Hello together,

wisefund crowdfunding 10 euro interview

it's time again and I've launched another crowdfunding test balloon. I actually wanted to start consolidating my platforms. Well, that have to wait.

So let's move on to my latest investment on Wisefund Capital where crowdfunding is possible from with only 10€. You will find an interview later in the blog post. There I asked some questions to Wisefund and CMO Ingus Linkevics answered them. But read for yourself.

Platform

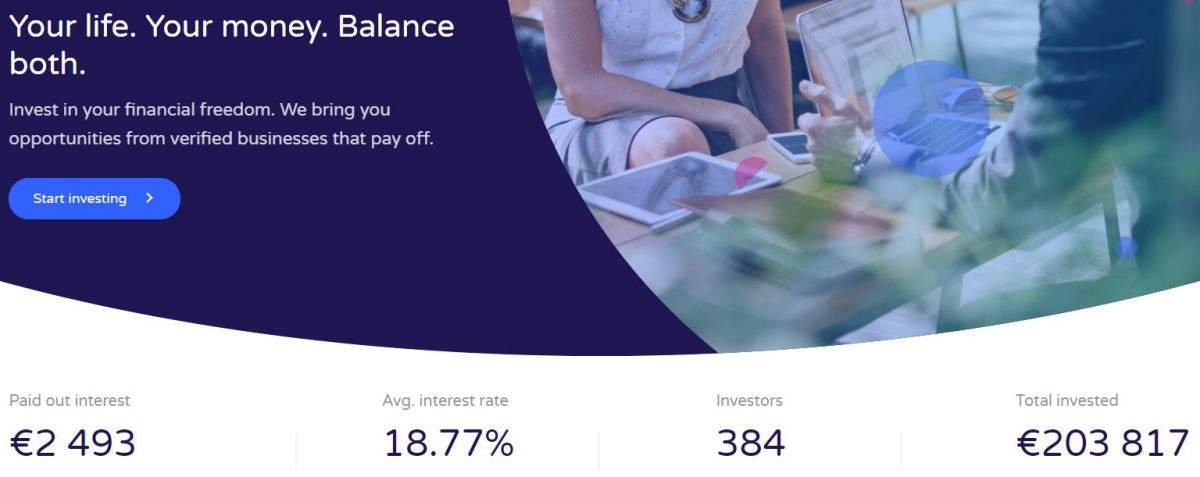

The Estonian platform, based in Latvia, joins the list of new platforms such as Kuetzal and Monethera. Wisefund currently lists three projects, one of them has already been funded. Interest rates are up to an insane 19.7% to a maximum of 8 months! Of course, the high interest rate also comes from the low maturity, but it is a high-risk investment.

no images were found

I have invested in both available projects. 125€ in Railway forwarding operations and 75€ in Electronic device stock purchase. For each project there is a short description of the project itself and the company. All in all, it's expandable.Let us come to a unique selling point of Wisefund namely the minimum investment. Foor other crowdfunding platforms 50€ or 100€ have to invested in a single project, this is possible on Wisefund for as little as 10€. There is also a maximum investment, i.e. 10% of the total financing amount. New for me.

In addition, there is a buyback guarantee, which applies from 60 days on, but here only the original investment is repayed, not the interests. If you want to exit a project earlier, you have to pay a fee of 5% for it.

Interview

Since Wisefund is still new and unknown. Could you please explain the platform and the business model? I think there are already some differences compared to other platforms.

Me and my colleagues have seen and examined very very closely Envestio/Monethera as well many other platforms on the market, their approach, their success etc. With close everyday work with the borrowers we're looking to offer the investors chance to make the right decision with a very comprehensive background information on each project.Our business model is to become a good partner for businesses willing to grow while they struggle with getting the trust from the banks, but in the same time benefit the investors with high interest rates and short term investment opportunities. There will certainly be loans listed with lower interest rates in near future (I do hope the interest in those will be maintained anyway), because not all of the businesses can afford such high rates. But we're looking at a quick turnaround for both parties – businesses get funding for certain ventures, investors get payback in less than a year feeling more secure on the investment.Platform itself is dedicated to be very selective on loans listed to ensure firstly the safety of the investors, but still, we're looking to create a platform towards which many SMEs willing to grow would likely turn to.

Ingus Linkevics

As transpareny is key I'd like to know some things. When did you found Wisefund? And why?

The company was founded in 2019. To be exact, March of 2019. But the idea was there for couple of years already in the mind of each of the team members. We saw how Mintos and Crowdestate grew, not even mentioning Funding Circle, October and Linked Finance. They all have different approach and eventually they grew into great companies. Together our team somehow came to an idea to found the company, with Olga as the leader and funder of the project, Rinalds with background in commercial partnerships and real estate development, and me, with experience in online platform operations and legal activities. What we were missing was a technical development and professional legal assistance. Once those parts were covered, we could start talks with businesses looking for loans and go live with the platform for the crowd. The main idea always stays to create a trusted funding partner for growing businesses. My own belief is that businesses create added value which allows the economy and overall prosperity of people to grow.

Ingus Linkevics

Would you please tell readers a little more about yourself and the team around Wisefund?

I am Ingus Linkevics. Some years I have been working in the legal background at a notary office which allowed me to gain a vast legal knowledge and background, as well as see how businesses and real estates get developed and managed. Other part of my activities have involved online activities with online SaaS platform success development and management and going into international market. At one point I decided to turn to international and online business to expand my reach and future possibilities. This was a wholly different industry, but developed skills of business development going internationally.Rinalds Ters has been a businessman for a long time, and mostly worked with real estate development under Remax brand. His main role in the company is partnership management and company representation – he's a professional in this area and looking to build a strong brand from the Wisefund.Olga Bobrova has a vast experience in financial industry, working previously with business professionals in financial analytics for many years. As the most experienced member of the team, she headed the company with providing the funding and investment, founded it in Estonia, although we're establishing an office in Latvia also.Then there is customer support who takes care of all inquiries and customer experience, technical support so we're in control of everything, and a specialist on partnerships, Dmitry, who's very well established with contacts in logistics and industrial space – he's working with possible borrowers.

Ingus Linkevics

Could you give me a step-by-step example how a project comes to the your page? And how long that process is normally?

The borrower if approaching is presented with a fee structure of the platform and requirements of our due diligence partners.If they agree with that, we ask to fill in Application form, provide a set of documents, financial statements and description why funding is required. Once that is meat, we do the checks on the company and it's management.After that project is listed with a deadline to meet a certain target. We don't fund them ourselves. If the investors don't see them attractive enough within 3 weeks, return all investment principals and project is not funded.But if the project is fully funded, we compile all the loan agreements, sign additional syndicated loan agreement and issue a loan to the borrower.The process until listing on the platform can take from 1 to 2 weeks.

Ingus Linkevics

No, we don't. If project does not meet its target, we credit investor accounts with the principal invested. Unfortunately, no interest is paid for that. But if the project meets its target, investor receives interest from the first day of investment, not the date when the target is met. This is a condition borrowers have to agree with in the fee letter.

Ingus Linkevics

How exactly does risk management work?

An outsourced lawyer with a very professional background takes care of this, does the risk analysis and provides us with final suggestion on each loan request. Of course, there are many things considered in the approach. The analysis for each industry and amount of the loan is taken individually.

Ingus Linkevics

Will Wisefund also implement an auto-invest?

It's possible, and we've thought about that. But there's no need for it yet, at the beginning of the operations. We'll integrate it once loans start meeting their targets quick enough, and there are requests for this feature from investors.

Ingus Linkevics

Minimal investment is about 10€. It's nice, but is there a reason for setting it to 10€ and not 50€ or 100€ like other plaltforms?

Why should we do like other platforms? We don't want to limit people who want to start with 10€ a road towards their financial independence.

Ingus Linkevics

Are there more than the three current projects in the pipeline? And in which frequency new projects come in on Wisefund?

Yes, we have 8 projects under review which, and more are applying each day. We're planning to maintain a frequency of 3-4 projects per month.

Ingus Linkevics

A little bit more into detail. Could you explain the buy-back process in case of default? Only principal and no interests are covered?

We have an agreement with a partner to buy out the loan within 2 business days, if such a request is made by investor, but this will incur a commission charge. Each loan has its early exit commission determined and listed on the Project description. Things may happen, you might need money earlier and wish to get your funds before the term. Our partner takes advantage of that, buys your loan at a reduced rate with an assignment agreement and becomes new lender. They benefit from the difference.In case of Borrower defaults, we've ‘insured' each loan currently listed with the same third-party partner to buyout the loans in case if the borrower is late with the payments for more than 60 days. Our partner will buyout the principal with an Assignment agreement and deal with the borrower and loan collection without the involvement of investors. But the interest for investors will be covered from the protection fund. With this type of approach we're looking to guarantee investors full return of the investment + the interest.

Protection fund covers things like investor interest rates. Further on there might be loan offers which are not covered by buy-out from third-party partner (this information will be available with the loan offers) – in this case our growing protection fund will be as an insurance for investors in case of borrower late payments or default cases.

We understand that sounds like a quite of a burden on borrower shoulders. But those are things they have to agree with before getting funded on crowd lending platform.

Ingus Linkevics

Yes, certainly. Once the platform operations expand, we're looking to introduce secondary market so the investors can benefit in short term or would not have to choose to exit with a fee if such a need appears

Yes, I have indeed. I have portfolios in Mintos, Crowdestate, Linked Finance and October.

We're hoping to fully fund at least 20 projects until the end of this year. And for sure, gain trust from the investors. We hope you will like our selection on the investment opportunities.

Crowdfunding with 10 Euros – a prelimiary conclusion

Wisefund offers a nice website and all looks a bit more professional than other new platforms of the same calibre. The 10€ minimum investment is also great. But that may just be my personal opinion. The fact is, it's a new platform that has to prove itself as always. A complete conclusion can therefore only be drawn when there are possible defaults incoming. Only then we know whether the buyback guarantee really works well or for example the mentioned security fund jumps in and is sufficient.

I'll keep you up to date on new projects and features on Wisefund. I'll also include the platform in the monthly portfolio update.

Information about new projects on Twitter and Instagram

On my own behalf, I would like to mention that I also present new projects Twitter and Instagram, in which I invest myself. So follow me :).