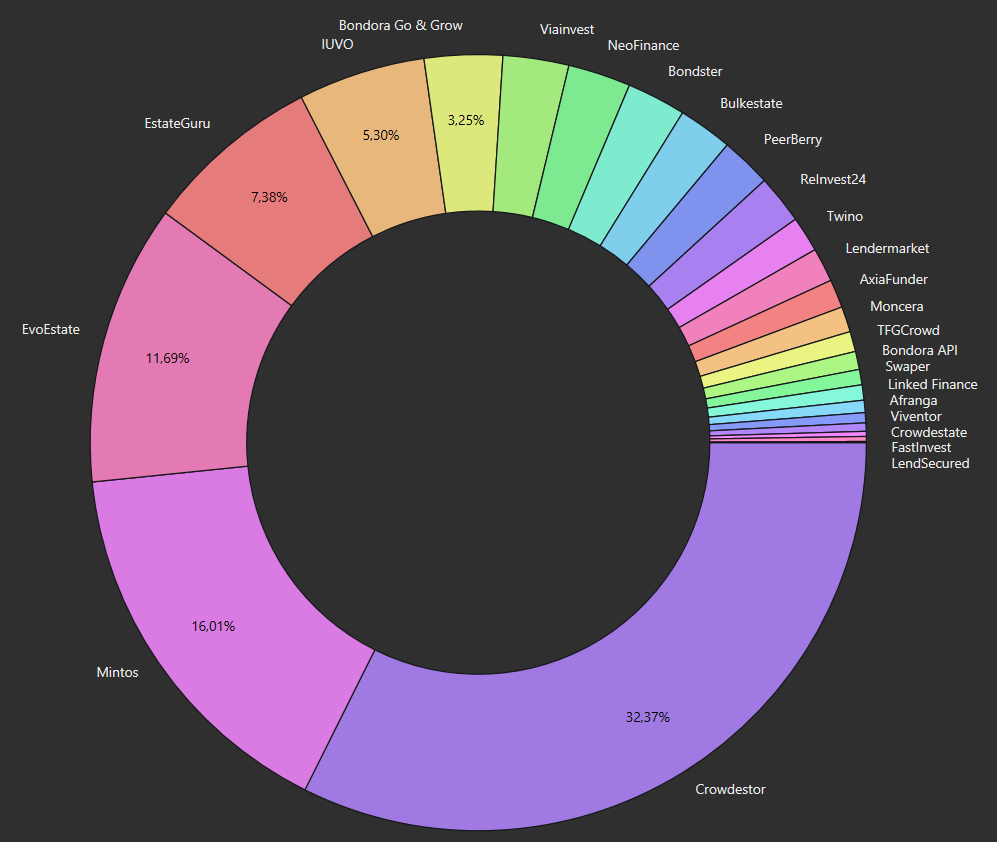

Hello dear interest lovers! Today there's again an update about changes in the individual P2P platforms with my P2P portfolio update April 2021. Let's go!

I would like to start today first with the current actions of the platforms, then briefly something about the current “strategy”. Then, as usual, comes the IRR ranking, to then look more closely at the individual platforms. With this blogpost I also want to change a little something again. I divide the platforms this time into platforms where I continue to (re)invest and possibly even increase, platforms that I let expire or the investment was stopped and I first reduce my investment. For platforms that I'm still testing, I write that it is a test balloon.

‘Strategy'

Another thing about the current strategy. Currently, I withdraw from platforms that bring me more than 10 EUR interest per month and build up some cash or redistribute it to other platforms. So I'm much more flexible and can consider whether I use it in the following month to specifically increase a platform or leave it as cash and invest elsewhere if necessary.

IRR ranking April 2021

I've selected the 01.07.2017 as a start, as this is where I started tracking my P2P investments.

Platform | Initial investment | IRR (%) | Change previous month (%) | Invested (EUR) | Change previous month (EUR) |

|---|---|---|---|---|---|

19.07.2017 | 13,30 | -0,11 | 7802 | -50 | |

30.10.2017 | 10,59 | -0,10 | 722,25 | +204,20 | |

09.11.2017 | 6,75 | -0,04 | 1585 | -98 | |

14.05.2018 | 12,78 | +0,03 | 1028 | -10 | |

31.07.2018 | 12,63 | -0,04 | 2581 | -16 | |

11.08.2018 | 12,56 | 0 | 311,96 | +3,03 | |

01.02.2019 | 9,57 | -0,07 | 3598 | +24 | |

14.02.2019 | 13,31 | +0,03 | 1273 | +14 | |

20.02.2019 | 9,05 | +0,93 | 994,24 | +143,35 | |

Viventor | 21.02.2019 | 7,66 | -0,13 | 206,11 | 0 |

21.03.2019 | 8,95 | -0,45 | 15770 | -181 | |

30.03.2019 | 11,31 | 0 | 1197 | -9 | |

12.04.2019 | 11,49 | +0,02 | 1336 | -7 | |

17.05.2019 | 7,45 | +0,09 | 1100 | -55 | |

Crowdestate | 20.05.2019 | -8,21 | +0,06 | 168,25 | 0 |

31.07.2019 | 3,82 | +0,05 | 5697 | -24 | |

TFGCrowd | 04.11.2019 | 18,95 | -0,52 | 409,86 | 0 |

31.01.2020 | 8,51 | -0,02 | 22,78 | -28,87 | |

15.02.2020 | 16,21 | -0,35 | 690,54 | +206,51 | |

20.02.2020 | 6,67 | -0,03 | 309,49 | +1,58 | |

04.05.2020 | 18,02 | +1,05 | 59,90 | +1,29 | |

19.05.2020 | 19,99 | +0,33 | 366,73 | +6,03 | |

29.05.2020 | 4,04 | -2,83 | 576,69 | -11,17 | |

22.07.2020 | 9,92 | -0,28 | 518,58 | +130,18 | |

28.01.2021 | 10,12 | -2,89 | 101,48 | +0,48/td> | |

21.03.2021 | 4,95 | +1,61 | 250,59 | 150,50/td> | |

30.04.2021 | -0,92 | +0,06 | 48676 | +391 |

Platforms

(Re)investing

Currently I'm in a kind of withdrawal phase or consolidation / reallocation. On the following platforms, however, I continue to reinvest and plan to increase the investment moderately in some cases.

P2P (Buy-back)

At Mintos, little has changed in April compared to the previous month, when I adjusted the auto-invests. On the part of the platform itself, however, there was another AI update. So you can now not only select the loan provider, but also the individual companies. Be sure to check your AIs to see if everything fits! At the end of the month there were 7.802 EUR on the account. I deducted most of the interest (60 EUR). The IRR was 13,30%.

Even if Mintos is one of my largest platforms, still 18,2% of my investment is questionable. Namely all pending payments and loans in recovery.

I have temporarily switched from the affiliate link to the referral link at Mintos* to be able to use the advantages of the Mintos Investor Club at some point. Unfortunately nothing changes for you, only I get a bonus from 10 EUR at 500 EUR investment.

In April I withdraw again 20 EUR from IUVO. 2.581 EUR are currently invested with an IRR of 12,63%.

Marking 10% of the capital as questionable seems to be appropriate because of the amount of HR loans.

- For IUVO there are two different offers. Unfortunately the referral program is extremely unattractive since a few days. For the first you can contact me because unfortunately it has to be done manually, and I have to invite you. You get 1,5% cashback for investement above 1.000€. I receive 1,5% too.

- With the 2nd offer (click on the banner) I get 5€ and 2% of the investment in the first 30 days and 3% for the investment of day 31-90

![]()

PeerBerry continues to shine with great numbers and rushes from one record to another despite the questions raised in the last P2P update about the group issue. The PeerBerry app came out in the meantime and is really not bad, as it provides a better overview of the distribution of loans across the individual loan originators. There was also a change in the board at the beginning of May, but more on that in the May update. My IRR at the end of April was 12,78% with 1.028 EUR invested. So here, too, I'm withdrawing cash.

One of the most solid platforms for over two years. However, the story with the group guarantee makes you think.

A while ago PeerBerry introduced a loyalty bonus, but with high requirements:

- 0,5% for 10.000€

- 0,75% for 25.000€

- 1% for 40.000€

If you use my PeerBerry* link, I'll receive 5€ + 1% from investments for 60 days.

Same shit different month. The interview with the new Bondster CEO Pavel Klema is still pending. If I don't get any answers by the end of May, I won't bother. The IRR ist 11,31% for an investment of 1.197 EUR.

I still see Bondster as a young platform and even if the collection of Polish loans works out very well, I see 30% of the investment as questionable.

There is a 1% cashback after 30, 60 and 90 days at Bondster*. I receive 2% .

In March I already announced that Lendermarket is a stock-up candidate for me. Now there is a good opportunity, because there is a cashback campaign again. There is a whopping 2% cashback on all new deposits until the end of June! My IRR is at 16,21%. Lendermarket itself shows me 14.12% with 690,54 EUR investment. So I have already invested a little more!

Because the platform is new and I only invested a few euros I won't put capital as questionable for now.

On the platform you get 1% cashback if you are using my link*. Additionally 2% cashback through the campaign running until the end of June. Currently, in total up to 17%! My reward is 5€ onetime + 1,5%

![]()

Swaper continues to run successfully, now and then a little cash drag, but this does not change anything in the IRR. This remains unchanged in April at 12,56% with an investment of 311,96 EUR.

Because I just have a few Euros invested I won't put it as questionable for now.

If you use my link* my reward is onetime 5€ + 2% cashback for 90 days.

![]()

As in March, there was quite a lot of uninvested money in the account at Viainvest in April. It seems that there are not enough credits coming in. The last mentioned workaround to stop and restart the AI should be used from time to time. Apparently it still doesn't work correctly. The IRR was 11,49% in April with 1.336 EUR invested.

In my opinion Viainvest is quite solid and so 0% of my capital is questionable (so far).

For the start at Viainvest* there is a 15€ bonus. For this only 50€ need to be invested. I'm also rewarded with 15€ if you register with my link.

Like Lendermarket, I have topped up Twino a bit with the funds withdrawn from other platforms. Currently, the IRR is 10,59% with 722,25 EUR invested.

So far, the platform has been running so solidly for 3 1/2 years that I don't consider my investment questionable.

Here* you can register. If you invest 100€ we both are rewarded with a bonus of 15€.

I have also increased my investment in Moncera, although the platform will continue as a test balloon. A little more skin-in-the-game does not hurt and also makes my reports more authentic. At the end of April, 518.58 EUR was invested with an IRR of 9,92%.

I'm watching the platform very closely, but so far I have no reason to consider my investment questionable. Nevertheless, the platform is of course very young.

If you use my Moncera link* I'll receive 1% on all deposits made by you in the first 60 days. This also supports my blog, so I want to say thank you in advance!

P2B (Real estate)

![]()

I continue to reinvest manually in EstateGuru. Invested are as of the end of April 3.598 EUR with an IRR of 9,57%. I'm invested here already over 2 1/2 years and so far everything runs as it should. Thomas from p2p-game.com has been invested for four years, which he reports about here.

I don't consider my invested capital to be ‘questionable'. So far EstateGuru has always ensured recovery.

At EstateGuru* there is a 1% cashback for 3 months until end of April. I also receive the cashback and in addition 5€.

![]()

At Bulkestate I have again a little money paid out, for lack of really new projects. Currently 1.100 EUR are invested and the IRR is at 7,45%. These are at least the numbers I expect. Both the account total and the XIRR should be a bit higher. Unfortunately, the whole thing is quite difficult to figure out, since repayment and interest are not shown separately and there are also partial repayments since some time. So I will have to smooth out the whole thing at some point.

I think about 9% of the capital is questionable, because of the two delayed projects and because I do not know how well the recovery is working. However, refinancing on Crowdestate is a step in the right direction.

If you use my link* I'll receive 2% cashback for 180 days and one-time 10€ until April 30.

![]()

Most recently I published a Reinvest24 blog post (about Moldova). In April, one project was successfully repaid and I was able to invest two new projects. The calculated IRR is 9,05% with now invested 994,24 EUR.

I consider 10% of my investment as questionable, as ReInvest24 is still a young platform.

If you want to invest on ReInvest24*, there is a 10€ bonus for you. I'll receive 1% of the investment.

I also withdrew some money from EvoEstate in April, as no suitable project was available to invest in. 5.697 EUR are currently invested in 83 projects with an IRR of 3,82%. By the way, the calculated return differs strongly from the “Net Annual Returns”, which are given with 10.93%, due to final maturity projects.

Although, EvoEstate is still one of the younger platforms. I don't (any longer) consider my capital to be questionable.

For EvoEstate there is a 0,5% cashback for 6 months with this link*. I get 0,5% too and one-time 5€.

P2B

![]()

Also in April, nothing was invested in Linked Finance via the AI. So here I must continue to observe whether new projects come and my AI can also strike. If not, I probably have to bite the bullet and end the investment. At the end of April, the IRR was 6,67% with a total investment of 309,49 EUR.

So far exclusively paying or already repaid projects. Only the lack of new projects clouds the entry. I do not consider my investment questionable at the moment.

Linked Finance doesn't have an affiliate program, so there's nothing for you or me. Nevertheless, you can register here if you like.

![]()

Strictly speaking, I already added Quanloop to my portfolio in April 2020 as a test balloon after publishing an interview with the platform on my English blog. In May I wanted to do a review and that's what I'm doing now in this April update. The investment has ended for me and I withdrew my money there as of 04/30/21. Right off the bat, this was hassle free and the money was in my Revolut account very quickly. I can not really report negative to the platform. Towards the end, 59,90 EUR were invested there and the IRR was at the end with cut-off date 30.04 at a whopping 18,02%, also thanks to the inflation compensation. Thus, I have received significantly more than the 13-14% set in auto invest.

You may now want to know why I'm now ending the investment anyway? That's easy to explain, because the platform is mega intransparent. To this day, I have no idea who receives my money and what it is invested in. I had already noted this before and this is also the reason why I initially invested only 50 EUR. In a real test, you would have to have more skin-in-the-game.

Anyway, ff you want to give it a try, you can use my link* to get a 5€ bonus.

P2P

![]()

With NeoFinance, things are also running smoothly so far, the red credits are at least no longer increasing that much. At the end of April 1.259 EUR are invested in NeoFinance and the IRR is 13,31%. I don't count the red credits as defaults so far, since they do make a payment from time to time. The manually selected loans have very strict criteria. Since I have been doing this specifically, the number of loans that are up to 90 days late has felt to be declining somewhat. However, I have yet to back up this observation with numbers. NeoFinance is one of the platforms where I have not paid out any interest, as there is a withdrawal fee. In the following screenshots a comparison of March 2021 and April 2021.

The return calculated by the platform is now 13,85% after an adjustment of the calculation. There is a deduction of 15% withholding tax (can be reduced to 10% by the way).

At least the 91-270 days overdue loans I have to mark as questionable even though some of them might pay in the future. I think approx. 17% of the capital is questionable in the current situation.

NeoFinance* changed and lowered their offer too. There is 1% cashback for you and me for 90 days.

P2P (Short-term)

![]() Go & Grow

Go & Grow

Go & Grow I mainly use for a small part of my cash and will also use it for my side hustle and savings for insurance payments. Because of the withdrawals from time to time and the fee of 1€ IRR is at 6,75%. However, I do not want to miss the liquidity available here. The total investment is 1.598 EUR.

I don't think my investment here is in question. Bondora has enough leverage.

5€ are available for you at Bondora* right after registration.

Crowdlending

In January I opened a new test balloon, namely at LendSecured*. As announced, there is a new type of loan, namely grain loans. Initially I invested 50 EUR in a first project and immediately bagged 1% cashback. In March a second project was added. The account currently shows 101,48 EUR with an IRR of 10,12%.

If you are interested in LendSecured, you can use my link*. I'll receive 10 € for the successful registration + 1% cashback for 180 days.

Stopped investment

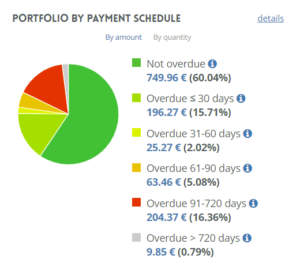

After the best month since December 2020, April was the worst in terms of cash flow. This was indeed very disappointing, as many projects paid late. May, however, looks a little better again, thank goodness. Nevertheless, I have made a decision for myself. I will first withdraw until I am back at 15.000 EUR investment. My new ratio, the delayed projects, continues to rise to now 52% (+6%). I had suspected this, but it is still not nice to look at. However, I took this risk consciously by buying projects on the secondary market, it must be said for the sake of completeness. My investment at the end of April was 15.770 EUR with an IRR of 8,95%.

Further, because of the risk of the platform and projects, 50% of the investment is ‘questionable' to me (regardless of the ~52% delayed projects). Especially due to the Corona pandemic, which will have a massive effect on tourism and restaurants.

With my link* there is 1% on top for 90 days on your investment! My reward is 1% too.

Withdrawing

![]() API

API

Another test balloon was the investment on Bondora via their API. After almost a year I have to end this experiment. On the one hand, Bondora clearly prioritizes Go&Grow, which can be seen from the fact that even through the API it is very difficult to invest more than a few euros per month. On the other hand, access to the API was terminated unilaterally. The plan was to let the investment expire, but I put the entire portfolio on the secondary market at a slight discount. Unfortunately, this took the whole of April as Bondora wanted to re-verify an already verified account. The sale of the portfolio went through in early May. So in the May update there is the final yield assessment. As of April 30, the investment was 366.73 EUR with an IRR of 19,99%.

A bonus of 5€ are available for you at Bondora* right after registration.

![]()

The British platform AxiaFunder offers investing in an area I haven't seen before because they offer investing in litigation cases. You can find an interview with CEO Cormac Leech at explorerp2p.com. Very worth reading!

My initial investment was £500. Yes, that's the minimum investment and a lot. You have to bring some capital with you in order to have proper diversification. The same is also possible for a total loss and even a loss of more than the invested money. My test project is not going very well and there might be a margin call soon. On the positive side returns of 20-30% p.a. are possible. So it's a high risk test balloon! In March the IRR is 6,87% due to currency effects.

I'm therefore letting my investment expire (if possible), because you need a lot of capital for a reasonable diversification. I don't have that and I'm not willing to invest that much there either.

If AxiaFunder is an interesting platform for you, I would be happy if you use my link*. My reward is 50€.

![]()

Also in April, Viventor has done a lot, oh but not! As already in March or even worse, it there was namely no interest at all. “Invested” are still 206,11 EUR or more or less, the numbers are not correct anyway. But my IRR is still at 7,66%. Nevertheless, stay away from the platform!

,

The situation is similar with Crowdestate, i.e. as far as my two remaining projects are concerned, not very rosy. The IRR was -8,21% at the end of April and there is still 168,25 EUR on the account.

![]()

At Debitum Network, the withdrawal of my investment is proceeding a bit faster. There are still 22,78 EUR left with an IRR of 8,51%.

As explained in previous months, the red flags at TFGCrowd are piling up and there is no recommendation from me! In April, 409,86 EUR are still invested at TFGCrowd. My projects I put with a discount on the secondary market unfortunately have a bit too much competition. The IRR is still 18,95%.

Portfolio performance income

April was very disappointing, as already described, and only 274,68 EUR in interest came across. This is the first time since September 2020 that I have fallen below my EUR 300 comfort level.

Affiliate/referral income

I mentioned that I'll be more transparent regarding income of affiliate sources. You have seen that I write down what I get in return if you're using my links. In addition, I would like to give an update on my affiliate income in April, which is very short. Because there was no such income.

Referral income I received from the following platforms:

- Moncera*: 26,70 €

- Reinvest24*: 22,91 €

- Quanloop*: 1,31 €

Summary

That was it again with my P2P portfolio update April 2021. For the first time in a long time I have not reached the goal of 300 EUR interest per month. This is certainly due to Crowdestor, but also due to my diversification. In the future, I will spread my investments again more, so that such lumps do not matter so much.

If there are any Crowdestor investors reading along, I would like to hear your opinion about the platform. Just write in the comments! 🙂

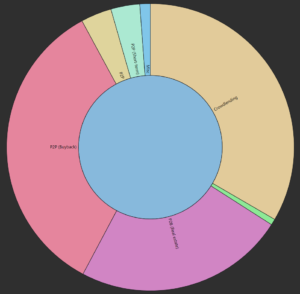

Distribution by P2P/Crowlending classes

Below you can find my distribution between the individual P2P / crowdlending classes for April.

- 34,34% (+0,20%) P2P (Buy-back)

- 33,39% (-0,07%) Crowdlending

- 0,68% (-0,14%) P2B

- 23,70% (-0,55%) P2B (Real estate)

- 3,46% (+0,01%) P2P

- 3,25% (+0,01%) P2P (Short-term)

- 1,18% (-0,01%) Misc.(AxiaFunder)

I hope you found my summary interesting as always. I'm always open for constructive criticism and suggestions. Follow me on Instagram. There I post not only about P2P and crowdlending, but also about stocks, dividends and options. So have a look! We will read about the next portfolio update in June.

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (investdiversified) in which I invest myself. Also, on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!