

Our mission at CROWDESTOR is to empower anyone who wants to invest their money in meaningful or financially sound future projects across various industries and geographical boundaries.

Best regards

Janis Timma

CEO

CROWDESTOR

I added 303€ in March to my Crowdestor account. The total investment is now 8.473€ with an IRR of 9,85% (-0,24%), which decreased because of the repayment pause.

With my link* there is 1% on top for 90 days on your investment! I'm rewarded with 1% too. I switched to the Crowdestor referral program because there are problems with the links of Circlewise in combination with adblockers, so I cannot offer 180 days anymore.

Questionable capital >=20%

I added Debitum Network* last month. The platform serve asset-backed business loans only. Interests are ‘lower' (7-8%) but including possible penalty fees (4,5-10%) it could be much higher in the end. I received 0,34€ interest so the calculated IRR is now 4,36%.

Debitum added two loan originators in the last weeks. Noviti Finacne from Lithuania and Triple Dragon from UK. The last one is very interesting because they are backed by Apple and Google receivables. Also Debitum published a blog post about their thoughts on the coronavirus.

Because it's a new platform for me and the platform offer investment in business loans (doesn't matter if's asset-backed or not) I put 30% of the capital as questionable.

IRR is in March 3,86% (-0,50%) because of some long-term loans.

If you also want to try out Debitum Network* you can use my link. If you invest 100€ I get a reward of 10€ and 2% cashback for 90 days.

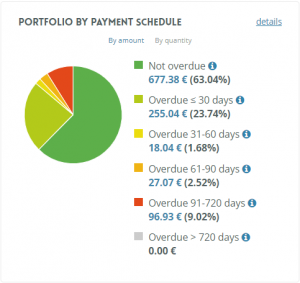

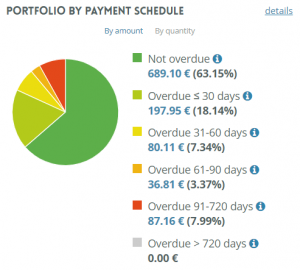

In February NeoFinance* IRR increased again to now 12,44% (+0,29%). The total investment is 1.091€ . Slowly we come to the area where it should be. I'm satisfied with NeoFinance* but noticed that there are more red loans. For now I don't count those as defaults, because there are repayments from time to time. In the following screenshot I compared January and February. Also I noticed that there are several discounted loans which fits my criteria available on the secondary market.

The platform calculated IRR dropped down to 12,17%. The reason is that NeoFinance adjusted their calculations.

At least the 91-270 days overdue loans I have to mark as questionable even though some of them might pay in the future. I think 30% of the capital is questionable in the current situation.

On March 31, 2020 the total investment is 1.103€ with an IRR of 12,59% (+0,15%).

At NeoFinance* there is bonus of 25€. If you use my link I get 5€ and 2% cashback for 2 months as a reward.

At Bondster* approx. 11€ interest increased the total investment to 1.069€. The dashboard IRR shows 12,98%, calculated IRR is 10,78% (+0,58%). Two weeks ago I did an interview with Jana Mücková where I tried to clarify some questions.

Regarding COVID-19 Jana published a post which you can find here. In addtion several loan originators posted statements.

Bondster is a young platform so I'll put 30% of the capital as questionable as well.

End of March 1.079€ were invested and the IRR slighlty increased to 10,84% (+0,06%).

Similar to Mintos there is a 1% cashback after 30, 60 and 90 days at Bondster*. I receive 1% as well.

Mintos* is my second largest platform with 6.342€ and now 13,71% (-0,56%). Mintos gone nuts in February and especially in March. Because of investor's panic there are soooo much loans with heavy discounts available on the secondary market. In the next blog post I'll go more into detail on this matter.

Some interesting and worrying news in February/March:

- Several new loan originators (Pinjam Yuk, DanaRupiah, SwissCapital, Mwananchi)

- Increase of limit to 500.000€ for Invest & Access

- Introduction of new loan type ‘Forward Flow'

- Webinar with Martins Sulte

- Status of loan originators regarding COVID-19

- Pending payments in detail

- Interest for pending payments

- Revocation of the licences for Varks.am (Fink Armenia)

- AlexCredit loans suspended from the primary/secondary market

Furthermore I can only recommend to follow the official Mintos blog for changes and also include the lender ratings from ExploreP2P in the selection of your loan originators.

Even if Mintos is one of my biggest platform I put 20% as questionable because I many short-term loans. For example several loans from Varks and AlexCredit.

In March the IRR made a massive jump because of the purchases on the secondary market. 1,34% more than in February and so the IRR is 15,05%. In addition to that I made several deposits of 665€ in total. New account value is 7.006€.

Mintos* stopped the cashback for investors. Only publishers like me receive onetime 5€ + 1% for 90 days.

Questionable capital >=5%

And another change of plans at Crowdestate*. I couldn't resist and invested in one project. Now the total investment is 1.584€ (+108€). Because of a bigger interest payment of one project IRR is now 6,44% (+0,98%). As I mentioned in the last portfolio update the payments for the project Baltic Forest X were stopped until summer 2020. But there are also some good news because the Pärnu County Court approved Baltic Forest OÜ’s reorganization plan and also it's tradeable over the secondary market again since February 3, 2020.

To lower the withholding tax I sent all the necessary documents to Crowdestate.

Approx. 15% of my capital I put as questionable because of the Baltic Forest X project.

Because there was no suitable project I withdrew a little bit in March. Total investment is still 1.565€ with an IRR of 5,95% (-0,49%).

Unfortunately there is no affiliate link with cashback which I could forward to you. If you use my link*, I receive up to 17€ + 0,5% cashback for 60 days. As of April 1st, 2020 my reward will be 5€ + 1% cashback for 60 days.

IUVO is now at 11,58% (+0,07%) with an investment of 1.289€. IUVO or the loan originators don't pay interest on late loans. Therefore, there is a difference between the IRR and the return displayed in the dashboard (14,31%). IUVO informed about the status of their loan originators too.

Marking 10% of the capital as questionable seems to be appropriate because of the amount of HR loans.

IUVO had the largest increase n volume. I added 1.053€, so in total 2.342€. IRR also made a jump to 12,90% (+1,32%) because I bought many discounted loans.

- For IUVO there are two different offers. For the first you can contact me because unfortunately it has to be done manually and I have to invite you. You get up to 90€ for the start on the platform. 30€ are available for an investment of 1.000€, another 60€ for 2.500€.

- With the 2nd offer (click on the banner) I get 5€ and had the idea to share my bonus of 200€ if you invest at least 2.500€ within 30 days and give away 90€. But unfortunately the collaboration with three parties (IUVO, affiliate network, me) doesn't work like expected.

With an IRR of 5,11% (+1,31%) the IRR increased compared to January at ReInvest24*. The total investment is still 395€. I really like the business model of ReInvest24*, although the funding of projects takes much longer than on other platforms. To lower the effort I will invest over EvoEstate in ReInvest24* projects. After a longer time there is a new project available.

I put 10% of the capital as questionable.

Two interest payments came in March, so IRR increased slighlty to 5,27% with 396,56€ invested

If someone wants to invest directly over ReInvest24* there is a 1% cashback (for me as well) in the first year.

Again I increased my total investment at EvoEstate to 3.598€ (+416€). IRR increases steadily to now 2,06% (+0,26%). A few weeks ago I published a blog post about the project originators connected to EvoEstate. A good read is also the investors update Q4 from EvoEstate and the interview with CEO Gustas Germanvicius in the Lithuanian TV (English subs are available). But there are more good news. EvoEstate closed a 180.000€ funding round! Regarding the current situation Evoestate published statements from their project originators.

I put 10% of the capital as questionable because of the buy-to-let project.

On EvoEstate I was active on the SM in March. Nonetheless IRR is now 2,70% (+0,64%). Other than that only interests were paid. Total investment is 3.612€.

There are two different offers from EvoEstate:

At Bulkestate*. IRR is in February at 13,03% (+0,27%). At the moment the investment is approx. 319€. Also for Bulkestate I will give the platform a second chance. In March I invested in several new projects. I will update it in a few days

I put 10% of the capital as questionable.

End of March the IRR is with 12,38% (-0,65%) a little bit lower than in February. But 305€ were invested. New total investment is now 624€.

Unfortunately there is no bonus or cashback for new investors. I'll receive 1% cashback for 180 days if you use my link*.

On EstateGuru* I added another 303€ in February so the total volume increased to 2.413€. IRR is 8,08% (-0,39%). I tried to add new projects with monthly payments or payments every 3 months only to have a constant cashflow.

5% of the capital is questionable because I think EstateGuru is one of the safest platforms around.

I made a deposit of 415€ at EstateGuru in March so 2.828€ are invested in total with a slightly reduced IRR of 7,87%.

At EstateGuru* there is a 1% cashback for 3 months until April 30, 2020. I also receive the cashback and in addition 5€.

Questionable capital 0%

In February I added Lendermarket* as a new p2p platform with buyback. The owner is Creditstar which some of you might know as a loan originator on the Mintos marketplace. At the moment the platform offers short-term loans from Spain and Poland but other countries will be added later on. The interest rate is 12% flat, but due to the current situation with higher risk it was adjusted to 14%. My initial deposit was 50€.

Because the platform is new and I only invested 50€ I won't put capital as questionable for now.

End of March I made a deposit of 272€ and the first interests were also paid. IRR is 2,89% with 322,27€ invested.

As of March 24, 2020 there is a cashback of 2% for every deposit until April 30, 2020. On top there is a 1% cashback for 60 days if you are using my link*. In total 17%! My reward is 5€ onetime + 1,5%.

I added Swaper* again to my portfolio in March. Mainly because they now offer 14% loans and 16% for VIP investors. In the past cash drag was a major problem. So let's see if it's better now.

Because I just have a few Euros invested I won't put it as questionable.

In March I made a deposit of 270€ to Swaper.

If you use my link* my reward is onetime 5€ + 2% cashback for 90 days.

PeerBerry* has now an IRR of 12,13% (+0,12%) with 629€ invested. So the second chance I gave the platform seems to be a good idea. No calculation errors so far. There are several Ukrainian loans with 15,5% on the platform. More important were the latest news that Aventus and GoFingo Group applies an additional group guarantee for loans issued by them. That's a nice decision I think. On top they published the key performance figures of the loan originators.

0% of the capital is questionable in my opinion.

635€ shows the dashboard at PeerBerry on March 31, 2020. IRR is 12,05% (-0,08%).

A while ago PeerBerry* introduced a loyalty bonus, but with high requirements

- 0,5% for 10.000€

- 0,75% for 25.000€

- 1% for 40.000€

If you use my PeerBerry* link, I'll receive 5€ + 1% from investments for 60 days.

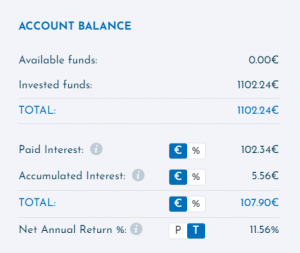

At Viainvest* I'm invested with 1.094€ and in February IRR is at 10,84% (+0,20%). The dashboard shows 11,56%. There were a lot of interesting and promising changes in the last time. First of all there will be a cooperation as a joint venture with Twino* called ‘VAMO'. The goal is to enter the Asian Pacific market and Vietnam as a first country. The other news is about loan originators. VIASMS.cz from Czech upgraded its lending product to a credit line and a new loan originator VIACONTO.ro from Romania with 12% was added to the platform.

0% of the capital is questionable in my opinion.

For Viainvest also interests were paid. 1.103€ is the total investment with an IR of 10,78% (slightly lower than in February).

For the start at Viainvest* there is a 15€ bonus. For this only 50€ need to be invested. I'm also rewarded with 15€ if you are register with my link.

Like Swaper* I added Twino* again to my portfolio in March. The now offer 14% loans which one reason. The other one is the cooperation with Viainvest* and the promising roadmap for the future.

Because I just have a few Euros invested I won't put it as questionable for now.

I reopend my account in March and added 270€.

Here* you can register. I get onetime 5€ for that plus a cashback of 1% for 90 days on your investments.

Unfortunately this investment possibility is only for investors from Germany, Austria, France, Hungary, Ireland, Luxembourg and Switzerland (yet). I'm invested in a stock property (an existing building which is already rented) at Exporo* with 1.000€. The expected return is 4,5% and payments come in every quarter. 1.000€ are still invested and IRR is currently at 1,57% (-0,21%).

0% of the capital is questionable in my opinion.

I sold my investment for 1.005€ on the secondary market and shifted the money to the stock market. But that's the only investment.

Exporo* does also offers real estate development projects. Here everybody can invest. Maybe for diversification it’s interesting for you. There is also a chance that investments from Exporo are available on EvoEstate too soon.

By the way, Exporo* offers you 100€ as promo code (use ID 157135 during registration) for your first investment directly after registration. If you invest I receive also a 100€ promo code.

Go & Grow* I mainly use for a small part of my cash and will also use it for my side hustle and savings for insurance payments. Because of the withdrawals from time to time and the fee of 1€ IRR is at 5,37%. However, I do not want to miss the liquidity available here. In total 1678€ are invested, so I added another 707€ in February.

I put nothing of my capital as questionable.

The last platform is Go&Grow. In March there were some bigger expenses, so I withdrew a bit. IRR is 5,33% with 883€ left.

5€ are available for you at Bondora* right after registration. If someone wants to invest a larger amount, just send me a message because I get 5% of your investments and I share my bonus (2,5% for you).

Scams

![]()

End of February I had an appointment at the German criminal investigation department. The were really interested in the ‘person' of Mr Ganzin.

Affiliate/referral income

February

As I mentioned that I'll be more transparent regarding income of affiliate sources. You have seen that I write down what I get in return if you using my links. Furthermore I will update you here about my affiliate income in February. I haven't received it yet, under normal conditions I get it in the following months. But in total it's 65,23€ distributed over 10 platforms. I see a trend here that the ‘income' from my hobby gets less and less. And the current situation for sure won't change it for good.

Referral income I received from the following platforms:

- Bondora: 1.209,75€

- Grupeer: 0,60€

March

Referral income I received from the following platforms:

- Bondora: 29,99€

My thoughts and summary

A black swan arrived and for sure it will have an impact on the P2P and crowdlending industry. In my opinion we will see some defaults in the next months from projects but also platforms will disappear. Honestly Grupeers ‘fall' was a surprise for me. The default of Monethera not so much, but I had the hope I get out of it sooner. In the end the wheat will be sort from the chaff. Hopefully next week I'll publish another blog post were I'll describe what I do on each platform in detail.

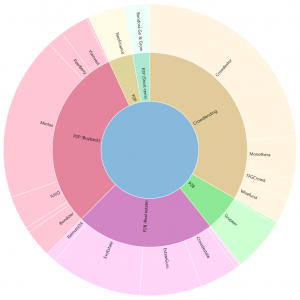

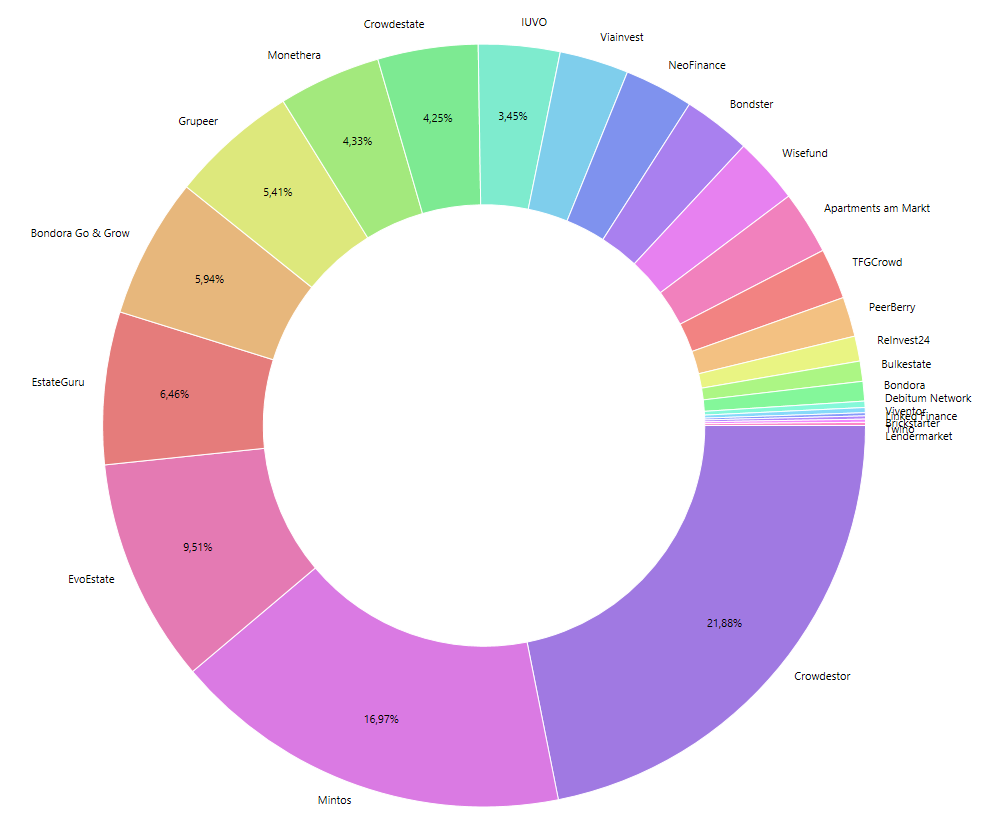

Below you can find my distribution between the individual P2P / crowdlending classes for February. I created a P2B class which consists of Grupeer and Debitum Network at the moment.

- 29,06% (-1,68%) P2P (Buy-back)

- 31,49% (-1,79%) Crowdlending

- 5,86% (-0,23%) P2B

- 25,27% (+2,27%) P2B (Real estate)

- 3,79% (+0,65%) P2P

- 4,53% (+1,94%) P2P (Short-term)

February

March

- 33,66% (+4,60%) P2P (Buy-back)

- 30,46% (-1,03%) Crowdlending

- 5,70% (-0,16%) P2B

- 23,52% (-1,75%) P2B (Real estate)

- 3,66% (+0,13%) P2P

- 2,30% (-2,23%) P2P (Short-term)

I hope you find my summary interesting. I'm always open to constructive criticism and proposals. See you in April for the next portfolio update and some other blog posts!

Events

To make it short: The INVEST in Stuttgart was cancelled and moved to March 26/27, 2021.

And then on June 19 and 20 there is the P2P Conference*. In 2020 again in Riga. I don't know if the event will be cancelled too but I think it will be probably. If you plan to go there you can use my link* to buy tickets for the ‘show'. Using the code ‘investdiv‘ you get a discount of 20%.

For using my link* for the conference I get a 5-10% reward.

Revolut -My account for p2p and crowdlending

Since I don't want to transfer everything from my regular bank account to the platforms, I was looking for a simpler solution. A few months ago I stumbled upon Revolut*. Since then I use the app for all financial transactions in the area of p2p/crowdlending and also in business context as freelancer with Revolut for Business*.

After being sceptical at first I'm now a big fan of the app. The execution of transactions to the different platforms and also withdrawals is very fast. In addition you can with the free Revolut* VISA card with max. 200€ cash limit per month at an ATM. And that without additional costs!

In addition Revolut* is my faithful travel companion. Since I also work abroad from time to time I also looked for a way to simply exchange currencies. This is easily possible with the Revolut* app. Also without fees (up to 6.000€ per month)!

Using my links for Revolut I get a reward of £2.00-3.00 for a standard card order. For Revolut for Business I get up to 66,35€.

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (invest diversified) in which I invest myself. Also on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!

Danke. Hast Du Gewinn von P2P erzielt?

Hi Steve. Wenn ich jetzt aussteigen würde nein (bedingt durch Kuetzal, Envestio etc.). Nicht berücksichtigt Referral und Affiliate. Aber das ist nicht der Plan. Sehe das als langfristiges Investment.

Good blog, who motivated you in this writing?

Thank you! I motivated myself I think. I wanted to share how I invest, and also want to share my mistakes so people out there can make it better.