Hi there! It's time again for a presentation of a new platform. It's somehow the ‘extended arm' of Placet Group, which many of you might know as a A-/B+ rated loan originator on Mintos. The platform's name is Moncera* and I had the chance to do an interview with their CEO Dmitri Pavlov.

Like usual, I wrote about how I ‘checked' the platform, how the platform looks like and asked some question which are interesting for me personally and I hope are also beneficial for you. Let's start directly!

Table of Contents

‘Due Diligence'

As usual I take a short look regarding the available information about a platform in the public registers. As Moncera is an OU teatmik.ee is the website I use for Estonian companies. Dmitri Pavlov, with whom I did the interview, and Aleksei Telitsyn are the two representatives. Besides that the page is clean as the company is quite young.

Platform

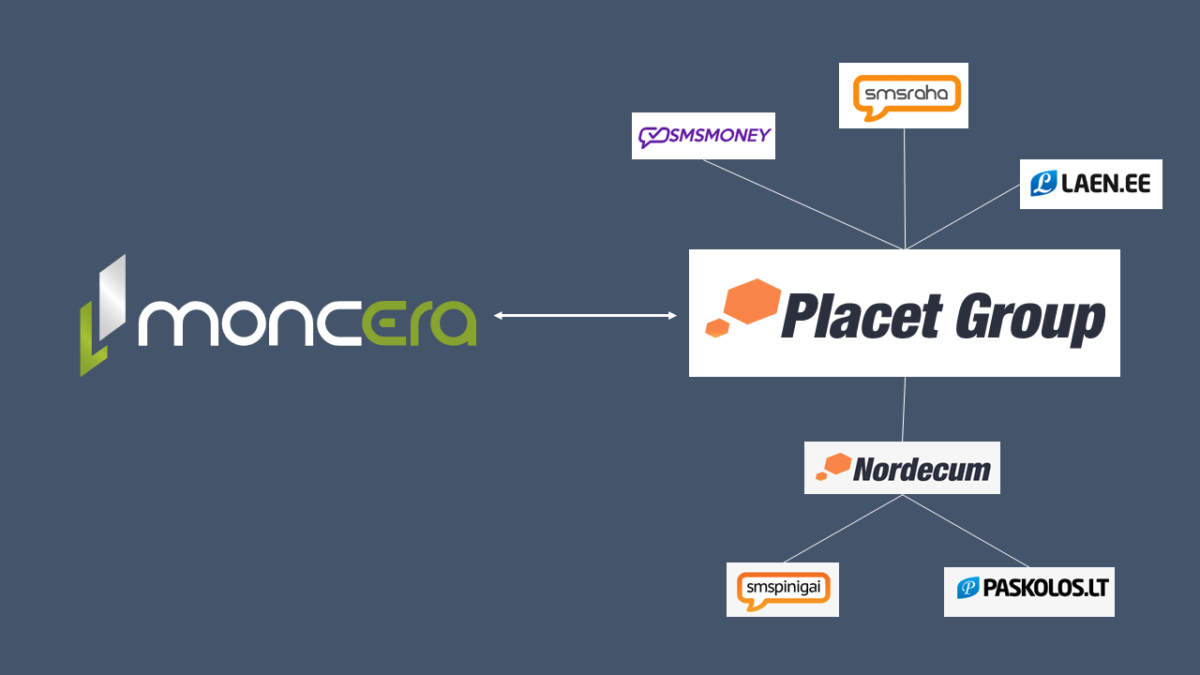

As you can see from the image of the blog post Moncera only offers loans from the Placet Group or its subsidiary Nordecum with their brands such as SMSMONEY or smspinigai. The interest rate is flat 12% with a term from 3 to 72 months.

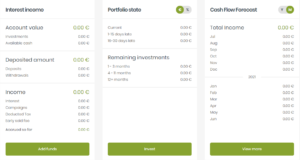

The dashboard shows and overview about the numbers. Especially interesting is that in the section Portfolio state only 16-30 days late is described. Why there are not more options we clarify in the following interview. Also interesting is the Cash Flow forecast on the right side.

Of course the platform has an auto invest. Nothing interesting here so far. But wait what's that? 1-Click-Exit???

How the 1-Click Exit feature is working I discussed with Dmitri in the interview.

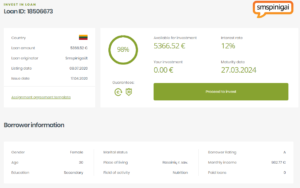

Also, nothing special regarding the details of single loan. The basic information are given I think including some details about the borrower. Also available, but not in the screen is the payment schedule.

Interview

What was the reason you found the platform?

Moncera was founded in March 2020, but the idea of creating a platform was adopted jointly with the PLACET GROUP in September 2019. Moncera is a platform created to attract

funding from Investors to loans issued by Placet Group in Estonia and Lithuania. Placet Group is a digital consumer finance company with its subsidiaries in Estonia, Lithuania

and Poland.

Who else is board member?

Alexey Telitsyn and me are members of the board and founders of Moncera. This information is also provided on our web page in the About us section.

My financial experience starts with Creditstar in 2008. Since 2015 I worked in Placet Group OU and been involved in integration with Mintos. In 2019, I decided to make a cooperation with Alexey and develop the same platform as Mintos.

Alexey has 20 years of IT experience. He worked for banks, developed and supported banking software, was engaged in the development of software for online stores, as well as financial

projects related with Placet Group.

How big is the team behind?

Our team consists of four people, which 100% focused on Moncera: Me as managing director, Aleksey as IT developer, client relation manager and customer support. Such services as accounting and marketing we are outsourcing. We're planning to hire more people at nearest future.

The platform/company was called Bancera OÜ before, why the change to Moncera?

We have started the registration of Bancera trademark and patent office has recommended changing the name due similar name on the market in financial sector. To avoid any doubts and future litigation we changed the name.

You offer loans from Placet Group and the sub-brands only. Will there be other loan originators in the future?

On present moment we have no plans to add more LO’s, instead of this we wish to concentrate on existing LO’s to offer best conditions on P2P market.

Why did you decide to partner with the Placet Group? How deep is that kind of cooperation?

We approached responsibly when choosing a partner, the key criteria were the duration of the activity, financial success, as well as reliability and confidence in the future. As you may

know, Placet Group is a company with 15 years of experience in the financial market, who lived over the crisis of 2008 and has never been, for all time of existence, in losses. Everyone

would like to have such partner. In view of the long-term personal relationships, it was decided to create a partnership with Placet Group and enter the P2P market with them.

Financial reports of Placet Group is available on their webpage www.placetgroup.com

What's the main difference between your platform and other P2P platforms?

High rated Loan Originator as Placet Group with its benefits:

1. Bank settlements each day, i.e. there are no pending payments

2. One click exit – instant liquidity for 0,5% from outstanding principal

3. 30 days buyback

4. Interest rate

How can you guarantee the immediate transaction in case of buyback or fast exit? And is there a buyback fund or something else or do you make the payment in advance?

Buyback and 1-click exit guarantee is provided by Placet Group. To avoid having any pending payments and ensure that investors money is always on Moncera account, we have agreed

with Placet Group to do Bank settlements each day and if the situation is required to, we can make even twice.

The cooling-off period is a really nice feature. I know a similar feature only from EvoEstate*. Is it just for convenience or what was the intention implementing it?

Almost every country in the world has passed laws to create ‘cooling-off periods' for specific transactions. We decided to apply such rule in our business too, offering to our investors a possibility to withdraw from transaction within 14-days without any consequences.

How many investors (active) do you have at the moment and from which countries are they?

Within 4 months of activity we have almost 1500 trusting investors, who invested more than €1 million. TOP 3 countries: Germany, Spain and Estonia.

Can everybody invest in Moncera or is it limited to individuals from Europe? Companies or US citizens as well?

Moncera gives an opportunity to invest both to private and business investors, who is the

resident of a European Economic Area (EEA) country.

Summary

- Moncera is a classic P2P platform, but wouldn’t call it marketplace

- They focus on the (Mintos) loan originator Placet Group

- Placet Group has 15 years experience, so started before the financial crisis

- With 12% the interest rate is higher for Placet Group loans than on other platforms

- The team has worked in the past for or with Placet Group which is good, because there is an existing business relationship

- But the platform and the team is quite young

Do I plan to invest?

It's somehow en vogue that platforms appear which have contracts with ‘better' credit companies (loan originators). For Lendermarket it's Creditstar, for Moncera* it's the Placet Group. The platform is new, the team small and somehow a blank piece of paper, so I'll invest 50-100€ in the next time and see how the development over the next months will be. Compared to the Placet Group loans available on Mintos the interest rate on Moncera is 2% higher. As soon as I invest the money I will track the performance in my monthly portfolio updates.

Bonus

There is a 25€ bonus until November 30, 2020 if you use my Moncera link*. To get the bonus you have to enter the code FB34OG3 during registration! And there are a few more requirements which you can find here. I will receive 1% on all deposits made by you in the first 60 days. This also supports my blog, so I want to say thank you in advance!

Revolut – My account for p2p and crowdlending

Since I don't want to transfer everything from my regular bank account to the platforms, I was looking for a simpler solution. A few months ago I stumbled upon Revolut*. Since then, I use the app for all financial transactions in the area of p2p/crowdlending and also in business context as freelancer with Revolut for Business*.

After being skeptical at first I'm now a big fan of the app. The execution of transactions to the different platforms and also withdrawals is very fast. In addition you can with the free Revolut VISA card with max. 200€ cash limit per month at an ATM. And that without additional costs!

In addition, Revolut is my faithful travel companion. Since I also work abroad from time to time I also looked for a way to simply exchange currencies. This is easily possible with the Revolut app. Also, without fees (up to 6.000€ per month)!

Using my links for Revolut I get nothing at the moment. Previously I got reward of £2.00-3.00 for a standard card order. For Revolut for Business I'd get up to 66,35€. Reason is that Revolut pausing their affiliate programs.

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (investdiversified) in which I invest myself. Also on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :).

*Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!

Just add me to your mailing list, please.

Hi Philipp. You’re welcome. Confirmation mail should be send out :).