Hello P2P friends! In today's blog post P2P portfolio update May 2022 we look back to the previous month. There are indeed some changes again. Have fun reading!

First comes the IRR ranking, as usual, and then a closer look at the individual platforms. I have adjusted the subdivision of the platforms once again because it has led to confusion here and there. There are the categories ‘(Re)invested‘, ‘Withdrawal phase‘ and ‘Investment expires'.

‘Strategy' (Update)

As recently announced, a real estate purchase is pending in the coming year, which will now have an impact on the previous strategy. Many platforms will switch to the withdrawal phase as of next month and the interest will always go directly into the money store at the end of the month.

IRR ranking May 2022

I've selected the 01.07.2017 as a start, as this is where I started tracking my P2P investments.

Platform | Initial investment | IRR (%) | Changes previous month (%) | Invested (EUR) | Changes previous month (EUR) |

|---|---|---|---|---|---|

19.07.2017 | 11,31 | -0,16 | 6602 | -573 | |

30.10.2017 | 10,72 | -0,01 | 1115 | +9 | |

09.11.2017 | 6,62 | -0,02 | 748 | -597 | |

14.05.2018 | 11,90 | -0,18 | 1072 | +3 | |

31.07.2018 | 11,45 | -0,09 | 1800 | +11 | |

11.08.2018 | 12,61 | -0,30 | 561,66 | +4,37 | |

01.02.2019 | 9,44 | -0,03 | 3636 | +26 | |

14.02.2019 | 12,98 | -0,04 | 1445 | +14 | |

20.02.2019 | 9,58 | +0,54 | 2230 | +45 | |

21.03.2019 | 9,24 | -0,14 | 12775 | -133 | |

30.03.2019 | 11,10 | -0,07 | 1262 | +9 | |

12.04.2019 | 11,63 | -0,01 | 1599 | +14 | |

17.05.2019 | 8,66 | -0,16 | 955,28 | +49,72 | |

Crowdestate | 20.05.2019 | -7,57 | +0,05 | 152,65 | 0 |

31.07.2019 | 6,59 | -0,08 | 4938 | -26 | |

15.02.2020 | 15,39 | +0,07 | 1401 | +18 | |

20.02.2020 | 7,42 | +0,06 | 488,61 | +65,93 | |

29.05.2020 | 2,86 | -0,91 | 587,35 | -8,61 | |

22.07.2020 | 9,62 | -0,05 | 593,99 | +4,30 | |

28.01.2021 | 11,00 | +0,47 | 160,66 | +2,01 | |

21.03.2021 | 12,93 | -0,01 | 664,80 | +6,80 | |

10.06.2021 | 12,94 | -0,32 | 575,38 | +5,05 | |

10.06.2021 | 11,04 | +0,12 | 700,78 | +6,67 | |

23.07.2021 | 10,79 | +0,12 | 545,75 | +5,18 | |

15.11.2021 | 17,74 | -0,01 | 67,92 | +0,94 | |

21.03.2022 | 0,18 | +0,18 | 420,43 | +199,70 | |

16.04.2022 | 0 | 0 | 2200 | 0 | |

17.04.2022 | 0 | 0 | 30 | 0 | |

31.05.2022 | +3,11 | +0,10 | 49428 | -737 |

Platforms

(Re)investing

I continue to reinvest on the following platforms and plan to increase the investment in a targeted manner in order to maintain a monthly cash flow of at least EUR 25 or even increase it beyond that. In the coming month, many of these platforms will move into the withdrawal phase.

P2P (Buy-back)

In May, I had cleaned up my Mintos account a bit in the run-up to the switch from ‘claims' to ‘notes'. I also stopped all auto-invests and am now manually investing in bonds for the time being. The IRR on Mintos at the end of the month was 11,31% with 6.602 EUR invested.

Even if Mintos is one of my largest platforms, still 28% of my investment is questionable. Namely all pending payments and loans in recovery.

Mintos has temporarily suspended its affiliate program again.

On IUVO 1.800 EUR were invested at the end of May with an IRR of 11,45%.

Currently, 22,9% of the investment is questionable due to the Polish CBC loans.

- For IUVO there are two different offers. Unfortunately, the referral program is extremely unattractive since a few days. For the first you can contact me because unfortunately it has to be done manually, and I have to invite you. You get 1,5% cashback for investment above 1.000€. I receive 1,5% too.

- With the 2nd offer (click on the banner) I get 5€ and 2% of the investment in the first 30 days and 3% for the investment of day 31-90

![]()

I was able to talk to Lendermarket about one topic at the Invest trade fair in Stuttgart and it was great to be able to talk face-to-face again after such a long time. Lendermarket still has a lot of plans, most recently the loan provider Credory was onboarded, which grants real estate loans. It was clearly communicated that the company wants to develop into a marketplace, but that it wants to learn from the mistakes of other platforms. This means that we investors can look forward to more, in places unknown, smaller, loan originators in the coming quarters.

My investment on Lendermarket continues to grow. With an IRR of 15,39% on an investment of 1.401 EUR, I am very satisfied.

Because the platform is new and I ‘only' invested 1.000 EUR I won't put capital as questionable for now.

On the platform you get 1% cashback if you are using my link*. Currently, in total up to 17%! My reward is 5€ onetime + 1,5%. By the way, Lendermarket will be present with a booth at the Invest fair in Stuttgart!

![]()

Business as usual at Swaper in May, as in the many months before. The less you can report on a platform, the better. The IRR was 12,61% at the end of May with an investment of 561,66 EUR.

Because I just have a few Euros invested, I won't put it as questionable for now.

If you use my link* my reward is onetime 5€ + 2% cashback for 90 days.

Due to a transfer cap of 10 million rubles, the repayment of Russian loans at Twino will now take longer than originally planned, namely a whole three years! But there was also good news: at the end of May, the platform was able to announce a milestone. They have now reached the limit of one billion EUR in financed loans. In addition, there will be a new fundraising campaign, but more about that in the upcoming portfolio update. The IRR was 10,72% at the end of May with 1.115 EUR invested.

For almost 4 years, the platform has been running so solidly that I don't considered my investment questionable. And then came this war. As of today, all Russian loans are questionable.

Here* you can register. If you invest 500€ we both are rewarded with a bonus of 20€. Until 24.5 you will also receive 1% cashback on investments via Auto-Invest (promotion must be activated!)

At Moncera, 593,99 EUR was invested at the end of May with an IRR of 9,62%. The platform does what it should.

1 1/2 years of investment in Moncera and the still small investment amount do not let me consider this investment as questionable.

If you use my Moncera link* we both receive 0,5% cashback on all deposits made by you in the first 60 day.

In the previous month, I had minimally increased my investment in Afranga. In total, 664,80 EUR were invested at the end of the month with an IRR of 12,93%.

I would say that Afranga has slowly outgrown its infancy. Since I have not invested a significant amount, I do not consider my investment questionable.

If you are interested in Afranga, you are welcome to use my link* and support my blog. Unfortunately, only I receive 1% cashback. Prerequisite for this, you invest >500 EUR.

At Esketit, the IRR in May was 12,94% with 575,38 EUR invested. In April, a loyalty program was launched, for more well-heeled investors than me. For the Gold level 25.000 EUR would have to be invested, for Platinum 50.000 EUR. For this, there is then 0,5% or 1% on top of the interest rate on Jordanian loans.

The same applies to Esketit as to Afranga. The platform has established itself in the meantime. Due to the low investment amount, I do not see the investment as such as questionable.

For the curious, there is 1% cashback on the investment for the first 90 days at Esketit with my link*. I also receive this as compensation + one-time 5€.

![]()

Robocash is running completely smoothly. 700,38 EUR was invested there at the end of May with an IRR of 11,04%.

Due to the increase, but still a small investment amount, I do not see the investment as such as questionable. Moreover, Robocash has quite a long track record.

If you are interested in Robocash, you can use my link*. As compensation, I get 1% cashback after 90 days and a one-time 5€.

On Income Marketplace 545,75 EUR were invested at the end of May with an IRR of 10,79%.

500€ is of course not a small amount for a test balloon, but without some skin-in-the-game experience reports are not authentic. I do not see the investment as questionable.

If you want to test the platform there is 1% cashback for you if you use my link* and use the code CLHOFU during registration. I receive 1% too + one-time 20€.

![]()

PeerBerry continues to be diligent and has already returned over 1/3 of the funds of the “war loans” to investors, so the platform is clearly ahead of its own plan. My IRR was 11,90% at the end of May with 1.072 EUR invested. Interest rates were increased accordingly for many loan initiators.

One of the most solid platforms for over three years! Also here until now. A war is of course a worst case scenario, which is why about 60% of my portfolio is questionable, despite the repayments made to date.

A while ago PeerBerry introduced a loyalty bonus, but with high requirements:

- 0,5% for 10.000€

- 0,75% for 25.000€

- 1% for 40.000€

If you use my PeerBerry* link, I'll receive 5€ + 1% from investments for 60 days.

There was not much new at Bondster. The platform was also warm at Invest in Stuttgart and you could talk to CEO Pavel Klema. The IRR at the end of the month was 11,10% with invested 1.262 EUR.

I still see Bondster as a young platform, but now already has 15.000 investors. Even if the collection of Polish loans works out very well, I see 30% of the investment as questionable.

There is a 1% cashback after 30 days at Bondster*. I receive 2%.

![]()

At Viainvest there is now 12% interest for all loans! Otherwise, the IRR at the end of May was 11,63% on an investment of 1.599 EUR.

In my opinion, Viainvest is very solid and therefore I do not consider my investment questionable.

For the start at Viainvest* there is a 15€ bonus. For this only 50€ need to be invested. I'm also rewarded with 15€ if you register with my link.

P2B (Real estate)

![]()

At EstateGuru I look at the moment as good as no longer. Only at the end of the month the received interest is checked, briefly looked at whether there are defaults. At the end of May, 3.636 EUR were invested at EstateGuru with an IRR of 9,44%.

I don't consider my invested capital to be ‘questionable'. So far EstateGuru has always ensured recovery.

At EstateGuru* there is a 0,5% cashback for 3 months. I also receive the cashback and in addition 5€.

![]()

In May, as in the months before, I increased my investment at Reinvest and invested in a new project. I also wrote a separate blog post about it. The IRR at the end of the month was 9,58% with 2.230 EUR invested.

In the meantime Reinvest24 is already 4 years old! I do not consider my invested capital questionable.

If you want to invest on ReInvest24*, there is a 10€ bonus for you. I'll receive 1% of the investment.

I was also able to take two more projects with me at InRento, and I am now invested in a total of four projects there. The first small interest payments have already been made. To state the IRR does not make sense at the moment.

I hope that new rental projects will regularly be available for investment on the platform. So far, I do not consider the investment questionable.

You can register via my InRento* link, for this you will receive a 20€ bonus, while I will receive 50€.

![]()

955,28 EUR was invested in Bulkestate at the end of May. The IRR was 8,66%. The platform had indicated that many projects were still experiencing delays. Nevertheless, a new product was launched with Flash. You can learn more about it in the blog post.

I consider about 15% of the capital to be questionable, as the platform tends to extend projects. Therefore, I will also only reinvest and not transfer fresh funds.

If you use my link*, I'll receive 1% cashback for 180 days and one-time 5€.

P2B

![]()

At Quanloop, 67,92 EUR was invested at the end of May. The IRR is at 17,74% due to the earlier investment, but should fall quickly to a normal level.

I'm sort of continuing the experiment, only with a bit more cash, in the medium term I had in mind 500-1.000 EUR. And of course I will report about everything.

If you register with Quanloop via my link*, you will receive a bonus of 5€. I get 2,5% cashback.

![]()

New projects are now coming onto the platform much more regularly. At the end of May, I added a little more and invested in two new projects. The IRR was 7,42% at the end of the month with a total investment of 488,61 EUR.

So far, exclusively paying or already repaid projects. Therefore, I do not consider my investment questionable.

Linked Finance doesn't have an affiliate program, so there's nothing for you or me. Nevertheless, you can register here if you like.

P2P

![]()

At NeoFinance, the lack of new loans is noticeable lately, these are usually financed again very quickly. Currently 1.445EUR are invested at NeoFinance with an IRR of 12,98%.

The return calculated by the platform is now 14,11% after an adjustment of the calculation. There is a deduction of 15% withholding tax (can be reduced to 10% by the way).

At least the 91-270 days overdue loans I have to mark as questionable even though some of them might pay in the future. I think approx. 19% of the capital is questionable in the current situation.

NeoFinance* changed and lowered their offer too. There is 1% cashback for you and me for 90 days.

P2P (Short-term)

![]() Go & Grow

Go & Grow

Go & Grow I mainly use for a small part of my cash and will also use it for my side hustle and savings for insurance payments. Because of the withdrawals from time to time and the fee of 1 EUR IRR is at 6,62%. In May again deducted something and there are still 748 EUR and in addition 100 EUR at Bondora Go & Grow Unlimited (4% interest instead of 6.75%).

I don't think my investment here is in question. Bondora has enough leverage.

A 5€ bonus is available for you at Bondora* right after registration.

Crowdlending

![]()

LendSecured is now officially Lande after the merger. I was also able to talk to CEO Ņikita Gončars at Invest in Stuttgart. At the end of May, 160,66 EUR was invested with an IRR of 11%.

If you are interested in Lande, you can use my link* and get 1% cashback for 180 days. I will receive 10 € for the successful registration and also 1% cashback for 180 days.

Misc.

![]()

I briefly introduced Bullride in the last portfolio update. Revenues are not expected here until the next few months.

For a test balloon this is a very high amount and this is 100% questionable until the first results roll in.

If you register with my link* you will get 10€ and 1% cashback for 90 days.

I also briefly mentioned Landex in the last portfolio update. The platform is a gimmick for the time being.

This is a test balloon, I want to gain experience on the platform first.

If you register with my link*, I will receive a one-time 5€ + 2% cashback on the investment for 60 days.

Withdrawal phase

Crowdlending

A meager 49,69 EUR in interest was available at Crowdestor in May. My ratio, the delayed projects, has decreased again compared to the previous month, also around 55,90%, but this is also due to repaid projects. At the end of the month, the investment was still 12.775 EUR with an IRR of 9,24%.

Further, because of the risk of the platform and projects, 50% of the investment is ‘questionable' to me (regardless of the ~55,90% delayed projects). Especially due to the Corona pandemic, which will have a massive effect on tourism and restaurants.

If you really want to register, you can do so via the platform's website. I can't recommend Crowdestor!

Investment expires

EvoEstate had invested 4.938 EUR at the end of May with an IRR of 6,59%. By the way, the calculated return differs strongly from the ‘Net Annual Returns', which is 11,02%, due to final maturity projects.

Alle Rückflüsse bei EvoEstate fließen zunächst automatisiert zu InRento. Wenn es dort neue Projekte gibt, investiere ich. Überschüssige Mittel werden abgezogen.

![]()

The British platform AxiaFunder offers investing in an area I haven't seen before because they offer investing in litigation cases. You can find an interview with CEO Cormac Leech at explorerp2p.com. Very worth reading!

My initial investment was £500. Yes, that's the minimum investment and a lot. You have to bring some capital with you in order to have proper diversification. The same is also possible for a total loss, and even a loss of more than the invested money. My test project is still floating in the air (I'm not allowed to give more details). On the positive side returns of 20-30% p.a. are possible. So it's a high risk test balloon! In May the IRR is 2,86% due to currency effects.

I'm therefore letting my investment expire (if possible), because you need a lot of capital for a reasonable diversification. I don't have that and I'm not willing to invest that much there either.

If AxiaFunder is an interesting platform for you, I would be happy if you use my link*. My reward is 30€.

There were small principal repayments at Crowdestate in May. The complete exit is thus dragging on. The IRR was -7,57% and there are still 152,65 EUR on the account.

Portfolio performance income

276,42 EUR in interest in May. No platform really stood out. Unfortunately, the feel-good limit of 300 EUR was not reached, but it should certainly work out in June.

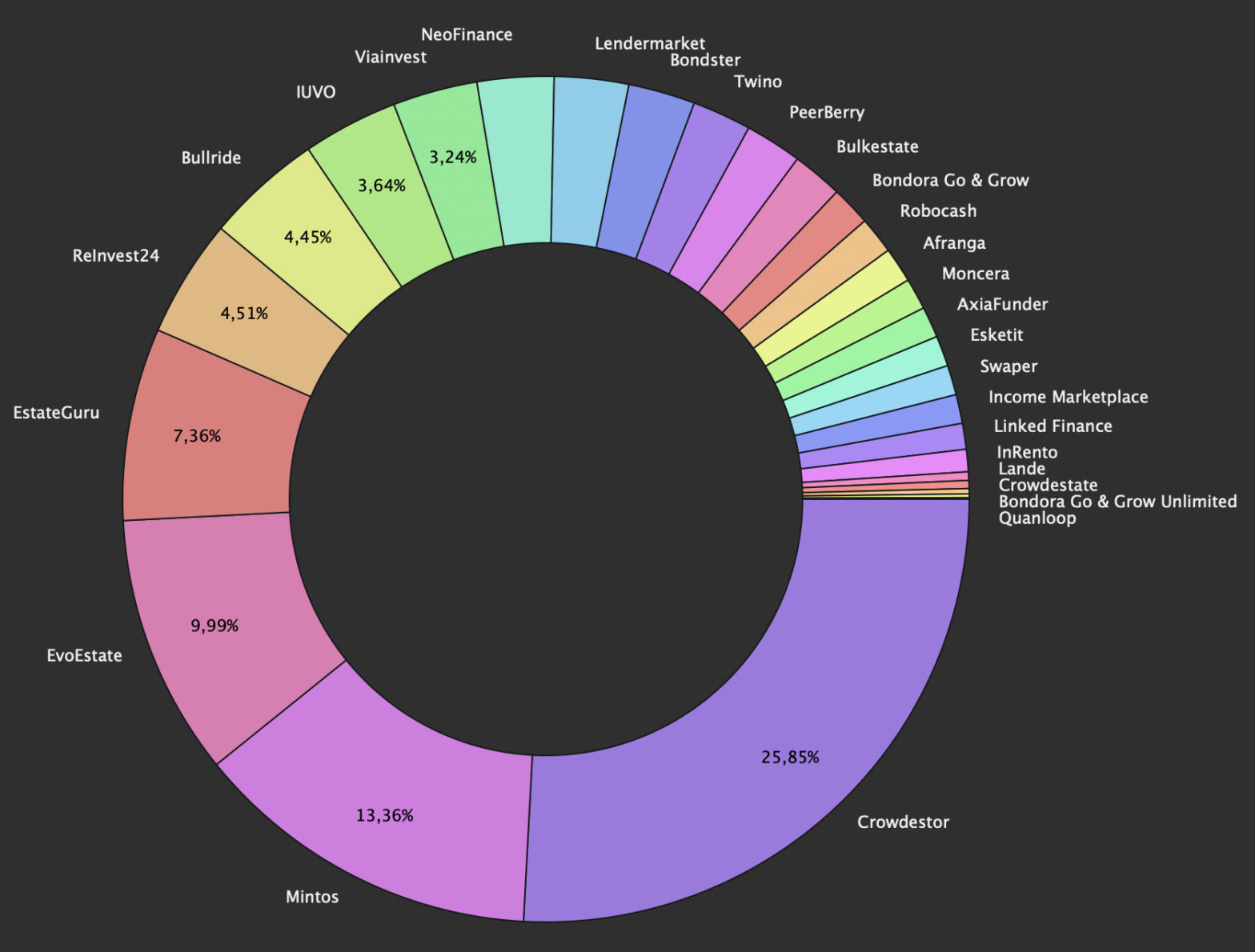

Distribution by P2P/Crowlending classes

Below you can find my distribution between the individual P2P / crowdlending classes for May.

- 37,41% (P2P (Buy-back)

- 26,17% Crowdlending

- 1,13% P2B

- 25,01% P2B (Real estate)

- 2,92% P2P

- 1,72% P2P (Short-term)

- 5,64% Misc. (Bullride, AxiaFunder)

Affiliate/referral income

I would say that I'm one of the most transparent bloggers when it comes to affiliate and referral income. Therefore, there is also pure transparency for May. 222,21 EUR were affiliate revenues distributed over four platforms.

Nevertheless, there was referral income from the following platforms:

- Quanloop*: 20,16 €

- Reinvest24*: 13,29 €

Summary

As already noted, April was a positive outlier on the upside. It was therefore clear that May would be significantly lower. Unfortunately, I also fell below the 300 EUR feel-good limit. C'est la vie! It remains to be said that P2P is currently much more stable than other asset classes *cough*. At least still! My initial goal to increase P2P start this year, I have now revised, because the cash cushion should first grow.

I hope you found my summary interesting as always. I'm always open for constructive criticism and suggestions. Follow me on Instagram. There I post not only about P2P and crowdlending, but also about stocks, dividends and options. So have a look! That's it for today's post, see you again at the P2P portfolio update for June. Till then ciao!

Feel free to let me know in the comments how your P2P investments are going or which platforms you have worries and concerns about!

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (investdiversified) in which I invest myself. Also, on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!