Hello dear readers! Today there is again a delayed P2P portfolio update August 2021. In August I had a lot going on, new job, many appointments, etc. so the update has “once again” dragged. Nevertheless, I would like to provide a detailed update again. Have fun reading!

First comes the IRR ranking, as usual, and then a closer look at the individual platforms. I have adjusted the subdivision of the platforms once again because it has led to confusion here and there. There are the categories ‘(Re)invested‘, ‘Withdrawal phase‘ and ‘Investment expires'.

‘Strategy'

Another thing about the current strategy. Currently, I withdraw from platforms that bring me more than 10 EUR interest per month and build up some cash or redistribute it to other platforms. So I'm much more flexible and can consider whether I use it in the following month to specifically increase a platform or leave it as cash and invest elsewhere if necessary.

IRR ranking August 2021

I've selected the 01.07.2017 as a start, as this is where I started tracking my P2P investments.

Platform | Initial investment | IRR (%) | Change previous month (%) | Invested (EUR) | Change previous month (EUR) |

|---|---|---|---|---|---|

19.07.2017 | 12,73 | -0,13 | 7217 | +10 | |

30.10.2017 | 10,50 | +0,06 | 1035 | +10 | |

09.11.2017 | 6,69 | -0,03 | 175,27 | -996,23 | |

14.05.2018 | 12,79 | -0,01 | 1041 | +1 | |

31.07.2018 | 12,17 | -0,09 | 1704 | -193 | |

11.08.2018 | 12,49 | +0,16 | 513,20 | +5,96 | |

01.02.2019 | 9,86 | +0,15 | 3425 | +36 | |

14.02.2019 | 13,22 | -0,02 | 1325 | +13 | |

20.02.2019 | 8,10 | -0,11 | 1489 | +190 | |

Viventor | 21.02.2019 | -22,26 | -29,77 | 0 | -206,11 |

21.03.2019 | 8,48 | -0,29 | 14672 | -227 | |

30.03.2019 | 11,48 | 0 | 1214 | +1 | |

12.04.2019 | 11,58 | -0,02 | 1358 | +2 | |

17.05.2019 | 7,28 | -0,27 | 970,47 | -2,67 | |

Crowdestate | 20.05.2019 | -8,00 | +0,05 | 168,25 | 0 |

31.07.2019 | 4,00 | -0,02 | 5978 | +50 | |

TFGCrowd | 04.11.2019 | 17,12 | -0,42 | 409,86 | 0 |

31.01.2020 | 8,67 | 0 | 6,59 | +0,04 | |

15.02.2020 | 16,37 | +0,64 | 1035 | +18 | |

20.02.2020 | 7,02 | +0,09 | 317,74 | +2,18 | |

29.05.2020 | 3,88 | -1,06 | 582,31 | -5,03 | |

22.07.2020 | 9,97 | -0,09 | 547,64 | +11,17 | |

28.01.2021 | 13,89 | +6,46 | 106,76 | +3,95 | |

21.03.2021 | 13,80 | +0,60 | 375,15 | +4,57 | |

10.06.2021 | 12,37 | +4,51 | 259,20 | +4,02 | |

10.06.2021 | 7,68 | +2,11 | 254,19 | +2,29 | |

23.07.2021 | 4,99 | +4,72 | 502,61 | +2,58 | |

31.08.2021 | +0,25 | +0,05 | 46682 | -1265 |

Platforms

(Re)investing

Currently I'm in a kind of withdrawal phase or consolidation / reallocation. On the following platforms, however, I continue to reinvest and plan to increase the investment moderately in some cases.

P2P (Buy-back)

With Lendermarket, things just keep going the way they have been. My IRR was 16,37% at the end of August. The investment is now 1.035 EUR.

Because the platform is new and I ‘only' invested 1.000 EUR I won't put capital as questionable for now.

On the platform you get 1% cashback if you are using my link*. Currently, in total up to 16%! My reward is 5€ onetime + 1,5%

![]()

Swaper remains one of the most opaque platforms, but also one that delivers, at least in terms of numbers. At the end of August, the IRR was 12,49% with an investment of 513,20 EUR.

Because I just have a few Euros invested I won't put it as questionable for now.

If you use my link* my reward is onetime 5€ + 2% cashback for 90 days.

I had also added to Twino in the previous month. End of August the IRR was 10,50% with an invested 1.035 EUR. To get ahead of the September update, Twino is now also among the regulated platforms, having received an Investment Brokerage Lincence from the Latvian FCMC.

So far, the platform has been running so solidly for almost 4 years that I don't consider my investment questionable.

Here* you can register. If you invest 100€ we both are rewarded with a bonus of 15€.

At Moncera, 547,64 EUR were invested at the end of August with an IRR of 9,97%. That's it!

I'm watching the platform very closely, but so far I have no reason to consider my investment questionable. Nevertheless, the platform is of course very young.

If you use my Moncera link* I'll receive 2% on all deposits made by you in the first 60 days and one-time 5€. This also supports my blog, so I want to say thank you in advance!

In the case of Afranga, the investment in August totaled 375,15 EUR with an IRR of 13,80%.

As always with new platforms, I test the whole thing first with a small amount and share my observations. Afranga is also a candidate like Moncera, where I could imagine to increase the investment a bit faster. Due to the small investment amount, I don't see the investment as such as questionable.

If you are interested in Afranga, you are welcome to use my link* and support my blog. Unfortunately, only I receive 1% cashback. Prerequisite for this, you invest >500 EUR.

Esketit continues to perform well, but for the time being there are no further deposits. At the end of August, 259,20 EUR were invested with an IRR of 12,37%. The return is slowly getting to where it should be.

Of course, this is also a test balloon. I'm looking at the platform over a longer period of time before I increase the investment further, however, there will also be a little more skin-in-the-game with the test balloons than before. Due to the low investment sum, I do not see the investment as such as questionable.

For the curious, there is 1% cashback on the investment for the first 90 days at Esketit with my link*. I also receive this as compensation + one-time 5€.

![]()

Also at Robocash the first interest rates came and let the yield climb a bit, although not as fast as at Esketit or Afranga. Currently there are 254,19 EUR on the account with an IRR of 7,68%.

I would also classify Robocash as a test balloon for now, although I will probably increase the investment here sooner. Due to the low investment amount, I do not see the investment as such as questionable.

If you are interested in Robocash, you can use my link* and support my blog. As compensation I get 1% cashback after 90 days and a one-time 5€.

In the previous month, I added another P2P platform, Income Marketplace*, which also sets some interesting features. I discussed what those are with CEO Kimmo Rytkönen in an interview. So take a look! The initial 500 EUR investment has meanwhile grown to 502,61 EUR and thus has an IRR of 4,99%.

500€ is of course not a small amount for a test balloon, but without some skin-in-the-game experience reports are not authentic.

If you want to test the platform there is 1% cashback for you if you use my link* and use the code CLHOFU during registration. I receive 1% too + one-time 20€.

P2B (Real estate)

![]()

At EstateGuru I continue to reinvest manually, in theory. In August, I had to start the auto-invest temporarily again, because I was too slow with manual investment. It can be observed that interest rates are also falling in the real estate sector. Invested at the end of the month were 3.425 EUR with an IRR of 9,86%. Soon the 10% should be reached!

I don't consider my invested capital to be ‘questionable'. So far EstateGuru has always ensured recovery.

At EstateGuru* there is a 0,5% cashback for 3 months. I also receive the cashback and in addition 5€.

![]()

In August, I had invested in two more projects at Reinvest24, both so-called buy-to-let projects, from which I expect a stable cash flow. The calculated IRR at the end of the month was 8,10% with invested 1.489 EUR.

I consider 10% of my investment as questionable, as ReInvest24 is still a young platform.

If you want to invest on ReInvest24*, there is a 10€ bonus for you. I'll receive 1% of the investment.

At EvoEstate, 5.978 EUR was invested at the end of August with an IRR of 4,00%. 100 EUR I had invested in a new project of InRento. I recently had an exciting interview with InRento CEO Gustas (who also founded EvoEstate). Check it out to learn more about the InRento projects. Incidentally, the calculated return deviates strongly from the “Net Annual Returns”, which is 10,96%, due to final maturity projects. I'm currently invested in 62 projects.

Although, EvoEstate is still one of the younger platforms. I don't (any longer) consider my capital to be questionable.

For EvoEstate there is a 0,5% cashback for 6 months with this link*. I get 0,5% too and one-time 5€.

P2B

![]()

Once again I was able to invest in a new project at LinkedFinance. The IRR was 7,02% at 31.08 with a total investment of 317,74 EUR.

So far exclusively paying or already repaid projects. Only the lack of new projects clouds the entry. I do not consider my investment questionable at the moment.

Linked Finance doesn't have an affiliate program, so there's nothing for you or me. Nevertheless, you can register here if you like.

P2P

![]()

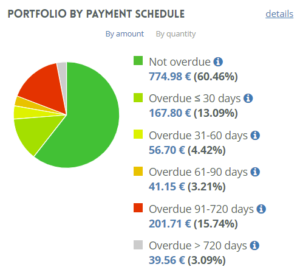

With NeoFinance, things are also running smoothly so far, the red credits are at least no longer increasing that much. At the end of August 1.325 EUR are invested in NeoFinance and the IRR is 13,22%. I don't count the red credits as defaults so far, since they do make a payment from time to time. The manually selected loans have very strict criteria. Since I have been doing this specifically, the number of loans that are up to 90 days late has felt to be declining somewhat. However, I have yet to back up this observation with numbers. NeoFinance is one of the platforms where I have not paid out any interest, as there is a withdrawal fee. In the following screenshots a comparison of July 2021 and August 2021.

The return calculated by the platform is now 14,07% after an adjustment of the calculation. There is a deduction of 15% withholding tax (can be reduced to 10% by the way).

At least the 91-270 days overdue loans I have to mark as questionable even though some of them might pay in the future. I think approx. 16% of the capital is questionable in the current situation.

NeoFinance* changed and lowered their offer too. There is 1% cashback for you and me for 90 days.

P2P (Short-term)

![]() Go & Grow

Go & Grow

Go & Grow I mainly use for a small part of my cash and will also use it for my side hustle and savings for insurance payments. Because of the withdrawals from time to time and the fee of 1€ IRR is at 6,69%. Some insurance payments were due in August, so Go & Grow had to be tapped. The total investment is now 175,27 EUR.

I don't think my investment here is in question. Bondora has enough leverage.

5€ are available for you at Bondora* right after registration.

Crowdlending

LendSecured has seen a jump in returns due to the successful repayment of a project. In August, 106,76 EUR was invested with an IRR of 13,89%.

If you are interested in LendSecured, you can use my link*. I'll receive 10 € for the successful registration + 1% cashback for 180 days.

Withdrawal phase

P2P (Buy-back)

I had reduced the investment in Mintos in the previous month, but now everything will continue like this for the time being. As of 31.08.21 were 7.217 EUR on the account. In the future, I will withdraw about 40 EUR in interest per month. The IRR was 12,73%.

Even if Mintos is one of my largest platforms, still 18,2% of my investment is questionable. Namely all pending payments and loans in recovery.

From October 4, 2021 Mintos* changes its affiliate programm and introduces a waiting list for new investors. I receive 6€ if you use my link* for registration.

I also shared my idea to halve the investment in IUVO in the last portfolio update. I started to implement it in August. 1.704 EUR were invested at the end of the month with an IRR of 12,17%. In future, the focus will be on Ibancar loans and only about 20% on other loan initiators. However, this is likely to prove more difficult than anticipated; there have been no new Ibancar loans for some time. These are presumably placed in batches.

Marking 10% of the capital as questionable seems to be appropriate because of the amount of HR loans.

- For IUVO there are two different offers. Unfortunately the referral program is extremely unattractive since a few days. For the first you can contact me because unfortunately it has to be done manually, and I have to invite you. You get 1,5% cashback for investement above 1.000€. I receive 1,5% too.

- With the 2nd offer (click on the banner) I get 5€ and 2% of the investment in the first 30 days and 3% for the investment of day 31-90

![]()

PeerBerry continues to run silently. My IRR was at the end of August at 12,79% with invested 1.041 EUR. Here I had also started to withdraw monthly 10 EUR cash.

One of the most solid platforms for over three years.

A while ago PeerBerry introduced a loyalty bonus, but with high requirements:

- 0,5% for 10.000€

- 0,75% for 25.000€

- 1% for 40.000€

If you use my PeerBerry* link, I'll receive 5€ + 1% from investments for 60 days.

In July I could finally publish the interview with Bondster. Otherwise, there is little to report in August. The IRR was at 11,48% as in the previous month with 1.214 EUR invested. Again, I'll withdraw 10 EUR at the end of the month.

I still see Bondster as a young platform and even if the collection of Polish loans works out very well, I see 30% of the investment as questionable.

There is a 1% cashback after 30, 60 and 90 days at Bondster*. I receive 2% .

![]()

An unspectacular July was followed by an unspectacular August. The IRR was 11,58% with invested 1.358 EUR. As with some other platforms, I have withdrawn 10 EUR.

In my opinion Viainvest is quite solid and so 0% of my capital is questionable (so far).

For the start at Viainvest* there is a 15€ bonus. For this only 50€ need to be invested. I'm also rewarded with 15€ if you register with my link.

P2P (real estate)

![]()

Bulkestate also currently has little to report. At the end of August, 970,47 EUR was still invested and the IRR was 7,28%. As mentioned last time, Bulkestate's figures are inaccurate here due to some partial redemptions. Both the invested amount and the IRR should be a bit higher and the yield should jump up if bullet repayments are successful. I assume 11-12%.

I think about 9% of the capital is questionable, because of the two delayed projects and because I do not know how well the recovery is working. However, refinancing on Crowdestate is a step in the right direction.

If you use my link* I'll receive 1% cashback for 180 days and one-time 5€.

Crowdlending

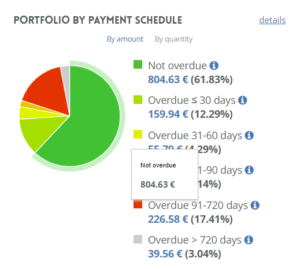

A great July in terms of interest rates was followed by a disappointing August in terms of interest rates with only 36,17 EUR. As I have mentioned before, the cash flow at Crowdestor is extremely unstable. My new metric, delayed projects, remains at 54% as in July. My investment at the end of August was 14.672 EUR with an IRR of 8,48%.

Since there are always new accusations against Crowdestor, partly justified, partly made up out of thin air, Thomas, Dirk and I arranged to meet the legendary Peerduck for a podcast in August.

Further, because of the risk of the platform and projects, 50% of the investment is ‘questionable' to me (regardless of the ~54% delayed projects). Especially due to the Corona pandemic, which will have a massive effect on tourism and restaurants.

With my link* there is 1% cashback for 180 days! I receive 1% too + one-time 10€.

Investment expires

![]()

The British platform AxiaFunder offers investing in an area I haven't seen before because they offer investing in litigation cases. You can find an interview with CEO Cormac Leech at explorerp2p.com. Very worth reading!

My initial investment was £500. Yes, that's the minimum investment and a lot. You have to bring some capital with you in order to have proper diversification. The same is also possible for a total loss and even a loss of more than the invested money. My test project is still floating in the air (I'm not allowed to give more details). On the positive side returns of 20-30% p.a. are possible. So it's a high risk test balloon! In August the IRR is 3,88% due to currency effects.

I'm therefore letting my investment expire (if possible), because you need a lot of capital for a reasonable diversification. I don't have that and I'm not willing to invest that much there either.

If AxiaFunder is an interesting platform for you, I would be happy if you use my link*. My reward is 50€.

![]()

I finally finished the Viventor topic in August. The write-off was a bit heavy and certainly needs to be corrected as the numbers are complete bullshit. 206,11 EUR I have thus written off, which leads to a final return of -22,26%.

Crowdestate already saw some movement in July, and the first small repayments even followed in August. The IRR was -8,00% at the end of August and there is still 168,25 EUR on the account.

![]()

At Debitum Network, the withdrawal of my investment is proceeding a bit faster. There are only 6,59 EUR left with an IRR of 8,67%.

As explained in previous months, the red flags at TFGCrowd are piling up and there is no recommendation from me! Nevertheless, on a recovery is being worked on, at least that's what was communicated via inbox. However, the costs for this will be passed on to the investors. In August, 409,86 EUR are still invested at TFGCrowd. The IRR is still 17,12% and continues to fall.

Portfolio performance income

Well, in August it unfortunately didn't work out to reach the 300 EUR in interest. This is due to the reallocations that I still make. But it is also once again due to Crowdestor, which simply does not provide the constant cash flow that one would expect with the amount of the investment. 270,74 EUR came together at the end of the month.

Affiliate/referral income

I mentioned that I'll be more transparent regarding income of affiliate sources. You have seen that I write down what I get in return if you're using my links. In addition, I would like to give an update on my affiliate income in August. This one was a positive outlier and I was able to collect a total of 130,66 EUR, spread over three platforms.

Referral income I received from the following platforms:

- Lendermarket*: 5,95 €

- Moncera*: 7 €

- Quanloop*: 8,28 €

- Reinvest24*: 6,18 €

Summary

That's it again with my P2P portfolio update August 2021. As last announced, just had to withdraw some money from Bondora Go & Grow. Overall, the portfolio is getting a little lighter, as I want to unwind the legacy and do everything I can to build a stable cash flow. Of course, this all takes time!

Feel free to let me know in the comments how your P2P investments are going or which platforms you have worries and concerns about!

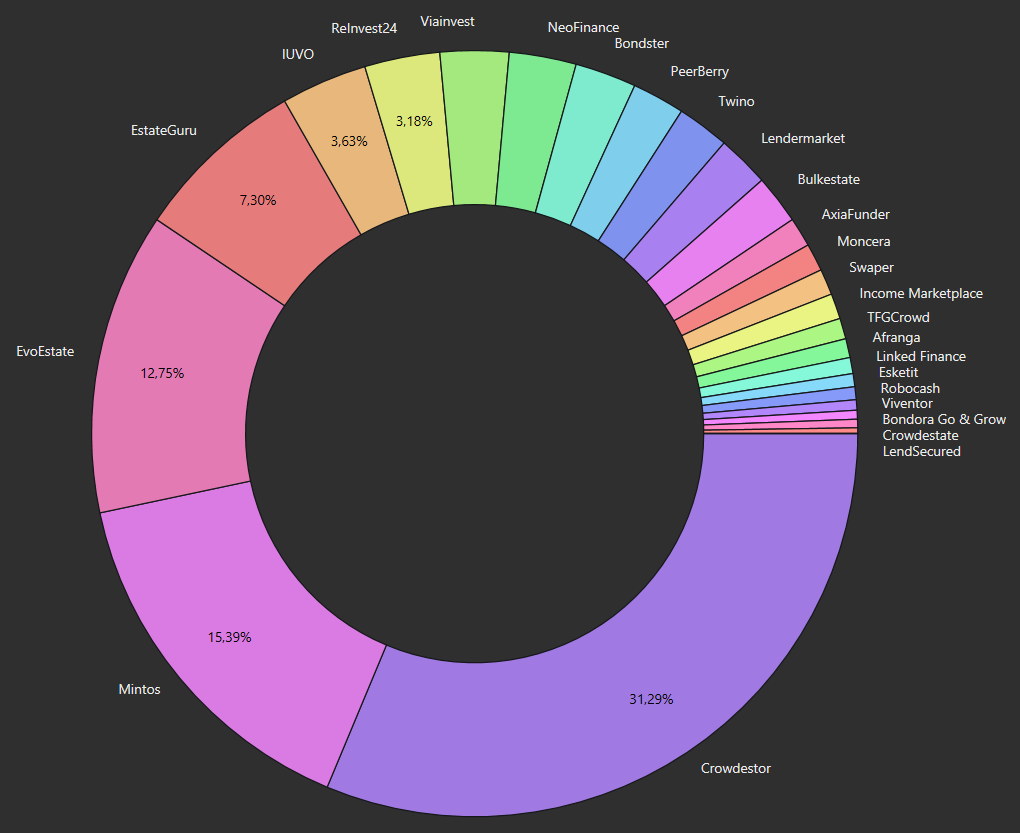

Distribution by P2P/Crowlending classes

Below you can find my distribution between the individual P2P / crowdlending classes for August.

- 36,82% (+0,57%) P2P (Buy-back)

- 32,39% (+0,24%) Crowdlending

- 0,69% (+0,02%) P2B

- 25,66% (+1,14%) P2B (Real estate)

- 2,83% (+0,09%) P2P

- 0,37% (-2,07%) P2P (Short-term)

- 1,24% (+0,01%) Misc. (AxiaFunder)

I hope you found my summary interesting as always. I'm always open for constructive criticism and suggestions. Follow me on Instagram. There I post not only about P2P and crowdlending, but also about stocks, dividends and options. So have a look! We will read about the next portfolio update in September/October.

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (investdiversified) in which I invest myself. Also, on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!