Hello everybody! In today's blog post there is again my monthly summary of the development in the field of P2P with the P2P portfolio update March 2022. Have fun reading!

First comes the IRR ranking, as usual, and then a closer look at the individual platforms. I have adjusted the subdivision of the platforms once again because it has led to confusion here and there. There are the categories ‘(Re)invested‘, ‘Withdrawal phase‘ and ‘Investment expires'.

‘Strategy'

My strategy for 2022 will be adjusted to the extent that the cash flow from interest on the platforms will remain or at least only be redistributed within the platforms. The goal is to increase the investment on as many platforms as possible to such an extent that I can receive 25 EUR in interest every month (if I want to!).

IRR ranking March 2022

I've selected the 01.07.2017 as a start, as this is where I started tracking my P2P investments.

Platform | Initial investment | IRR (%) | Changes previous month (%) | Invested (EUR) | Changes previous month (EUR) |

|---|---|---|---|---|---|

19.07.2017 | 11,57 | -0,14 | 7136 | +37 | |

30.10.2017 | 10,72 | -0,02 | 1097 | +9 | |

09.11.2017 | 6,64 | -0,01 | 1312 | +305 | |

14.05.2018 | 12,26 | -0,21 | 1065 | +3 | |

31.07.2018 | 11,62 | -0,09 | 1778 | +11 | |

11.08.2018 | 12,91 | +0,01 | 553,42 | +5,75 | |

01.02.2019 | 9,63 | +0,04 | 3597 | +31 | |

14.02.2019 | 13,05 | -0,02 | 1418 | +14 | |

20.02.2019 | 9,19 | -0,13 | 2081 | +201 | |

21.03.2019 | 9,22 | +0,53 | 13361 | -283 | |

30.03.2019 | 11,23 | -0,09 | 1244 | +9 | |

12.04.2019 | 11,65 | -0,04 | 1423 | +12 | |

17.05.2019 | 8,43 | -0,15 | 888 | +1,72 | |

Crowdestate | 20.05.2019 | -7,66 | +0,05 | 152,65 | 0 |

31.07.2019 | 3,49 | +0,20 | 5883 | +38 | |

15.02.2020 | 15,28 | -0,27 | 1366 | +261 | |

20.02.2020 | 7,38 | -0,04 | 420,31 | +89,37 | |

29.05.2020 | 3,48 | -0,91 | 591,12 | -7,40 | |

22.07.2020 | 9,71 | -0,09 | 585,46 | +4,05 | |

28.01.2021 | 10,78 | +0,56 | 111,61 | +1,54 | |

21.03.2021 | 12,98 | -0,59 | 651,60 | +42,15 | |

10.06.2021 | 13,39 | +0,03 | 483,33 | +5,20 | |

10.06.2021 | 10,77 | +0,17 | 687,72 | +6,46 | |

23.07.2021 | 10,56 | -0,24 | 535,73 | +3,84 | |

15.11.2021 | 17,89 | -0,08 | 66,18 | +0,86 | |

31.03.2022 | +2,53 | +0,31 | 48488 | +802 |

Platforms

(Re)investing

I continue to reinvest on the following platforms and plan to increase the investment in a targeted manner in order to maintain a monthly cash flow of at least EUR 25 or even increase it beyond that.

P2P (Buy-back)

As mentioned in the last update, I would like to show you today in which loan providers I invest. As mentioned, I am strongly oriented towards the P2P Platform Rating Premium, which you can find further down in the blog post. Current loan providers with their own auto invest:

- Planet42

- Eleving

- LF Tech

- Watu Credit

- Delfin Group

- Evergreen Finance

- GoCredit

- Fenchurch Legal

- Capem

- Everest Finanse

- IuteCredit

- Esto

- Alivio

- Creamfinance Poland

It may well be that I still adjust the auto invests. The IRR at Mintos at the end of March was 11,57% with 7.136 EUR invested.

Even if Mintos is one of my largest platforms, still 28% of my investment is questionable. Namely all pending payments and loans in recovery.

Mintos has temporarily suspended its affiliate program again.

On IUVO 1.778 EUR were invested at the end of March with an IRR of 11,32%.

Currently, 22,9% of the investment is questionable due to the Polish CBC loans.

- For IUVO there are two different offers. Unfortunately, the referral program is extremely unattractive since a few days. For the first you can contact me because unfortunately it has to be done manually, and I have to invite you. You get 1,5% cashback for investment above 1.000€. I receive 1,5% too.

- With the 2nd offer (click on the banner) I get 5€ and 2% of the investment in the first 30 days and 3% for the investment of day 31-90

![]()

At Lendermarket, the IRR continued to decline slightly in March to 15,28%. My investment now stands at 1.366 EUR thanks to a small deposit.

Because the platform is new and I ‘only' invested 1.000 EUR I won't put capital as questionable for now.

On the platform you get 1% cashback if you are using my link*. Currently, in total up to 17%! My reward is 5€ onetime + 1,5%. On top there is a cashback campaign until May 2nd. If you invest at least 1.000 EUR (and don't withdraw anything until 31.7) you will get 2% cashback! By the way, Lendermarket will be present with a booth at the Invest fair in Stuttgart!

![]()

Business as usual on Swaper. At the end of March, the IRR was 12,91%. All this with an investment of 553,42 EUR.

Because I just have a few Euros invested, I won't put it as questionable for now.

If you use my link* my reward is onetime 5€ + 2% cashback for 90 days.

Twino had reported last month about how to deal with currency-influenced loans. Russian loans are to be extended to the maximum, which currently means six extensions plus 61 days. Interest continues to accrue and is paid monthly. So we are playing for time. However, there has been no change in cash flow so far. The IRR at the end of March was 10,72% with 1.097 EUR invested.

For almost 4 years, the platform has been running so solidly that I don't considered my investment questionable. And then came this war. As of today, all Russian loans are questionable.

Here* you can register. If you invest 500€ we both are rewarded with a bonus of 20€.

At Moncera, 585,46 EUR was invested at the end of March with an IRR of 9,71%. The platform does what it should. Of course, higher interest rates would be nice, but I am also quite satisfied.

1 1/2 years of investment in Moncera and the still small investment amount do not let me consider this investment as questionable.

If you use my Moncera link* we both receive 0,5% cashback on all deposits made by you in the first 60 day.

I had deposited a small amount in March and at the end of the month, Afranga had 651,60 EUR working with an IRR of 12,98%.

As always with new platforms, I test the entire platform first with a small amount and share my observations. Due to the still small amount invested, the investment itself is not questionable.

If you are interested in Afranga, you are welcome to use my link* and support my blog. Unfortunately, only I receive 1% cashback. Prerequisite for this, you invest >500 EUR.

In March, except for interest paid, nothing happened with Esketit. The IRR was 13,39% with 483,33 EUR invested.

Of course, this is also a test balloon. I look at the whole thing over a longer period of time before I strongly increase the investment. Nevertheless, the investment should be increased further. Due to the low investment amount, I do not see the investment as such as questionable.

For the curious, there is 1% cashback on the investment for the first 90 days at Esketit with my link*. I also receive this as compensation + one-time 5€.

![]()

As expected, Robocash is running completely smoothly. 687,72 EUR was invested there at the end of March with an IRR of 10,77%.

Due to the increase, but still a small investment amount, I do not see the investment as such as questionable. Moreover, Robocash has quite a long track record.

If you are interested in Robocash, you can use my link* and get 1% cashback until April 30, 2022. As compensation, I get 1% cashback as well after 90 days and a one-time 5€.

At the end of March, 535,73 EUR was invested on Income Marketplace with an IRR of 10,56%. At the end of the month, the platform announced that it had raised 1,3 million EUR in a seed funding round. Here is the blog post about it.

500€ is of course not a small amount for a test balloon, but without some skin-in-the-game experience reports are not authentic. I do not see the investment as questionable.

If you want to test the platform there is 1% cashback for you if you use my link* and use the code CLHOFU during registration. I receive 1% too + one-time 20€.

![]()

PeerBerry has the largest exposure to Ukrainian and Russian loans. About 50% of the total loan portfolio is affected. However, the CEO has been very honest and transparent about the situation in the previous month. The plan is to balance everything within 24 months. 50% of the company's profits are to be used for this purpose. And look at PeerBerry, they are putting their money where their mouth is and the first repayments have already been made. In addition, an Independent Supervisory Board has been formed, which is populated with investors who will hear more about progress from management. My IRR at the end of March was 12,26% with 1.065 EUR invested. Interest rates have been increased accordingly for many loan originators.

One of the most solid platforms for over three years! Also here until now. A war is of course a worst case scenario, which is why about 60% of my portfolio is questionable.

A while ago PeerBerry introduced a loyalty bonus, but with high requirements:

- 0,5% for 10.000€

- 0,75% for 25.000€

- 1% for 40.000€

If you use my PeerBerry* link, I'll receive 5€ + 1% from investments for 60 days.

Bondster also has some Russian loan originators on board, namely Kviku and Lime. These are also no longer offered on the primary market, but on the secondary market. The IRR at the end of March was 11,23% with 1.244 EUR invested.

I still see Bondster as a young platform, but now already has 15.000 investors. Even if the collection of Polish loans works out very well, I see 30% of the investment as questionable.

There is a 1% cashback after 30 days at Bondster*. I receive 2%. Bondster will also be visiting the Invest fair in Stuttgart in May!

![]()

The IRR at Viainvest was 11,65% in March on an investment of 1.423 EUR. In fact, there is nothing more to report at Viainvest.

In my opinion, Viainvest is very solid and therefore I do not consider my investment questionable.

For the start at Viainvest* there is a 15€ bonus. For this only 50€ need to be invested. I'm also rewarded with 15€ if you register with my link. By the way, until 30.04 there is still 1% cashback for everything invested via auto invest!

P2B (Real estate)

![]()

At the end of March, 3.597 EUR were invested with an IRR of 9,63%. In the meantime, I am also using the auto invest again.

I don't consider my invested capital to be ‘questionable'. So far EstateGuru has always ensured recovery.

At EstateGuru* there is a 0,5% cashback for 3 months. I also receive the cashback and in addition 5€.

![]()

Also in March I have continued to stock up at Reinvest24! I invested in three new projects. The IRR was at the end of the month at 9,19% with invested 2.081 EUR.

In the meantime Reinvest24 is already 4 years old! I do not consider my invested capital questionable.

If you want to invest on ReInvest24*, there is a 10€ bonus for you. I'll receive 1% of the investment. Until May 16th the Anniversary Cashback Campaign is still running, where you get 1% cashback if you invest >1.000 EUR via the primary market!

The merger is done, free funds are now automatically transferred to InRento. In the next portfolio update I will also separate the platforms. In total, 5.883 EUR were invested in EvoEstate at the end of March with an IRR of 3,49%. By the way, the calculated return differs strongly from the ‘Net Annual Returns', which is 11,08%, due to final maturity projects.

I welcome the merger as it brings some advantages for us EvoEstate investors.

For EvoEstate there is a 0,5% cashback for 6 months with this link*. I get 0,5% too and one-time 5€. Currently there is also 1.5% cashback for investments on the primary market!

Alternatively, you can also register via my InRento* link, for this you will receive a 20€ bonus, while I receive 50€.

![]()

888 EUR was invested in Bulkestate at the end of March. The IRR was 8,43%. The platform had pointed out that many projects are still experiencing delays.

I think about 5% of the capital is questionable, because of the two delayed projects and because I do not know how well the recovery is working.

If you use my link*, I'll receive 1% cashback for 180 days and one-time 5€.

P2B

![]()

At Quanloop, 66,18 EUR was invested at the end of March. The IRR is at 17,89% due to the earlier investment, but should fall quickly to a normal level.

I'm sort of continuing the experiment, only with a bit more cash, in the medium term I had in mind 500-1.000 EUR. And of course I will report about everything.

If you register with Quanloop via my link*, you will receive a bonus of 5€. I get 2,5% cashback.

![]()

In March I transferred some money to Linked Finance after a long time. The IRR was 7,38% at the end of the month with a total investment of 420,31 EUR. There are now again more often projects available.

So far, exclusively paying or already repaid projects. Therefore, I do not consider my investment questionable.

Linked Finance doesn't have an affiliate program, so there's nothing for you or me. Nevertheless, you can register here if you like.

P2P

![]()

At NeoFinance, the lack of new loans is noticeable lately, these are usually financed again very quickly. Currently 1.418 EUR are invested at NeoFinance with an IRR of 13,05%.

The return calculated by the platform is now 14,07% after an adjustment of the calculation. There is a deduction of 15% withholding tax (can be reduced to 10% by the way).

At least the 91-270 days overdue loans I have to mark as questionable even though some of them might pay in the future. I think approx. 19% of the capital is questionable in the current situation.

NeoFinance* changed and lowered their offer too. There is 1% cashback for you and me for 90 days.

P2P (Short-term)

![]() Go & Grow

Go & Grow

Go & Grow I mainly use for a small part of my cash and will also use it for my side hustle and savings for insurance payments. Because of the withdrawals from time to time and the fee of 1 EUR IRR is at 6,64%. At the end of March, the account was replenished and had 1.312 EUR invested.

I don't think my investment here is in question. Bondora has enough leverage.

A 5€ bonus is available for you at Bondora* right after registration.

Crowdlending

LendSecured is one of the smallest investments, which should (still) change soon. At least 500 EUR should work there and earn interest. This is still the plan, but the free funds are missing (will change soon). At the end of March, 111,61 EUR were still invested there with an IRR of 10,78%.

If you are interested in LendSecured, you can use my link* and get 1% cashback for 180 days. I will receive 10 € for the successful registration and also 1% cashback for 180 days.

Withdrawal phase

Crowdlending

In March, Crowdestor was finally able to deliver the cashflow that was originally promised by the interest rates of the individual projects. There was 269,28 EUR in interest. My key figure, the delayed projects, has risen sharply again compared to the previous month, also around 63%. At the end of the month my investment was still 13.361 EUR with an IRR of 9,22%.

Further, because of the risk of the platform and projects, 50% of the investment is ‘questionable' to me (regardless of the ~63% delayed projects). Especially due to the Corona pandemic, which will have a massive effect on tourism and restaurants.

With my link* there is 1% cashback for 180 days! I receive 1% too + one-time 10€.

Investment expires

![]()

The British platform AxiaFunder offers investing in an area I haven't seen before because they offer investing in litigation cases. You can find an interview with CEO Cormac Leech at explorerp2p.com. Very worth reading!

My initial investment was £500. Yes, that's the minimum investment and a lot. You have to bring some capital with you in order to have proper diversification. The same is also possible for a total loss, and even a loss of more than the invested money. My test project is still floating in the air (I'm not allowed to give more details). On the positive side returns of 20-30% p.a. are possible. So it's a high risk test balloon! In March the IRR is 3,48% due to currency effects.

I'm therefore letting my investment expire (if possible), because you need a lot of capital for a reasonable diversification. I don't have that and I'm not willing to invest that much there either.

If AxiaFunder is an interesting platform for you, I would be happy if you use my link*. My reward is 30€.

There were small principal repayments at Crowdestate in March. The complete exit is thus dragging on. The IRR was -7,66% and there are still 152,65 EUR on the account.

Portfolio performance income

With 499,93 EUR in interest, I was well above the 300 EUR feel-good limit in March. Overall, this was also the highest income since December 2020!

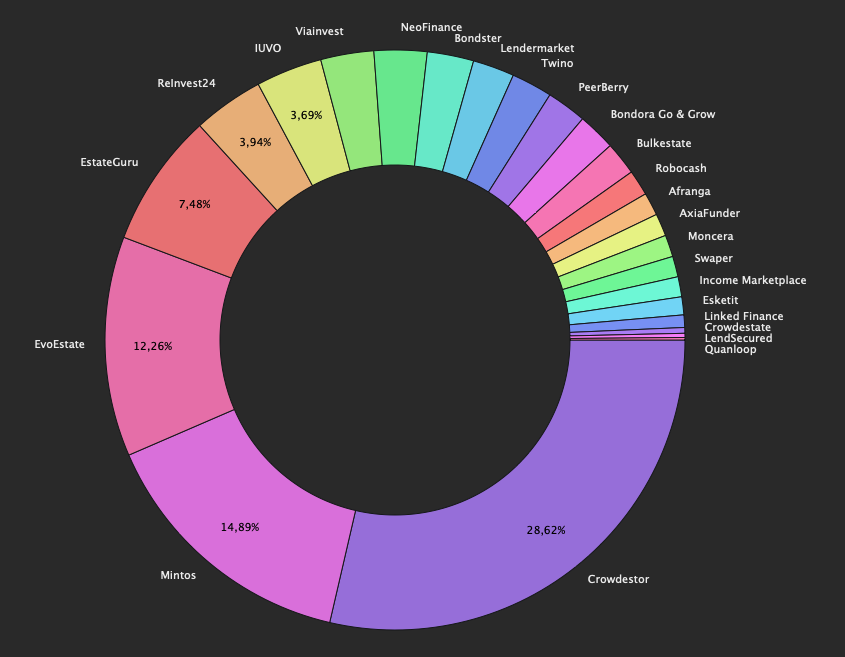

Distribution by P2P/Crowlending classes

Below you can find my distribution between the individual P2P / crowdlending classes for March.

- 38,30% (P2P (Buy-back)

- 27,20% Crowdlending

- 0,99% P2B

- 26,70% P2B (Real estate)

- 2,89% P2P

- 2,72% P2P (Short-term)

- 1,20% Misc. (AxiaFunder)

Affiliate/referral income

I would say that I'm one of the most transparent bloggers when it comes to affiliate and referral income. Therefore, there is also pure transparency for March. 104,55 EUR were affiliate revenues distributed over two platforms.

Nevertheless, there was referral income from the following platforms:

- Quanloop*: 19,31 €

- Reinvest24*: 6,50 €

Summary

All in all, I'm very satisfied with March, of course also due to the high interest payments. I am positively surprised how PeerBerry handles the current situation. Here, some platforms can take a leaf out of their book! But of course I hope that this war is over soon!

I hope you found my summary interesting as always. I'm always open for constructive criticism and suggestions. Follow me on Instagram. There I post not only about P2P and crowdlending, but also about stocks, dividends and options. So have a look! That's it for today's post, see you again at the P2P portfolio update for April. Stay healthy!

Feel free to let me know in the comments how your P2P investments are going or which platforms you have worries and concerns about!

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (investdiversified) in which I invest myself. Also, on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!