Happy Sunday to all stock and dividend fans! In the previous month, I still divided my stock purchases into two blog posts, for the stock purchases February 2021, there is only one blog post that contains all purchases and sales. Whereas sales there were actually none. But again I took some opportunities to further diversify my portfolio. You can read which stocks I bought in the post. Have fun!

Table of Contents

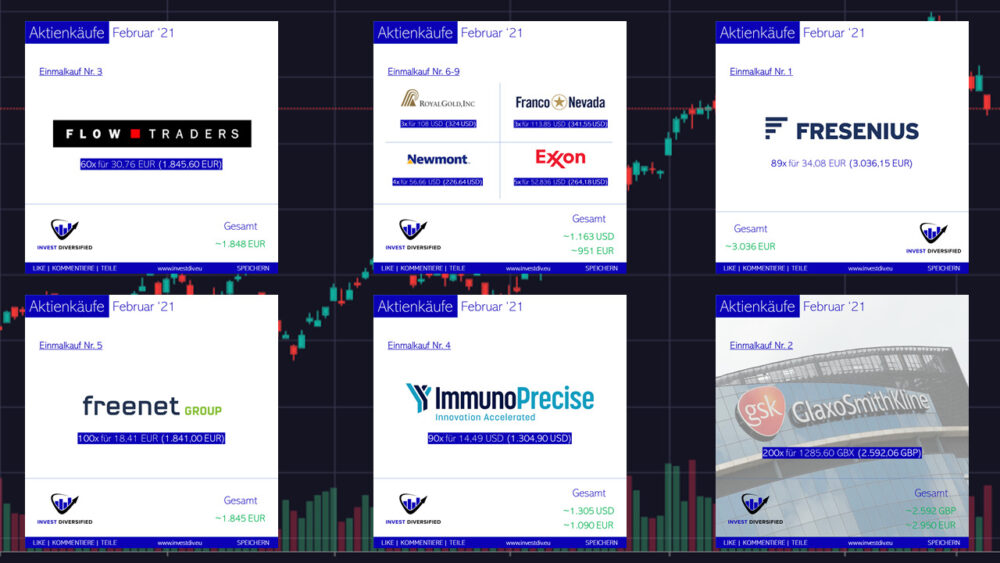

Stock purchases February 2021

Originally I wanted to start building up cash again already at the end of January. But then there were some opportunities that I simply had to take advantage of. And so it happened that I invested a total of 13.350 EUR in February…

Fresenius

[aaq isin=”DE0005785604″ chart=”RevenueChart”]

But let's just start with the 1st purchase in February, Fresenius SE & Co KGaA (FRE). I already had some shares via savings plans. I bought an additional 89 shares at 34,08 EUR. In total ~3,036 EUR incl. fees.

The reason for the purchase in this size was the price setback caused by the profit warning at Fresenius Medical Care, which also affects FRE. Some people think the whole thing is a value trap? Personally, I don't think so, even though FRE is not doing very well in a growth market. But I'm positive about the future. Patience is definitely the order of the day.

GlaxoSmithKline

[aaq isin=”GB0009252882″ chart=”RevenueChart”]

Purchase No. 2 was a new purchase. And so GlaxoSmithKline (GSK), the British pharma giant, found its way into my portfolio. I bought 200 shares at 1.285,60 GBX per share directly on the London Stock Exchange. In total ~2.592 GBP incl. fees or approx. 2.950 EUR.

GSK has been on my watch list for a while because I was playing catch-up in the healthcare sector. So far, the company has not really been involved in the Corona vaccine manufacturing and thus not in the upswing other pharma companies like Pfizer cooperating with Biontech. In the meantime, however, there is such a cooperation, namely with CureVac. GSK has a stake in the Tübingen-based company. So with the purchase of GlaxoSmithKline and Fresenius, as well as the holdings positions in Abbvie and a couple of venture positions, I am now quite well positioned in the healthcare sector.

The dividend yield is ~6.2% relative to the cost price. This has actually not been increased since 2012 and is expected to change quite a bit in 2022. Probably 2022 follows namely the split of the group. Already in 2019, the division for otc drugs etc. was merged with that of Pfizer. This is now to go public separately and a new group similar to P&G would be created.

It is to be expected that I, as a shareholder, will also receive shares in this new company. However, the dividend policy will change (presumably this will be reduced somewhat for GSK), details of which will be available in the summer.

Flow Traders

The shopping trip then went a little further and I bought shares in a company that tends to run under the radar, but has an important task. I bought 60 shares of the Dutch company Flow Traders (FLOW) at 30,76 EUR per share on AEB. Including order fees, that is ~1.848 EUR.

But what does FLOW actually do? Founded back in 2004, the Dutch company is something like the big brother of Lang & Schwarz. One is a so-called liquidity provider for exchanges and trading venues around the world with a focus on exchange traded products (ETP), so for example ETF. FLOW is therefore an essential part of the stock market!

The market share in Europe is 35% and growing strongly. Expansion into Asia is currently being pushed. 2020 was an astonishing year for the company, but an exception! The 2020 P/E ratio is ~3 and the dividend yield was even in double digits, which is of course rather a warning signal. But that is also due to the fact that traditionally 70% of profits are distributed. For 2021, the dividend yield is rather expected to be 6%.

I expect that in the coming years, also due to the explosion of the money supply, a lot of money will continue to flow into ETFs and FLOW will benefit.

Freenet

In February, I actually bought shares in Freenet AG (FNTN). I bought 100 shares at 18,41 EUR per share (1,845 EUR incl. fees) via XETRA.

Freenet as a brand is probably known to some of you as a mobile communications provider. Last year, the company was able to sell its stake in the Swiss company Sunrise for 1,1 billion. This is to be used mainly for debt repayment. However, there is also enough left over to satisfy shareholders and to finance potential takeovers or acquisitions.

Recently, Freenet announced a reasonable dividend again, after paying 0,04 EUR per share in the previous year. Even more, the regular dividend is 1,50 EUR per share. In addition, there is a special dividend of 0,15 EUR. In total, therefore, 1,65 EUR. Based on the cost price, this results in a dividend yield of ~8.9%.

Rohstoffe – Manueller Sparplan

In the last week of February, there were still a few purchases, to which I would like to write something. Since I wanted to use parts of my option profits, I have executed so to speak manual savings plans. The focus was on gold and precious metals, which just weaken a bit. Here I wanted to expand existing positions, as well as open small entry positions.

First positions were opened in Royal Gold (RGLD) and Franco-Nevada (FNV). Here I bought 3 shares for 108 USD and 3 shares for 113,85 USD per share. Exxon Mobil (XOM) was also minimally expanded with 5 shares at 52,836 USD. In addition, I have increased at Degiro* Newmont Mining (NEM) with 4 shares at 56,66 USD per share.

New venture positions

10% of my portfolio is currently reserved for riskier investments. With advancing age, the 10% will be reduced further and further. From time to time, there are purchases and sales that I would like to report on.

ImmunoPrecise Antibodies (IPA)

I have a lively exchange with some investors on Instagram and we also talked about IPA. The short analysis (it's in German) of the company by disrupelligentcashflowinvestor convinced me to put 90x IPA for 14,49 USD into the venture portfolio.

Kinsale Capital Group (KNSL)

KNSL was also brought to my attention. Here I bought 7 shares for 190 USD per share. The company is active in the specialty insurance sector and is a growth monster. There will be a short analysis about it next week exclusively on Instagram

LUX Health Tech Acquisition (LUXA)

SPACs (Special Purpose Acquisition Companies) are the newest shit. These are companies that raise money by going public in order to take over another company. Which one is not known beforehand! So the whole thing is an absolute black box and as a shareholder you are quite far down the food chain. Nevertheless, I bought 50 LUXA shares at 12,80 USD per share. With 642 USD incl. order fees this is a small sum. I want to observe what will become of it.

My broker(s)

I have several brokers for my stocks, but the majority are German ones, so European readers of my blog cannot register there. As you may know I'm very transparent about the income I receive if you use one of my * affiliate or referral links. Most of the time there is a bonus for you, but never ever costs!

Degiro is my second largest broker. A while ago they did a fusion with the German broker flatex, and it's now the biggest broker in Europe. You can trade already from 0,50€ directly on the NYSE or other US stock exchanges. Also, I trade European options there.

If you use my link* and register an account on Degiro you get a refund of 20€ transaction credit. You only need to spend 20€ transaction credit within 3 months. If you do so, and only then, I have also the possibility to get a refund.

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (investdiversified) in which I invest myself. Also, on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!