Hello everybody! Today I am writing about the events of the past few weeks at Kuetzal and new developments at Envestio and effects on the entire P2B industry. But that's just the plug, actually I want to show you which sources you can choose to get information about projects on the platforms and do your own due diligence in the P2B crisis.

Table of Contents

Podcast – P2P deep dive

You can also hear the whole thing about Kuetzal in the podcast (only in German), because I was a guest of Thomas from p2p-game.com. Together with Dirk, who is also invested in Kuetzal, we summarized the events with a bit of gallows humor, tried to evaluate them and showed possible options for further actions. First of all, there will be at least one more episode.

Kuetzal

I simply link here to the German-language document that Dirk created. The most important is summarized chronologically here. Unfortunately I had no time to translate it. I and certainly other investors have filed a complaint with both the German and the Estonian police and are also considering taking legal actions.

Kuetzal – die schillernde baltische P2B-Plattform

Envestio

Since January 13, many investors have been waiting for their withdrawals. As early as December there was an increase in requests for buybacks. You could see this quite well by the fact that older, fully funded projects were suddenly open again.

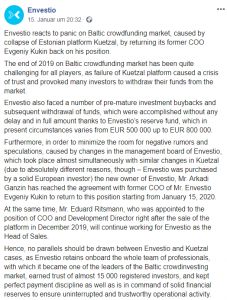

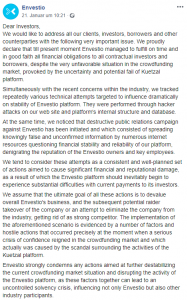

On January 15, the following statement was published on the official Envestio Facebook page:

After the pressure apparently got too big, a change of personnel was carried out and Mr Ritsmann was praised away as Head of Sales. Mr Kukin is said to return as COO. In the meantime, buy-back inquiries continued unabated. At Envestio, the fees are ‘only' 5%.

On January 21, the whole situation worsened with the following message:

And then it went quickly:

- The Envestio website has been down since January 22nd

- The new and old COO Kukin has deleted his Facebook and LinkedIn accounts

- Nothing was found looking for the offices (although bloggers have already been invited)

- ECN responded with a complaint

That's the situation roughly summarized. As for Kuetzal, there is a Telegram group for German investors, and there is also an international one. In the former you will also find a template for an advertisement with the Estonian police. Either way, an report is essential. In Germany it might also be advisable to be able to prove something for the tax authorities.

UPDATE 29.01.2020

I visited the address where Arkadi Ganzin lives, due to the information of the contracts. Big surprise. No such name name on the door bell nameplates and also the people there don't know the name and also didn't see the person on Ganzin's pictures in the past.

Reactions of other platforms

Wisefund and Monethera temporarily suspended the buy-back. In my opinion, this was the only way to survive for these two platforms and shows the general problem of such buy-back or early exit options. For younger platforms with a smaller volume that are then suddenly withdrawn (justified or not is irrelevant here), this would inevitably lead to a broken neck. Even a fee of 20% (at Wisefund) did not prevent many investors from applying for a buy-back, even though there are no rumors regarding SCAM etc. at the platform as mentioned today. Of course, one can now ask whether something like this is legal.

How to due diligence

Now we come to the topic of due diligence. Yes what is that again? Roughly speaking, the careful examination of projects in our case projects in which we invest. Ideally before the investment ;). Unfortunately I also have to admit that I have been neglecting this topic so far and I had to ask myself why obvious ‘red flags', for example at Kuetzal, were not noticed.

Artificial pressure

The platforms don't make it easy either. Countdowns to projects and auto invests, such as those at Envestio, that invested before the project started, put pressure on the investor. It would of course be fatal to miss a great project ;). In addition, not all information are visible on many platforms at the start of a project and one would have to ask the platforms themselves. The expenditure of time certainly discourages many.

Due diligence – Which sources you can use

Nevertheless, you should and have to take the time to check the projects thoroughly. Since many of the projects are located in the Baltic States, I will concentrate on them first. But let's get started.

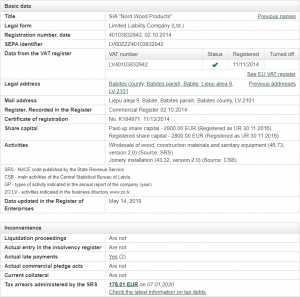

- Lursoft.lv or firmas.lv

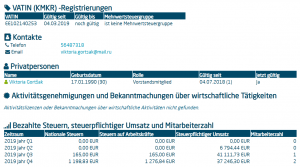

The Latvian site provides a good overview, provided you translate it into English or German using a browser. I'm looking for example after the company behind the latest Monethera project SIA Nord Wood Products, which looks like this:

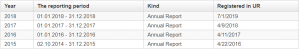

- Here you get a lot of information, such as the address, contact and e.g. the accumulated tax debts below. Approximately 179 € are not that wild, I would think. There is also more information about taxes and the annual reports.

- B2Bhint.com

The site pulls information from the company registers of different countries. I find this very interesting to make the connections between companies more visible. This information may help to rethink an investment decision that has already been made.

- Here you get a lot of information, such as the address, contact and e.g. the accumulated tax debts below. Approximately 179 € are not that wild, I would think. There is also more information about taxes and the annual reports.

- Lursoft.lv or firmas.lv

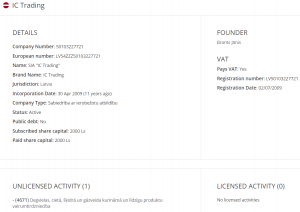

The (un) licensed activities and the founder field are interesting too. If, as with a project, the actual activity is gastronomy and then a project in the area of cloud computing services is to be financed, this is an incentive to look more clearly. In the screenshot below you can see SIA IC Trading (it's a coincident that it's also from Monethera). Here you can see which companies were also founded by the same person.

The (un) licensed activities and the founder field are interesting too. If, as with a project, the actual activity is gastronomy and then a project in the area of cloud computing services is to be financed, this is an incentive to look more clearly. In the screenshot below you can see SIA IC Trading (it's a coincident that it's also from Monethera). Here you can see which companies were also founded by the same person.

- Teatmik.ee

After the search for culprits in the Kuetzal case, it was looked up to see who is really registered as a shareholder. And lo and behold Miss Gortsak is the lucky one.

- Teatmik.ee

- The Handelsregister is of course recommended for German projects. For English projects it's Companies House.

Platform transparency

Before you get to the projects, you should of course take a closer look at the platform itself. So which points are important?

- Professional team with a good reputation and verifiable background and history (track record)

- It is clear where the head office is and what is maybe just a virtual office

- There are no major changes in the company (keyword sale of the platform in the case of Envestio)

- The terms of use are reasonable and do not change (as with Kuetzal)

- Support answers questions, possibly even the management itself

- Sufficient information about projects is available or available on request

- Ideally a longer track record of the platform itself

These points just occured to me in a quick way and are not complete.

Which sources do you use?

So since I'm not omniscient, I want to pass the ball to you. Which sources do you use for your research? I have certainly forgotten some or simply overlooked them.

If you have read this far, I would like to thank you 🙂 We will be reading again soon!

Revolut -My account for p2p and crowdlending

Since I don't want to transfer everything from my regular bank account to the platforms, I was looking for a simpler solution. A few months ago I stumpled upon Revolut. Since then I use the app for all financial transactions in the area of p2p/crowdlending and also in business context as freelancer with Revolut for Business*

After being skeptical at first I'm now a big fan of the app. The execution of transactions to the different platforms and also withdrawals is very fast. In addition you can with the free Revolut VISA card with max. 200€ cash limit per month at an ATM. And that without additional costs!

In addition Revolut is my faithful travel companion. Since I also work abroad from time to time I also looked for a way to simply exchange currencies. This is easily possible with the Revolut app. Also without fees (up to 6.000€ per month)!

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (invest diversified) in which I invest myself. Also on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!