Hi folks! Today I want to write about my journey and give you a portfolio update January 2020. Again it was a rough month with many bad and some good news, with rumors, facts, insights and new information. In the end I have to think more about my investment choices than it was planned in the beginning. Let's go!

Table of Contents

IRR-Ranking

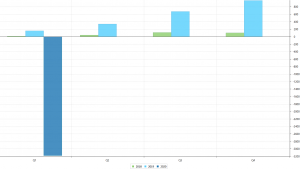

Platform | IRR (%) | Changes to previous month (%) | Invested (EUR) | Changes to previous month (EUR) |

|---|---|---|---|---|

26,27 | + 6,21 | 709 | 209 | |

21,09 | - 0,81 | 994 | 251 | |

13,71 | - 0,14 | 80 | 0 | |

13,15 | - 0,06 | 6274 | 1058 | |

Boldyield | 12,92 | + 12,92 | 0 | -713 |

12,76 | + 0,29 | 165 | 50 | |

12,15 | + 0,33 | 1079 | 13 | |

12,01 | + 0,13 | 594 | 22 | |

11,51 | - 0,02 | 1277 | 13 | |

11,04 | + 1,40 | 7965 | 1164 | |

10,64 | + 0,01 | 1084 | 10 | |

10,20 | + 0,16 | 1058 | 10 | |

8,47 | - 0,48 | 2110 | 212 | |

5,80 | + 0,12 | 977 | 123 | |

5,46 | - 0,49 | 1476 | 6 | |

3,80 | - 0,02 | 394 | 1 | |

1,80 | + 0,83 | 3182 | 1002 | |

1,78 | + 0,38 | 1000 | 0 | |

0,00 | 0,00 | 100 | 0 | |

-9,61 | - 4,02 | 319 | ||

Grupeer | 13,27 | + 0,05 | 1829 | 21 |

Monethera | 21,35 | + 1,12 | 1643 | 98 |

Kuetzal | -105 | - 105 | 0 | 1957 |

Envestio | -95,16 | - 95,16 | 0 | 1563 |

-4,77 | 34309 | -1137 |

Platforms

This time I want to start with the platforms which have the highest share in my portfolio because I think you get a better overview how I move my funds around so that it isn't too much cash drag on the platforms. Every withdrawal goes to my Revolut* account as central instance from which I also make my deposits. For the start I think nothing can describe January better than a picture. This was the start in 2020.

Hodor

7.965€ total account value is it on Crowdestor* in January. This means In invested another 1.164€. Finally IRR made a small jump and is now at 11,04% (+1,4%). Again due to a lot of interest payments. The average interest rate for my projects shown in the dashboard is 17,21%.

I don't invest in every project and focus more on the high-yield short-term projects. In January I invested in the following projects:

- Fur processing company (II) (26%, 21 months)

- Fertilizer Export Financing (II/III) (21%, 3 months)

- E. Fon Trompowsky Quarter (II) (19%, 23 months)

- Meat Chef in Old Town (14%, 18 months)

- Renewable energy (53.19ha) (18%, 6 months)

- Forestland investments (59 ha) (16%, 12 months)

- Forestland investments (122 ha) (16%, 12 months)

With my Link* there is 1% on top for 180 days on your investment! I'm rewarded with 1% too.

Mintos* is my second largest platform with 6.274€ and now 13,15% (-0,06%). In January 1.058€ were invested. The period of lower interests seems to be over and meanwhile you can find up to 16% loans on the primary market.

Some interesting news in January:

- Mogo now offers car loans from Albania

- Vietnam short-term loans were offered by Sun Finance

- Moneyboat, a UK loan originator, joined Mintos

- Mikro Kapital added loans from Belarus

- TASCREDIT from Kazachstan joined Mintos aswell

And I had the chance to test the beta version of the Mintos app for Android. Of course not that many functionality for now but it looks very smooth and is fast. Also I like the visualisations they introduced. Below you see some screenshots.

Furthermore I can only recommend to follow the official Mintos blog for changes and also include the lender ratings from ExploreP2P in the selection of your loan originators.

If you want to invest on Mintos* there is a 0,5% cashback on your average investment. It's calculated after 30, 60 and 90 days. I receive 5€ + 1%.

I invested a lot in EvoEstate in the last month and so in January. The aggregator platform is now third by volume. In total 3.182€. So I transfered 1.002€ to EvoEstate in January. IRR increase steadily to now 1,80% (+0,83%). A few weeks ago I published a blog post about the project originators connected to EvoEstate. A good read is also the investors update Q4 from EvoEstate and the interview with CEO Gustas Germanvicius in the Lithuanian TV (English subs are available). But there are more good news. A few days ago EvoEstate closed a 180.000€ funding round!

There are two different offers from EvoEstate:

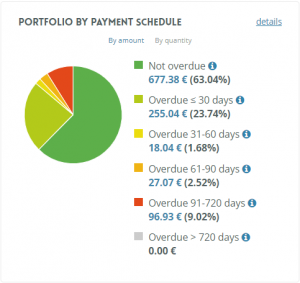

The 4th place by volume is reserved for EstateGuru*. Here I added 212€ in January so the total volume increased to 2.110€. IRR is 8,47% (-0,48%). I tried to add new projects with monthly payments or payments every 3 months only to have a constant cashflow.

At EstateGuru* there is a 0,5% cashback for 3 months. I also receive the cashback and in addition 5€.

1.829€ my account showed at Grupeer at the end of January and the calculated IRR is now 13,27% (+0,05%). So I changed nothing and just the interests were added and reinvested. In February my plan is to invest more.

Monethera is at 5th position as of now. Due to the recent events and the storm after Kuetzal and Envestio I want to decrease my investment in such platforms. I planned to sell my projects and pay the exit fee. Unfortunately (or thank god) Monethera suspended this feature temporarily. So I hope I can sit it out. Nonetheless I withdrew some of the money (98€) which was paid back. Total account value is now 1.643€ with an IRR of 21,35% (+1,12%).

Monethera's reaction was more communication and transparency, at least superficially. But I'm not satisfied because some answers are still very vague.

In January I continued withdrawing money at Crowdestate*. This time only the interests. There are now 1.472€ (-6€) invested. I didn't trade at the secondary market and the IRR is therefore now at 5,46% (-0,49%). As I mentioned in the last portfolio update the payments for the project Baltic Forest X were stopped until summer 2020. But there are also some good news because the Pärnu County Court approved Baltic Forest OÜ’s reorganization plan and also it's tradeable over the secondary market again starting from February 3, 2020.

Important news from December: Crowdestate will withhold tax for Italian projects.

Unfortunately there is no referral link with cashback which I could forward to you. If you use my link*, I receive up to 17€ + 0,5% Cashback for 60 days.

IUVO* is now at 11,51% (-0,02%) with an investment of 1.277€. IUVO* or the loan originators don't pay interest on late loans. Therefore, there is a difference between the IRR and the return displayed in the dashboard (14,28%). Because of fresh money and temporarily lack of new loands IRR decreased a little bit. By the way the platform cracked the 100 million in volume.

- For IUVO* there are two different offers. For the first you can contact me because unfortunately it has to be done manually. You get up to 90€ for the start on the platform. 30€ are available for an investment of 1.000€, another 60€ for 2.500€.

- With the 2nd offer (click on the banner) I would like to share my bonus of 200€ if you invest at least 2.500€ within 30 days and give away 90€. So if you're interested just send me a short message.

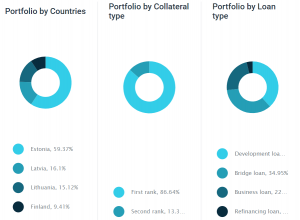

At Viainvest* I'm invested with 1.084€ (+10€) and in January IRR is at 10,64% (+0,01%). As a platform for diversification I can clearly recommend Viainvest and I will continue to invest here. Especially because you cannot find that much Swedish loans. The dashboard shows 11,55% by the way.

For the start at Viainvest* there is a 15€ bonus. For this only 50€ need to be invested. I'm also rewarded with 15€ if you are register with my link.

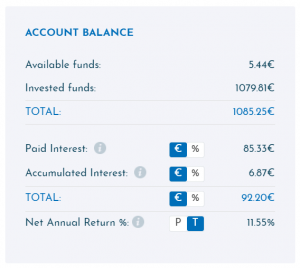

In January NeoFinance* IRR increased again to now 12,15% (+0,33%). The total investment is 1.079€ . Slowly we come to the area where it should be. I'm satisfied with NeoFinance* but noticed that there are more red loans. For now I don't count those as defaults, because there are repayments from time to time. In the following screenshot I compared December and January.

The platform calculated IRR dropped down to 15,63%.

At NeoFinance* there is bonus of 25€. If you use my link I get 5€ and 2% cashback for 2 months as a reward.

IRR climbs slightly again to 10,20% (+0,16%) at Bondster* and now 1.058€ are invested. The dashboard IRR shows 13,02%. Bondster is an excellent alternative because it offers a variety of loans up to 14% from at the moment 12 loan originators. Some of the are also known from Mintos or Grupeer.

Similar to Mintos there is a 1% cashback after 30, 60 and 90 days at Bondster*. I receive 1% aswell.

Unfortunately this investment posibility is only for investors from Germany, Austria, France, Hungary, Ireland, Luxembourg and Switzerland (yet). I'm invested in a stock property (an existing building which is already rented) at Exporo* with 1.000€. The expected return is 4,5% and payments come in every quarter.

The awaited payment came in January but was much lower than expected (only 2,72€). 1.000€ are still invested and IRR is currently at 1,78% (+0,38%).

Exporo* does also offers real estate development projects. Here everybody can invest. Maybe for diversification it’s interesting for you. There is also a chance that investments from Exporo are available on EvoEstate too.

By the way, Exporo* offers you 100€ as promo code (use ID 157135 during registration) for your first investment directly after registration. If you invest I receive also a 100€ promo code.

Like Monethera Wisefund* suspended the early exit feature for now. Also there was only one new project and several rumors about the 3rd party insurance company Best Treasure Limited. For now IRR is 21,09% (-0,81%) with 994€ (-251€) total investment. End of January the Electronic devices stock purchase project paid back earlier than expected. So I withdrew the idle cash and the money which came back from the project and the interests aswell.

Again I had a call with Ingus Linkevics, fromer COO, now CEO of the Wisefund Finance OÜ and drill him with my questions. Next week a secondary market will be available due to him. It seems that there are fees for the buyer. Also the first round of buy-back requests will be processed.

Ingus confirmed that you can see Wisefund at the INVEST in Stuttgart and also at the P2P Conference in Riga.

Wisefund* offers 0,5% cashback for your investments within the first 270 days!

Go & Grow* I mainly use for a small part of my cash and will also use it for my side hustle and savings for insurence payments. Because of the withdrawals from time to time and the fee of 1€ IRR is at 5,80%. However, I do not want to miss the liquidity available here. In total 977€ are invested, so I added another 123€.

5€ are available for you at Bondora* right after registration. If someone wants to invest a larger amount, just send me a message because I get 5% of your investments and I share my bonus (2,5% for you).

Next is one of my newly added platforms TFGCrowd*. Here you can find my short review/interview. Meanwhile my investment at the platform is 709€. Due to the early repayment of a project including several months of interests IRR made a huge jump to 26,27% (+6,21%). But that's only temporarily.

Kristaps digged out some serious stuff about their projects. Claus from p2p-kredite.com asked them and this was the answer:

Thanks for reaching out to us about the blog post.

I would like to give you my best possible answer to the risen questions.Our priority is investor safety, which is also our reputation.

1. Referring to content that we feel is superfluous, short comments from us, without going into depth – Real Estate in Yacht Club is a private house building in the “Kapteinu Osta” area, but has nothing to do with company Kapteinu Osta SIA which Kristaps mentions in his blog.

2. Wardrobe company – has invested in manufacturing and is actively revving, as evidenced by the company's 2019 financials, Kristaps is based on 2018 outdated data. A promising and steady growing company that can be assured both on the website and in life.

3. Modern Compact Houses – Once the escrow account has been fulfilled, the money will be transferred to the borrower's account and secured by a first round mortgage on the property.

4. Real Estate in Cambridge and London – Properties are bought, collateral exists. In our website mentioned that TFGcrowd takes part in projects.

Our participation in projects is one of the conditions of our core business.

All our information is transparent and can be seen in currently active projects.Articles like this or similar in the current situation are a classic phenomenon.

Because the answers of TFGCrowd were very vague I will withdraw the interests in the next month. I think we have to educate the platforms to more transparency!

However if you want to test the platform you can use my link. I get 20€ as a reward if you invest at least 100€.

PeerBerry* has now an IRR of 12,01% with still 594€ invested. I withdrew 21€ in January BUT there is a change of my plan…

Because of the current situation in the industry I will increase my investment again. There were reasons why I lowered my investment at PeerBerry but the calculations issues are fixed (at least the dashboard numbers are correct now). So I give it a try.

PeerBerry* introduced a loyality bonus, but with high requirements

- 0,5% for 10.000€

- 0,75% for 25.000€

- 1% for 40.000€

If you use my PeerBerry* link, I'll receive 5€ + 1% from investments for 60 days.

With an IRR of 3,80% (-0,02%) nothing changed in January at ReInvest24*. The total investment is still 394€. I really like the business model of ReInvest24*, although the funding of projects takes much longer than on other platforms. To lower the effort I will invest over EvoEstate in ReInvest24* projects.

A few days ago the platform wrote an email regarding the current status of the two apartment projects in Tallinn's tech hub. The selling price for the properties will be lowered now to sell the apartments faster.

If someone wants to invest directly over ReInvest24* there is a 1% cashback (for me aswell) in the first year.

For me the loan portfolio at Bondora* consists only of red loans, I sold all other loans after 4 years of investing. Through the recovery process I hope that something remains. Of course I could sell them with high discount, but I'm not reliant on the ~319€. Therefore, the money stays where it is for the time being. If you want to know why IRR is negative I count the not payed money as interest charge within Portfolio Performance.

I can't really recommend Portfolio Pro. If you stop putting in more money, the return drops very quickly into the basement. Although Bondora's* recovery process is one of the best in the p2p industry, there are plenty of alternatives.

Another project was paid back in January at Bulkestate*. IRR is now at 12,76% (+0,29%). At the moment approx. 165€ are invested. Also for Bulkestate I will give the platform a second chance but at the moment there are no new projects. Hopefully they come soon and with monthly payments.

Unfortunately there is no bonus or cashback for new investors. I'll receive 1% cashback for 180 days if you use my link.

Due to the recent events I thought about adding a new somehow established platform to my portfolio which was on my watch list for a longer time. And the choice was Debitum Network*. The platform serve asset backed business loans only. Interests are ‘lower' (7-8%) but including possible penalty fees (4,5-10%) it could be much higher in the end. My first investment was just 100€ and I'll test the platform in the next month.

If you also want to try out Debitum Network* you can use my link. If you invest 100€ I get a reward of 10€ and 2% cashback for 90 days.

The 80€ from November are still ‘invested' in January at Viventor*. As on Mintos, there is also no news regarding the Aforti loans at Viventor. IRR is at 13,71%. If you want to know why I left Viventor*. It's mainly because of the (bad) communication in the Aforti case. It's not about the platform itself, as you can see the IRR is very high.

If you want to invest at Viventor* unfortunately there is only a bonus of 5€ and 1% cashback for 30, 60 and 90 days for me as publisher.

The pawn sacrifice

It's a pity but Boldyield one of my newest platforms paused their business. In the end it's a strategic decision because the team around Edgars Mass know that the wouldn't survive the current situation in the industry. Especially not if other platforms will go south too. Below you can find the full statement. All my invested fund were transfered to my account including the acrued interets. So at the end IRR was 12,92%.

Fishy, scammy, runaways

Nothing new in the Kuetzal case. In total I lost 1.957€. I won't see the money again. At the moment I check together with other investors which legal steps there are to maybe get at least parts of it back.

Unfortunately my last withdrawal request cam too late. Envestio is gone too…Website down etc. In total I lost 1.563€. As for Kuetzal I was at the German police a few days ago and gave them all the information about the suspects. Especially the person of Mr Ganzin is very interesting for the criminal investigation division.

And by the way I was at the address of Mr Ganzin in Germany and big surprise, nobody was there, no sign at the door bell plates and also the neighbors haven't heard of somebody called Ganzin and also haven't seen the person on the pictures.

Affiliate/referral income

As I mentioned that I'll be more transparent regarding income of affiliate sources. You have seen that I write down what I get in return if you using my links. Furthermore I will update you here about my affiliate income in December. I haven't received it yet, normally I get it in the following months. But in total it's 301,92€ distributed over 9 platforms. But minus Envestio, because the won't pay anymore.

Referral income I received from the following platforms:

- EvoEstate: 60€

Outlook and summary

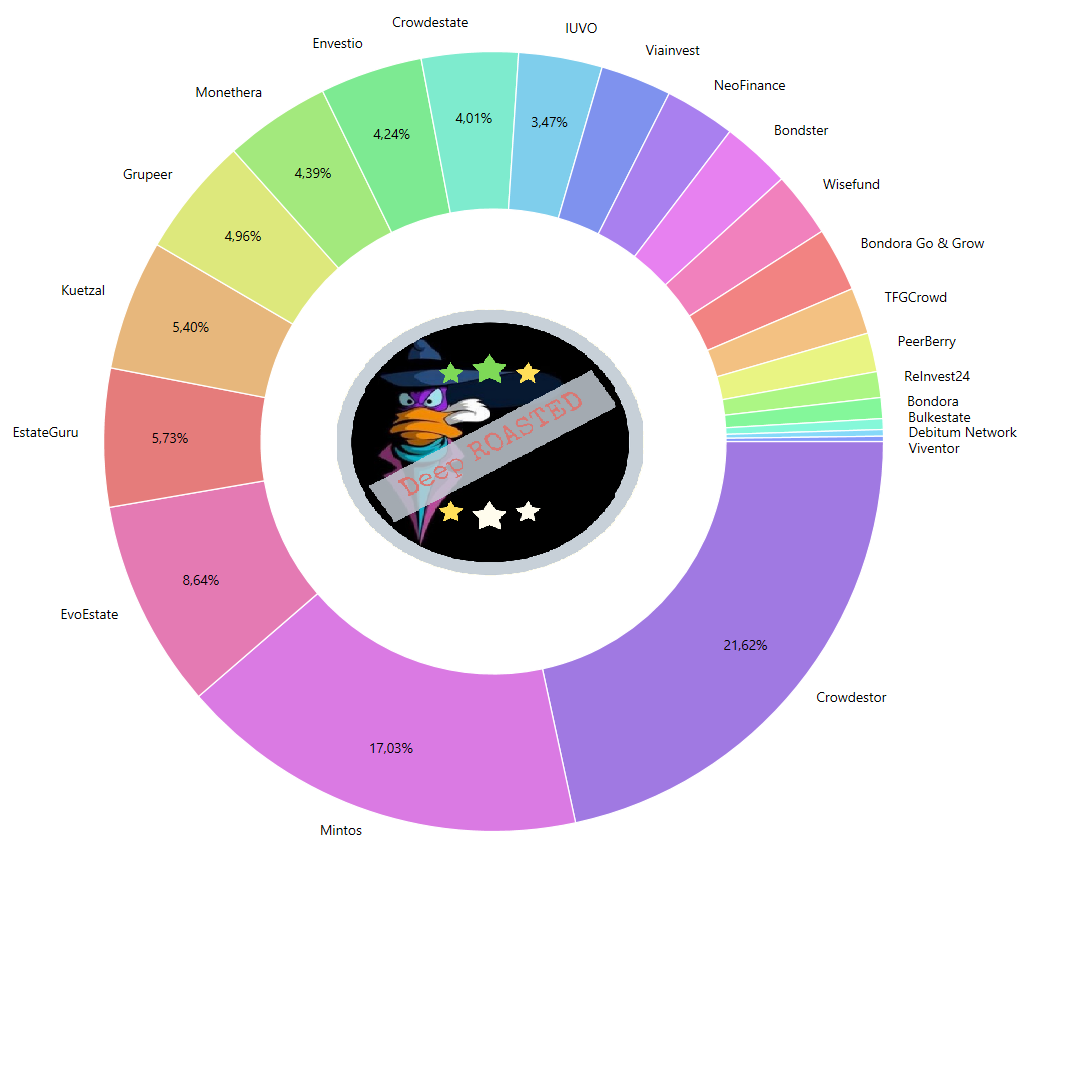

So my first loss is here. In total I lost approx. 3.520€ in Kuetzal and Envestio and ~9% of my P2P and crowdlending portfolio and ~3,1% of my overall portfolio. Will need some time to get back on track. You can see that I already began to shift funds more into real estate P2B platforms and also some sorted out platforms will get a second chance.

Below you can find my distribution between the individual P2P / crowdlending classes. I created a P2B class which consists of Grupeer and Debitum Network at the moment.

- 30,74% (-1,61%) P2P (Buy-back)

- 33,28% (-7,22%) Crowdlending

- 6,09% (+6,09%) P2B

- 23% (+2,51%) P2B (Real estate)

- 3,13% (-0,94%) P2P

- 2,59% (+0,24%) P2P (Short-term)

I hope you find my summary interesting. I'm always open to constructive criticism and proposals. See you in March for the next portfolio update!

Events

There are some events I plan to attend. In April (24/25) there is the INVEST in Stuttgart, Germany where a lot of platforms will be .

And then on June 19 and 20 there is the P2P Conference*. In 2020 again in Riga. If you plan to go there you can use my link* to buy tickets for the ‘show'. Using the code ‘investdiv‘ you get a discount of 20%.

For using my link* for the conference I get a 5-10% reward.

Revolut -My account for p2p and crowdlending

Since I don't want to transfer everything from my regular bank account to the platforms, I was looking for a simpler solution. A few months ago I stumpled upon Revolut*. Since then I use the app for all financial transactions in the area of p2p/crowdlending and also in business context as freelancer with Revolut for Business*.

After being skeptical at first I'm now a big fan of the app. The execution of transactions to the different platforms and also withdrawals is very fast. In addition you can with the free Revolut* VISA card with max. 200€ cash limit per month at an ATM. And that without additional costs!

In addition Revolut* is my faithful travel companion. Since I also work abroad from time to time I also looked for a way to simply exchange currencies. This is easily possible with the Revolut* app. Also without fees (up to 6.000€ per month)!

Using my links for Revolut I get a reward of £2.00-3.00 for a standard card order. For Revolut for Business I get up to 66,35€.

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (invest diversified) in which I invest myself. Also on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!

Why do you withdraw from Crowdestate?

Hi Steve. Mainly because they slept regarding due diligence and more projects than ususal have problems. But I have an eye on such things now.

I’m not sure if I continue withdrawing in the next month. End of February and in March higher repayments are awaited.