Hello again. In the last time there were only portfolio updates and my blog post about my thoughts on due diligence in general. But now I think it's time again for an interview. In honour of this occasion I did an interview with Jana Mücková the CEO of the P2P marketplace Bondster*. I started my investment almost a year now and the platform made a nice development. Have fun reading!

Table of Contents

Interview

First of all what is Bondster exactly?

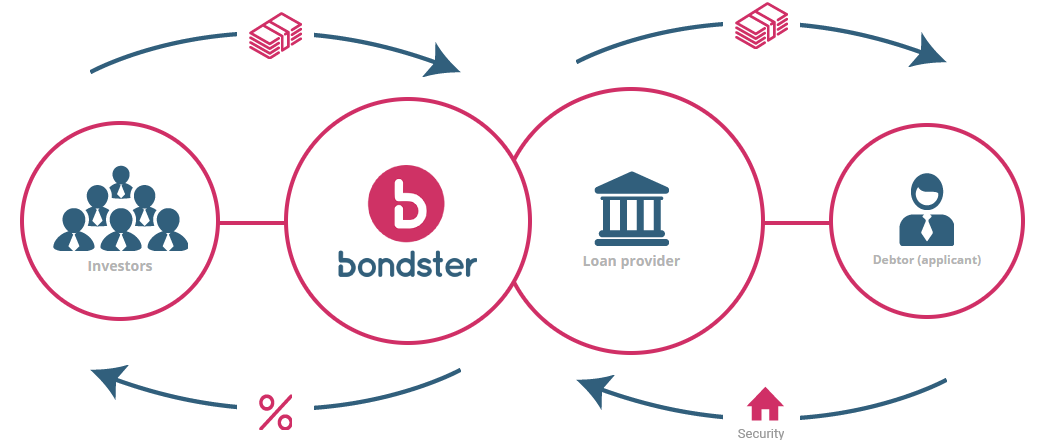

Bondster* is a global online P2P investment platform that operates as a marketplace. We connect investors looking for high interest rates and diversification possibilities with loan originators seeking for flexible funding.

What is the USP of Bondster in comparison to other big P2P players?

Except the fact, that we are the only online P2P investment platform from the Czech Republic and therefore a very good alternative to Baltic based or Baltic origin platforms, we were the first platform to introduce the product called Smart Reserve. Smart Reserve was created with our strategic partner Acema Credit Czech, a.s., one of the strongest loan originators in Europe and the leader of the Czech non-banking sector.

Smart Reserve is basically a loan you can invest in for 3,99 % p.a. but you can exit from any time you want for zero cost and therefore benefit from its high liquidity. It is something like a current account in your bank in terms of liquidity, but with much higher interest rate.

How many investors do you have at the moment?

It is crazy if you think about it, because three years ago, when the platform was established, we had investors mostly from Czech or Slovak Republic. Now, we have almost 9 thousand investors from 73 countries. We really went global.

CEP Invest Privat Equity is the owner of Bondster. Can you give us some information about the company?

Sure, CEP Invest Private Equity is a 100% Czech investment company that searches for interesting fintech or innovative ideas with a global potential in terms of market coverage and success. Except from Bondster, the company owns two other companies and looks for other investment opportunities not only in the Czech Republic, but also abroad.

Is CEP just giving the money for development or do they also provide objectives?

The relationship between the investor and the CEO is always complicated and I would say it is the case for all companies with this structure. Bondster* and CEP is not any different. The investor obviously wants to have a certain control over what is going on at Bondster and where we are heading. I think it is only natural when you invest big chunks of money into a company. I put together the budget and the strategy that has to be approved by the investor on annually basis. Other than that, we meet on quarterly basis to discuss how successful we are at fulfilling the plan and the budget and what are the plans for next quarter.

Maybe you can introduce yourself. The last time I read about you, you had the position as a relationship manager. But since then there were some changes?

Well, I started as a Relationship Manager at Bondster more than a year ago after I had left banking sector. I managed an international team of three relationship specialists and our primary goal was to bring foreign loan originators on board. We succeeded on that as we closed the deal with 12 loan

originators in less than a year and on top of that we managed to sign loan originators from exotic countries like South Africa, Mexico or the Philippines to ensure diversification opportunities for our investors. When the former CEO decided to pursue other career opportunity and I was offered the position of CEO, it felt natural to accept the challenge and gain the power to change things.

What are the challenges as a CEO?

I like the plural form of the word. Yes, there are definitely a lot of challenges. Some of them are connected to the managerial position itself – managing people, taking care of their career

development, environment and work satisfaction, others are mostly related to the technical operations and development of the platform and business relationships with the loan originators.

The world of P2P investments and fintech is a very fast changing environment, so that is a challenge itself. I do not mean only the technology now, but also the changing mindset, behaviour and preferences of the investors.

Let's speak now about the platform itself. There is a 7 days grace period. But it's only due to the information transfer process of the

providers/loan originators right?

Yes, this is a usual question of newcomers and I think that we should do a better job on explaining this to new investors. This grace period which we call “Waiting for entry” period is caused by the delay in transferring updated information about the status of loans. There are loan originators on our platform from different time zones and if you count in also the weekends and different public holidays schedules, it can easily happen that there is a delay of few days before we get the update information.

I often read that Bondster don’t pay interest for delayed loans. As far as I know it isn’t true but maybe you can clarify this once and for all?

You are right, we do pay the interest on loans with delayed repayments and this is clearly explained also in our FAQ on bondster.com*. In case the loan has a buyback guarantee, then you as an investor are entitled to interest earning for the period of delay. In case there is no buyback guarantee offered on the loans you invested in, then you are entitled to penalty charges. You can always check the “Loan details” section of each loan where you find this information.

One of your long-term goals is an own mobile app. Has the development already started?

Unfortunately, not yet. We believe that we have to work on the transparency first to become the most transparent platform in the P2P industry. The whole industry is highly dependent on investors´ trust. We could all see what happened to some of the P2P platforms that did not do a proper job on risk assessment and transparency about loan originators and how they ended.

We take the risk assessment and the transparency really seriously. It is also one of the reasons why we never use indirect investment structure on Bondster when you do not have a control over your risk. We see that some of the platforms using this structure basically promote the loans to belong one loan originator but the legal entity that you buy the loan from is a totally different one, sometimes even from a different country.

We developed our own methodology of assessing the loan originators and we are now working on our own rating system. Our goal for this year is to implement it into the platform and introduce it to our investors.

How far are the plans for a CX feature? I think IUVO also implemented such a feature but the CX-rates are not that good. Do you think such a feature is really need in times of apps like Revolut which offers the same feature?

One of the reasons why we want to implement conversion exchange into our platform is the big pool of Czech investors. As you know, Czech Republic has not yet accepted euro as its national currency, therefore for Czech investors it is still a bit of a burden to convert CZK into EUR to fully enjoy the diversification possibilities when investing with us. Czech investors still represent more than 80 % of our investors´ base, so we naturally wanted to make investing in EUR easier for them.

Do you plan to add new and unique providers/loan originators in the near future?

Absolutely, we are in negotiations with several of loan originators that would be again unique on Bondster. I will not name them yet, but follow our FB, blog or subscribe to our newsletter to stay posted.

Are there plans for limited offers in the near future like the 15% Stikcredit loans?

Well, I would spoil the magic if I would tell you now, don´t you think? 🙂

What happens in case of bankruptcy?

We do believe that this will never happen. However, it should be noted that a potential bankruptcy of Bondster will not affect the fundamental investors´ rights (i.e. rights for repayments of the principal and the interest from the debtors or loan originators) in respect of the agreements on the assignment of a claim or the participation agreement).

What happens if CEP sells Bondster?

There are no indicators whatsoever that CEP would consider selling Bondster.

Do you plan to attend the INVEST in Stuttgart or the P2P Conference in Riga this year?

We will definitely be at P2P Conference in Riga, also, if investors would wish to meet us at any other event, we are open to any further suggestions. You can reach us through our zen chat on our website or send us your suggestions to info@bondster.com.

My thoughts

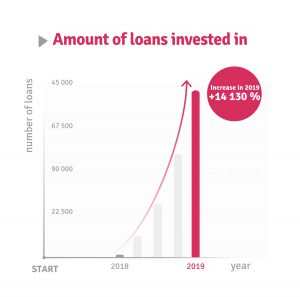

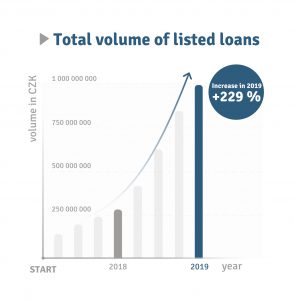

Almost one year ago I started investing at Bondster with just 200€ to test out the fresh platform back then and bumped up the investment steadily to now 1.072€. During this time the platform added more and more loan originators and added more relevant information for investors. I think Bondster can improve for example the dashboard even further and make it easier for investors. But I hope this development will continue in the same pace. Due to the strong increase of investors it will be interesting to see if there will be enough loans to meet the demand. Nonetheless I have a good feeling and will increase my investment at Bondster.

If you have other questions don't hesitate to contact me or post your questions in the comments!

Bonus for new investors

Similar to Mintos there is a 1% cashback after 30, 60 and 90 days at Bondster*. I receive 1% aswell.

P2P Conference Riga 2020

The P2P Conference* where you can meet Bondster among other platforms is on June 19/20 in Riga. If you plan to go there you can use my link* to buy tickets for the ‘show'. Using the code ‘investdiv‘ you get a discount of 20%.

For using my link* for the conference I get a 5-10% reward.

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (invest diversified) in which I invest myself. Also on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!