ATTENTION! INVESTMENT STOPPED!

Monethera shut down all platform activities. The ostensible reason is COVID-19. The platform had many red flags before. So it seems to be a SCAM. More information you can find in the Monethera Telegram group. Please don't register or invest at the platform!

A few days ago a new platform called Monethera was mentioned in P2P Facebook groups and forums. I registered there for testing and would like to give you some information and a short interview.

Dashboard, projects and project descriptions

Monethera does not yet have a significant track record as a platform. So you should look at the whole thing calmly and with argus eyes. At first glance I noticed the very good German translations (relevant for me) – in contrast to some other young platforms. Otherwise the platform offers similar features to Envestio. Very similar. But there are smaller differences as you will read.

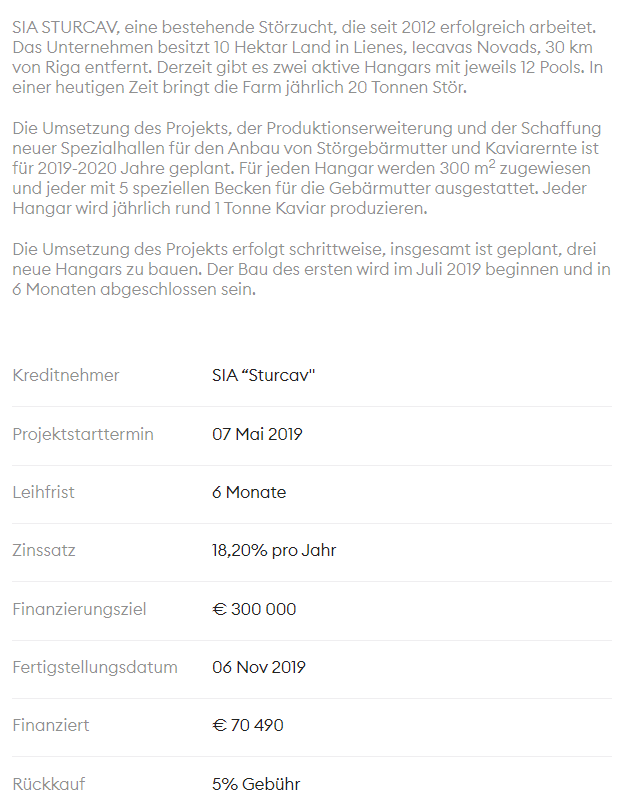

Monethera offers a project overview like other platforms too. Currently there are only three projects. Namely one real estate development, a business loan for a luxury clothing company and a business loan for a sturgeon farm. Pretty fishy :). However the projects are very attractive with an interest rate of 18%. The maturities are 6, 8 and 12 months.

There is also an information page for each project. However this is very sparse. There are only one or two sentences to the borrower and what the loan should be used for. I would definitely expect more here.

In the following interview I wanted to know from the platform who they are and how some things like the buy-back work exactly.

The interview

Monethera is a very young and fresh platform. Does the platform briefly present?

The business model of Monethera is associated with the financing of a project by a large number of individuals. Fundraising begins with an announcement introducing the public to a project that needs financial contributions. After the implementation of the project – the borrower under the contract must return the money by paying pre-determined interest. Funding is usually based on the “all or nothing” principle. In other words, the project starts implementation only when collecting the necessary amount of funds.

Andis Taubers

Since transparency is a key element in this investment area, I would like to know a few things about Monethera. You founded Monethera as a private investment fund in 2017. The platform itself in November 2018, but the URL was only released about 4 months. How did the platform come about?

As a private investment fund, we have achieved some success. The idea of opening an open crowd-investing platform was born in 2018. This decision was made to give individual investors the opportunity to invest with us in the most interesting, profitable and noteworthy projects.

Andis Taubers

Can you say anything about your career and the team?

Andis sent me his CV and that of his colleagues. I publish this without comment. But I don't know what to think of the individual positions. If there are any further questions, just write it to the comments.

How does project acquisition work at Monethera and how long does it take for a project to be available for investors?

1) We are looking for profitable projects or project owners send us projects for consideration.

Andis Taubers

2) We conduct our own research and comprehensive verification.

3) We approve the project if Due Diligence was successful.

4) We conclude a loan agreement with the project.

5) The project is provided to the attention of investors on the platform.

Due Diligence may take from 2 weeks up to 2 months, depending on a project and area of activity.

How does your risk management work?

First our risk analysts are looking for any possible investments risks in the selected project/borrower. If they are identifying any risks – they have to rank them.

Andis Taubers

After rating the risk they are looking for a way to get rid of them. If previous steps are passed successfully we conclude a loan agreement with a borrower.

The platform currently lacks an auto-invest. Are you planning something like this?

Probably auto invest will be implemented to our platform in July 2019.

Andis Taubers

Currently, there are only three projects. Are further projects planned or ready for publication?

There are 2 projects already pre-approved and 5 more on the stage of Due Diligence.

Andis Taubers

Other platforms have introduced a buy-back fund. How do you think about this idea?

This is a great solution and we fully support it. In the event of a default of a project – Monethera will cover 35% of users' investments.

Andis Taubers

More into detail. Can you explain the buy-back process in the event of a default? Does this work exactly as e. g. on Envestio?

There are two buy back options.

Andis Taubers

1) You have invested 100 EUR in one of the projects on our platform.

If you want to exit earlier you, you will get back 95EUR back and no any profit extra. (The buy-back system will be fully integrated to our platform soon)

2) Monethera keep a reserve fund to cover Investors in a case of default.

If any project will be unsuccessful all investors will have back 35% of their investments.

Are there already plans for a secondary market?

Not for a present moment. If situation will change – we will make an announcement.

Andis Taubers

Are there any annual reports when Monethera was a private fund that you can make available to investors?

Soon we will publish reports for the time when Monethera was a private fund where you can see the investment statistics.

Andis Taubers

What are your pleadings for 2019? And what is the next milestone?

We are going to increase the user base of our platform in order to diversify investment portfolios to the maximum, which accordingly reduces investment risks.

Andis Taubers

We will look at the results at the end of 2019, after which we will draw up a development plan for 2020.

Preliminary assessment

New platform, new happiness? Possible. Very attractive offer, but just a very young platform, similar to Kuetzal. However, the fact that I have already been able to speak to Kuetzal CEO Albers Cevers in person means that the investment there is something else.

Nevertheless I will start at Monethera with a small test balloon of 100€ and continue to report on how the platform is developing. Even after the interview there some open questions for me which I want to clarify.

If you still have any questions, please post them in the comments. I will forward them to Monethera!

Digging deeper! Facts!

Because e.g. the FAQ is 95% identical to Envestio there is a plagiarism suspicion. There were also other inconsistencies regarding a not mentioned person of the management.

Since I and certainly also other investors are skeptical about new platforms at first, I perstered the Monethera team a little bit.

Buy-Back

- When will interest be paid?

From the project start date.

Projects and possible defaults

- What happens if a project is not fully funded?

There are two scenarios here. If more than 80% of the target is reached, Monethera contributes the remaining 20%. If <80% investors receive their money back.

- What happens exactly in the case of a default?

Investors receive 35% of the investment in case of project failure. At the end of the project.

- What about the remaining 65%?

The remaining 65% and interest will be issued when Monethera collects the entire debt from the project owners. The term depends on the speed of the judicial process. Based on judicial practice, this may take up to one and a half years.

Monethera carefully selects the investment targets. Furthermore, the platform monitors compliance with the contracts. Guarantees are required from the borrowers (personal guarantees and commercial pledging).

Transparency

- What is there to know about the copied texts?

Monethera claims to have hired an external copywriter here. He did his work in “bad faith”. They are already working on a global text change. Conceptually all information is correct. The necessary changes are made in the “Cooperation” area. It takes a few days to solve the problem.

- Who is Andrei Bogdanov?

Andrei Bogdanov is a business man. Togehter with Andis Taubers he is owner of the company. Andis Tauber is the CEO.

- Inconsistencies with business address

You can find the official address of Monethera on the website. The company is registered in Estonia for tax and legal reasons. This has led to confusion due to the Google Street View images of a residential building. The office is located in Riga. To be precise, Krišjāņa Valdemāra street 118, Riga, Latvia, LV-1013 .

- Is there an annual report when Monethera was a private investment fund?

They sent me a PDF which I publish below without any comment.

Hi, thanks for your efforts.

Just to point out that the “annual report” is everything but an annual report.. it’s a self-made portfolio breakdown and that’s all. An annual report should contain a P&L and a balance sheet at the very minimum. With this we can’t know if the fund behing the platform is sound or not.

Hi Julien,

yes if course it’s no real annual report. That time I made the I interview with them I let it count. I reach out beginning of next year for a correct annual report of 2018/19.

Any news about the new annual report?

Good questions Vlad. So far I’ve heard nothing but I’ll ask them.

Monethera is a total scam.

They have disappeared with all the money.

They don’t answer any mails… and never had a simple telephone number.

Don’t invest there.

Andis Taubers and is team are criminals.

Hi Frederico. I know the platform seems to be a SCAM. I emphazised this at the top of the blog post.