Hello dear readers! We are already in the middle of September and I still owe you the P2P portfolio update August 2022. As always, there is pure transparency for you, what has happened in terms of P2P with me. Enjoy reading and feel free to leave a comment!

First comes the IRR ranking, as usual, and then a closer look at the individual platforms. I have adjusted the subdivision of the platforms once again because it has led to confusion here and there. There are the categories ‘(Re)invested‘, ‘Withdrawal phase‘ and ‘Investment expires'.

‘Strategy' (Update)

As recently announced, a real estate purchase is pending in the coming year, which will now have an impact on the previous strategy. Many platforms will switch to the withdrawal phase and the interest will always go directly into the money store at the end of the month.

IRR ranking August 2022

I've selected the 01.07.2017 as a start, as this is where I started tracking my P2P investments.

Platform | Initial investment | IRR (%) | Changes previous month (%) | Invested (EUR) | Changes previous month (EUR) |

|---|---|---|---|---|---|

19.07.2017 | 11,03 | -0,0* | 6646 | +4 | |

30.10.2017 | 10,73 | -0,01 | 1125 | 0 | |

09.11.2017 | 6,58 | 0 | 17,63 | +0,06 | |

14.05.2018 | 11,49 | -0,13 | 1078 | 0 | |

31.07.2018 | 11,23 | -0,08 | 1812 | -1 | |

11.08.2018 | 13,03 | +0,15 | 573,58 | +7,65 | |

01.02.2019 | 9,36 | -0,03 | 3690 | +5 | |

14.02.2019 | 12,84 | -0,05 | 1406 | -1 | |

20.02.2019 | 9,70 | -0,06 | 2375 | +49 | |

21.03.2019 | 8,87 | -0,11 | 12588 | -17 | |

30.03.2019 | 11,16 | 0 | 1276 | 0 | |

12.04.2019 | 11,72 | -0,04 | 1652 | +32 | |

17.05.2019 | 8,28 | -0,02 | 901,69 | -52,77 | |

Crowdestate | 20.05.2019 | -7,44 | +0,04 | 150,05 | -2,60 |

31.07.2019 | 6,50 | +0,14 | 4969 | +18 | |

15.02.2020 | 16,03 | -0,04 | 1465 | +18 | |

20.02.2020 | 7,45 | -0,04 | 497,79 | +2,77 | |

29.05.2020 | 2,06 | -1,22 | 581,23 | -14,15 | |

22.07.2020 | 9,54 | -0,03 | 598,40 | -0,72 | |

28.01.2021 | 11,02 | -0,35 | 164,97 | +0,87 | |

21.03.2021 | 13,05 | -0,02 | 671,65 | -7,65 | |

10.06.2021 | 13,04 | +0,07 | 588,64 | +6,35 | |

10.06.2021 | 11,44 | +0,12 | 722,06 | +7,32 | |

23.07.2021 | 10,87 | +0,40 | 554,29 | +3,76 | |

15.11.2021 | 17,70 | -0,13 | 70,73 | +0,84 | |

21.03.2022 | 5,07 | +0,62 | 620,70 | +82,34 | |

16.04.2022 | -1,91 | -13,60 | 2060 | -35 | |

17.04.2022 | 0 | 0 | 30 | 0 | |

31.08.2022 | +3,40 | +0,16 | 48884 | +115 |

Platforms

(Re)investing

I continue to reinvest on the following platforms and plan to increase the investment in a targeted manner in order to maintain a monthly cash flow of at least EUR 25 or even increase it beyond that. Many platforms have been transferred to the withdrawal phase, and some will follow.

P2P (Buy-back)

![]()

Lendermarket continues to run quite smoothly. The Creditstar loans on Mintos, where some pending payments had accumulated and are now being restructured, are quite different. IRR is at 16,03% on an investment of 1.465 EUR.

Because the platform is new and I ‘only' invested 1.000 EUR I won't put capital as questionable for now.

Currently there is still the chance to win 500 EUR if you use my link* and deposit at least 500 EUR. Every 500 EUR deposit counts as a single ticket. I will receive 5€ + 1,5% once. Every week two winners will be determined. The 3rd round of the raffle and drawing of the winners is from 19.09.22-25.09.22. The last round of the raffle runs from 26.09.22-02.10.22!

![]()

At Robocash, there were interest rate adjustments at the end of August, otherwise everything is running as usual. 722,06 EUR were invested at the end of August with an IRR of 11,44%. I would also like to transfer Robocash to the withdrawal phase, but I almost never have free money there. Maybe next month!

Due to the increase, but still a small investment amount, I do not see the investment as such as questionable. Moreover, Robocash has quite a long track record.

If you are interested in Robocash, you can use my link*. As compensation, I get 1% cashback after 90 days and a one-time 5€.

P2B (Real estate)

![]()

In August, for a change, I did not take a new project with Reinvest24. However, there were two repayments of a project at the end of the month! The IRR at the end of the month was 9,70% with invested 2.375 EUR.

In the meantime Reinvest24 is already 4 years old! I do not consider my invested capital questionable.

If you want to invest on ReInvest24*, there is a currently a great bonus campaign for new investors on investments of the first 30 days, which runs until 30.11.2022! I receive 1% cashback, as before.

- 500 – 1.999 EUR investment = 25 EUR bonus

- 2.000 – 9.999 EUR investment = 50 EUR bonus

- 10.000 – 99.999 EUR investment = 200 EUR bonus

- From 100.000 EUR investment = 1.000 EUR bonus

At InRento, I keep investing in new projects when there are enough paybacks from EvoEstate. At the time of writing this blogpost, the new interface is also already online, but there are still some new features to come. The IRR is currently at 5,07% with an investment of 620,70 EUR at the end of August.

I hope that new rental projects will regularly be available for investment on the platform. So far, I do not consider the investment questionable.

You can register via my InRento* link, for this you will receive a 20€ bonus, while I will receive 20€, too.

P2B

![]()

At Quanloop, 70,73 EUR was invested at the end of August. The IRR is at 17,70% due to the earlier investment, but should fall quickly to a normal level.

I'm sort of continuing the experiment, only with a bit more cash, in the medium term I had in mind 500-1.000 EUR. And of course I will report about everything.

If you register with Quanloop via my link*, you will receive a bonus of 5€. I get 2,5% cashback.

![]()

At LinkedFinance the IRR was 7,45% at the end of August with a total investment of 497,79 EUR. Currently, new projects are regularly available for investment. This was rather a weakness in the past.

So far, exclusively paying or already repaid projects. Therefore, I do not consider my investment questionable.

Linked Finance doesn't have an affiliate program, so there's nothing for you or me. Nevertheless, you can register here if you like.

P2P (Short-term)

![]() Go & Grow

Go & Grow

Go & Grow I mainly use for a small part of my cash and will also use it for my side hustle and savings for insurance payments. Because of the withdrawals from time to time and the fee of 1 EUR IRR is at 6,58%. In August there is still about 17 EUR left on the account.

I don't think my investment here is in question. Bondora has enough leverage.

A 5€ bonus is available for you at Bondora* right after registration.

Crowdlending

![]()

Lande (formerly Lendsecured) also paid some interest again in August.. At the end of August, 164,97 EUR was invested with an IRR of 11,02%.

If you are interested in Lande, you can use my link* and get 1% cashback for 180 days. I will receive 10 € for the successful registration and also 1% cashback for 180 days.

Misc.

![]()

Bullride I had briefly introduced in April portfolio update. In July there was already the first income and in August also additional adjustment entries in my favor. The IRR was positively influenced by this and is now at -1.91%. The negative value is due to the fact that I write-off my two e-scooters monthly over the next four years.

For a test balloon this is a very high amount and this is 100% questionable until the first results roll in.

If you register with my link* you will get 10€ and 1% cashback for 90 days.

I also briefly mentioned Landex in the April portfolio update. The platform is a gimmick for the time being with only 30 EUR invested.

This is a test balloon, I want to gain experience on the platform first.

If you register with my link*, I will receive a one-time 5€ + 2% cashback on the investment for 60 days.

Withdrawal phase

P2P (Buy-back)

On Mintos, I continue to manually invest in notes. I also try to take advantage of one or two cashback promotions. The IRR on Mintos at the end of August was 11,03% with 6.646 EUR invested. More and more loan originators are now placing their notes on the platform.

Even if Mintos is one of my largest platforms, approx. 36% of my investment is questionable. Namely all pending payments and loans in recovery.

Mintos has currently suspended its affiliate program again.

On IUVO 1.812 EUR were invested at the end of August with an IRR of 11,26%. Otherwise, there was no great news from the platform. In the protracted attempts to win back investors' money, BBG and CBC now have the first positive news to report.

Currently, 22,9% of the investment is questionable due to the Polish CBC loans.

- For IUVO there are two different offers. Unfortunately, the referral program is extremely unattractive since a few days. For the first you can contact me because unfortunately it has to be done manually, and I have to invite you. You get 1,5% cashback for investment above 1.000€. I receive 1,5% too.

- With the 2nd offer (click on the banner) I get 5€ and 2% of the investment in the first 30 days and 3% for the investment of day 31-90

![]()

As usual, there is little to report about Swaper. The IRR was 13,03% at the end of August with an investment of 573,58 EUR.

Because I just have a few Euros invested, I won't put it as questionable for now.

If you use my link* my reward is onetime 5€ + 2% cashback for 90 days.

Twino had also switched to bonds (called Securities) in July. The IRR at the end of the month was 10,73% with 1.125 EUR invested. The repayment of Russian loans is very slow and lately it has been very quiet in this regard. I suspect that Twino would like to throw the issue under the bus.

For almost 4 years, the platform has been running so solidly that I don't considered my investment questionable. And then came this war. As of today, all Russian loans are questionable.

Here* you can register. If you invest 500€ we both are rewarded with a bonus of 20€. Until 24.5 you will also receive 1% cashback on investments via Auto-Invest (promotion must be activated!)

At Moncera, 598,40 EUR was invested at the end of August with an IRR of 9,54%.

1 1/2 years of investment in Moncera and the still small investment amount do not let me consider this investment as questionable.

If you use my Moncera link* we both receive 0,5% cashback on all deposits made by you in the first 60 day.

There is also nothing to report at Afranga. A total of 671,65 EUR was invested at the end of August with an IRR of 13,05%.

I would say that Afranga has slowly outgrown its infancy. Since I have not invested a significant amount, I do not consider my investment questionable.

If you are interested in Afranga, you are welcome to use my link* and support my blog. Unfortunately, only I receive 1% cashback. Prerequisite for this, you invest >500 EUR.

At Esketit, the IRR climbed slightly in August to 13,04%. 582,29 EUR are invested on the platform.

The same applies to Esketit as to Afranga. The platform has established itself in the meantime. Due to the low investment amount, I do not see the investment as such as questionable.

For the curious, there is 1% cashback on the investment for the first 90 days at Esketit with my link*. I also receive this as compensation + one-time 5€.

At the end of August, 554,29 EUR was invested on Income Marketplace with an IRR of 10,87%. With ITF and Juancho te Presta, two more, well-known, loan originators were added in July.

500€ is of course not a small amount for a test balloon, but without some skin-in-the-game experience reports are not authentic. I do not see the investment as questionable.

If you want to test the platform there is 1% cashback for you if you use my link* and use the code CLHOFU during registration. I receive 1% too + one-time 20€.

![]()

PeerBerry continues its efforts to recover investor funds from the Russian and Ukrainian loans, and so far with success. My IRR was 11,49% at the end of August with 1.078 EUR invested.

One of the most solid platforms for over three years! Also here until now. A war is of course a worst case scenario, which is why about 60% of my portfolio is questionable, despite the repayments made to date.

A while ago PeerBerry introduced a loyalty bonus, but with high requirements:

- 0,5% for 10.000€

- 0,75% for 25.000€

- 1% for 40.000€

If you use my PeerBerry* link, I'll receive 5€ + 1% from investments for 60 days.

At Bondster there is also relatively little to report with the exception of the information that for Bondster the actually defaulted Mikrokasa loans have not defaulted. It's a matter of definition it seems… The IRR at the end of the month was 11,16% with 1.276 EUR invested.

I still see Bondster as a young platform, but now already has 15.000 investors. Due to the “defaulted” Polish loans, I see 30% of the investment as questionable.

There is a 1% cashback after 30 days at Bondster*. I receive 2%.

![]()

At Viainvest had raised interest rates across the board to 12% in May, and at the writing of this blog post, it's been up to 13% recently. The platform seems to be slowly getting a grip on the problems with the conversion to the notes (securities). The withholding tax is 20% by default, but you can lower it by providing the proper proof, which I did in August. Besides that, the IRR at the end of Augst was 11,72% on an investment of 1.652 EUR.

In my opinion, Viainvest is very solid and therefore I do not consider my investment questionable.

For the start at Viainvest* there is a 15€ bonus. For this only 50€ need to be invested. I'm also rewarded with 15€ if you register with my link.

P2P

![]()

There is nothing new at NeoFinance. Currently, 1.406 EUR are invested at NeoFinance with an IRR of 12,84%.

The return calculated by the platform is now 13,91% after an adjustment of the calculation. There is a deduction of 15% withholding tax (can be reduced to 10% by the way).

At least the 91-270 days overdue loans I have to mark as questionable even though some of them might pay in the future. I think approx. 19% of the capital is questionable in the current situation.

NeoFinance* changed and lowered their offer too. There is 1% cashback for you and me for 90 days.

P2B (Real estate)

![]()

At EstateGuru I rarely look at the account at the moment. Only at the end of the month, the interest received is checked, briefly looked at whether there are defaults. At the end of Augus, 3.690 EUR were invested at EstateGuru with an IRR of 9,36%.

I don't consider my invested capital to be ‘questionable'. So far EstateGuru has always ensured recovery.

At EstateGuru* there is a 0,5% cashback for 3 months. I also receive the cashback and in addition 5€.

Crowdlending

48,20 EUR in interest was paid at Crowdestor in August. My ratio, the delayed projects, has increased again compared to July, to 64,52%. At the end of the month, the investment was still 12.588 EUR with an IRR of 8,87%.

Further, because of the risk of the platform and projects, 50% of the investment is ‘questionable' to me (regardless of the ~64,52% delayed projects). Especially due to the Corona pandemic, which will have a massive effect on tourism and restaurants.

If you really want to register, you can do so via the platform's website. I can't recommend Crowdestor!

Investment expires

EvoEstate had invested 4.969 EUR at the end of August with an IRR of 6,50%. By the way, the calculated return differs strongly from the ‘Net Annual Returns', which is 11,04%, due to final maturity projects.

All returns at EvoEstate first flow automatically to InRento. If there are new projects there, I invest. Excess funds are withdrawn.

![]()

The British platform AxiaFunder offers investing in an area I haven't seen before because they offer investing in litigation cases. You can find an interview with CEO Cormac Leech at explorerp2p.com. Very worth reading!

My initial investment was £500. Yes, that's the minimum investment and a lot. You have to bring some capital with you in order to have proper diversification. The same is also possible for a total loss, and even a loss of more than the invested money. My test project is still floating in the air (I'm not allowed to give more details). On the positive side returns of 20-30% p.a. are possible. So it's a high risk test balloon! In August the IRR is 2,06% due to currency effects.

I'm therefore letting my investment expire (if possible), because you need a lot of capital for a reasonable diversification. I don't have that and I'm not willing to invest that much there either.

If AxiaFunder is an interesting platform for you, I would be happy if you use my link*. My reward is 17,50€ and 3% Cashback.

There were small principal repayments at Crowdestate in August again. Anyway, the complete exit is dragging on. The IRR was -7,44% and there are still 150,05 EUR on the account.

![]()

901,69 EUR was invested in Bulkestate at the end of August. The IRR was 8,28%. One project was repaid after a long time and the free funds were withdrawn by me. I intend to continue to do so.

Portfolio performance income

I received 397,01 EUR interest in August from my various platforms. The feel-good limit of 300 EUR finally exceeded again, which was, as in the previous month, due to Bullride and the correction entries. But this time with positive effect.

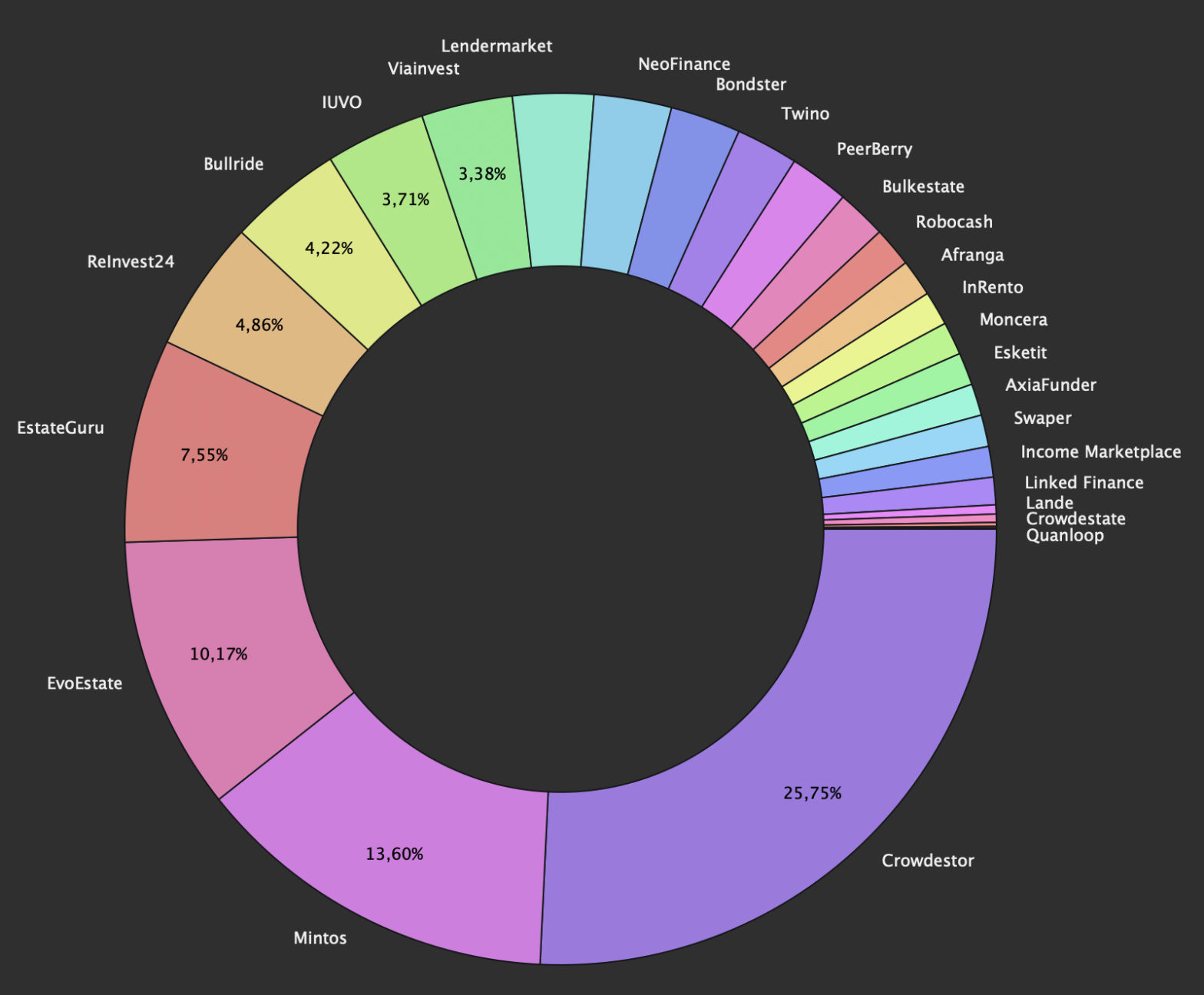

Distribution by P2P/Crowlending classes

Below you can find my distribution between the individual P2P / crowdlending classes for August.

- 38,38% (P2P (Buy-back)

- 26,09% Crowdlending

- 1,16% P2B

- 26,06% P2B (Real estate)

- 2,88% P2P

- 0,04% P2P (Short-term)

- 5,39% Misc. (Bullride, AxiaFunder)

Affiliate/referral income

I would say that I'm one of the most transparent bloggers when it comes to affiliate and referral income. Therefore, there is also pure transparency for August. There were 630 EUR in affiliate income distributed across five platforms.

Referral-‘income' im August:

- Quanloop*: 18,89 €

- Reinvest24*: 32,36 €

Summary

The situation in the economy is becoming increasingly gloomy; there is nowhere to hide, it feels, in either stocks or bonds. However, P2P itself is holding up very well in terms of cash flow. The defaults, which of course are part of it, are also keeping within limits. I am curious to see how the whole P2P industry behaves in a recession. Also, the recent (and upcoming interest rate hikes) are certainly toxic for some regions and loan types. However, the cash flow in my portfolio fits so far and with August there was finally a month above 300 EUR again. I continue to withdraw cash regularly and try to reduce my problem platforms.

About new projects on Twitter, Instagram and Facebook

I hope you found my summary interesting as always. I'm always open for constructive criticism and suggestions. Follow me on Instagram (or Twitter and Facebook). There I post not only about P2P and crowdlending, but also about stocks, dividends and options. So have a look! That's it for today's post, see you again at the P2P portfolio update for August. Bye!

Feel free to let me know in the comments how your P2P investments are going or which platforms you have worries and concerns about!

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!