Hello to a new blog post.

evoestate aggregator platform interview

This time it's about EvoEstate, the first aggregator platform in the P2P segment. In the blog post you will find a short presentation of the platform, followed by an interview with CEO Gustas Germanavičius. Finally, I would like to share my thoughts for includingEvoEstate in my portfolio. Happy reading!

Platform

As mentioned before, EvoEstate is the first aggregator platform in the field of P2P. As of today, 10 platforms are already connected via API. More will follow. For example well-known platforms such as Crowdestor, Bulkestate or ReInvest24 and even with Bergfürst a German platform.

Once a project is listed on the a particular platforms, it is also available for investment at EvoEstate. The minimum investment of 50 euros is positive. EvoEstate can also be used to invest in platforms that normally require significantly higher investment. An example here is ReInvest24 with 100€ or Bergfürst with even 500€.

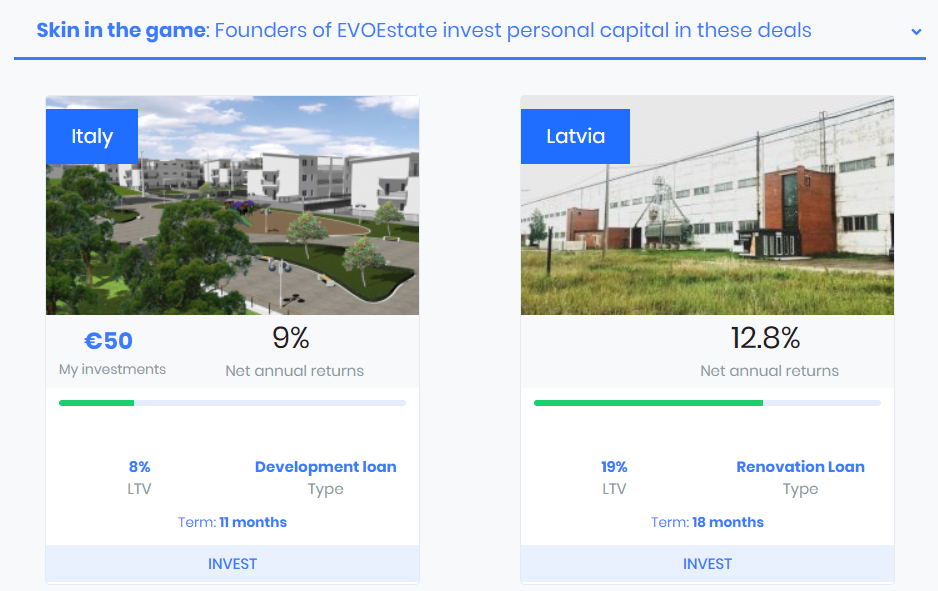

Furthermore, the projects are divided into skin-in-the-game projects and other projects. In the first the two founders are invested with their own capital. As usual there is a project description for each platform and for the skin-in-the-game projects also the reasons why they are invested or for other projects why not! There are also interesting information of already funded projects on Bulkestate or Crowdestor.

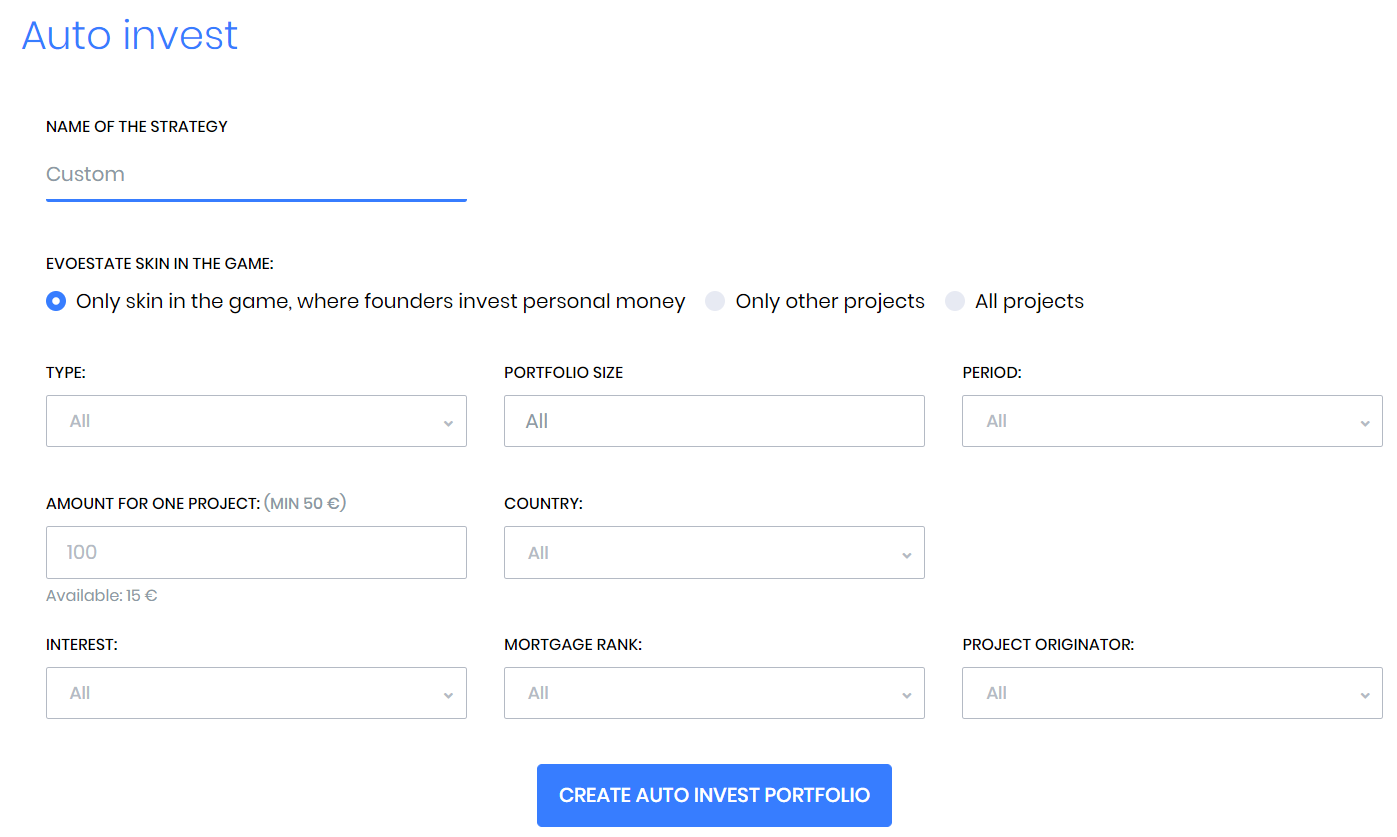

EvoEstate offers an auto-invest, which has been offering a great feature since yesterday. After all, you can exit projects that have been invested in by your auto-invest within 24 hours!In the following interview there is some interesting information about the expertise in the real estate segment and the architecture of the platform. If there are any questions, just write in the comments or email me. Enjoy reading!

Interview

Since EvoEstate is still quite new, what exactly are you doing? I think you are the first aggregator platform in this segment.

Yes, indeed. We are an aggregator for real estate deals, in Germany people often refer to as Meta Platform. The platform provides investors with a possibility to invest over 10 platforms deal-flow without having the hassle of signing up to every each of them. On top of that, we provide an additional layer of due diligence and supply investors with state of the art auto-invest and soon with the secondary market. Many of the platforms we work with do not have auto-invest or secondary market. We make money by charging a commission to the platform from the invested amount because we invest larger amounts of money.

Gustas Germanavičius

As transpareny is key I'd like to know some things. When did you found the company. And why?

We have established the company back in February 2019, however, we started out by working in a private mode with selected investors, that we could get the feedback and work on finding bugs and improving the security side of the platform.

Our team has been investing in P2P real estate deals for more than 6 years now and we felt that there’s a need for such a platform. If you want to truly diversify your portfolio, it’s impossible to keep track of upcoming and already existing investments, not to mention the accounting.

Gustas Germanavičius

Can you tell me more about the team behind EvoEstate?

My name is Gustas Germanavičiusand I’m the CEO of EvoEstate, before starting EvoEstate I had built and sold a venture-backed startup WellParko. (Interesting fact: we had the same investors as EstateGuru)

Audrius Visniauskas CIO- has spent long years in internet businesses and sold 2 of them in the past. Before EvoEstate he was a full-time investor in startups, stocks, real estate and P2P.

Our CTO Volodimyr Gizny has been developing internet products and platforms for close to 20 years now and is in charge of the technical aspects.

Although we are 3 people working full time, we have a property advisory network and work with multiple law firms in different countries and the rest is being outsourced.

Gustas Germanavisius

Where does your expertise in real estates come from?

Our expertise comes from personal real estate investments, family property businesses and our advisory network, which helps us understand the investment opportunities in different countries.

Gustas Germanavičius

How many platforms you support at the moment? And are there plans to integrate more of them?

At this moment our clients were able to invest in 10 platforms through EvoEstate, however, the number of the partners is higher we haven’t launched their first deals yet.

Yes, we are always working to integrate more platforms, our goal with time, of course, it to integrate every platform. I believe that by the end of the year we should have 17-20 platforms.

Gustas Germanavičius

How does the ‘integration' work in detail?

It is spread out to few stages. First is to get the data, the pictures, descriptions and the documents. Secondly, is to enable us to reserve the amounts, meaning, that we only make the transfer when the project is fully financed.

Gustas Germanavičius

Could you give me a step-by-step example how a project comes to the your page?

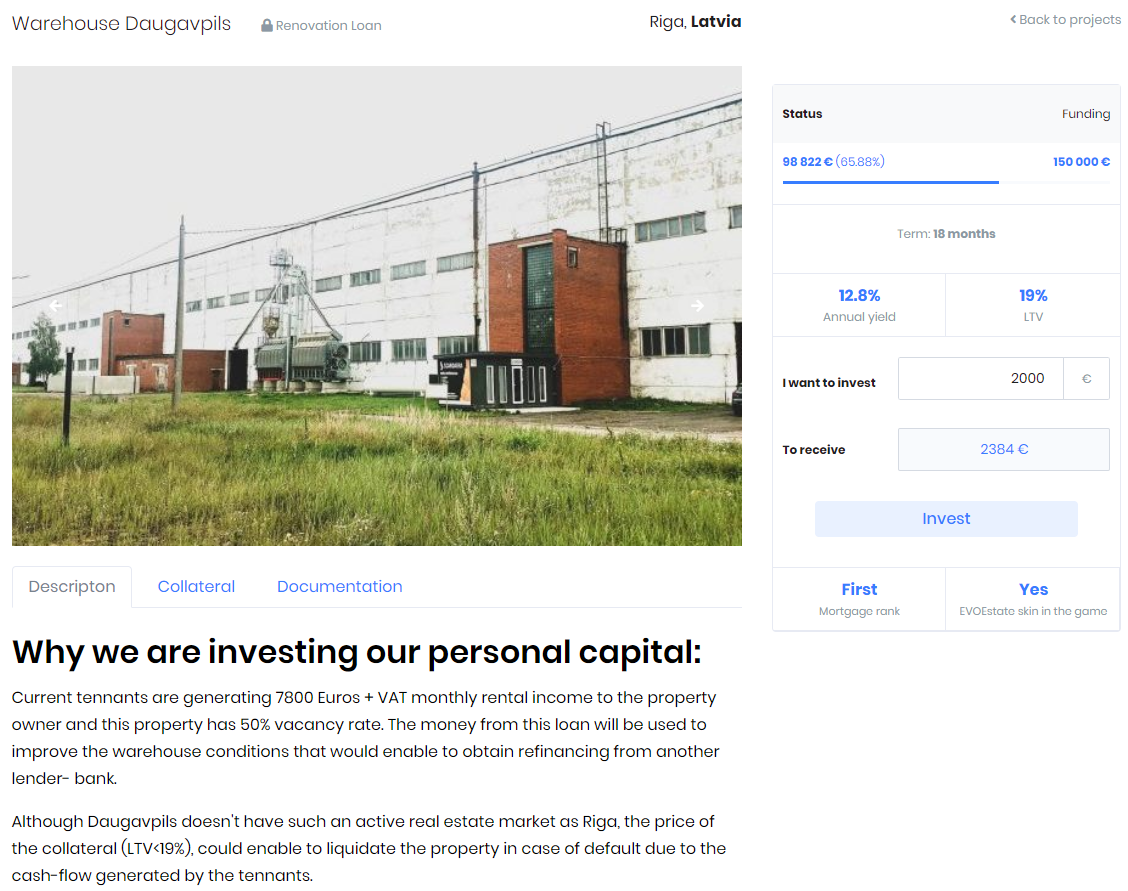

Basically, once we have the systems integrated with the API the project comes instantly if we don’t have it fully integrated at that moment, it can take a little longer. Before we publish the projects we always try to asses the risks, write about them to investors and make an investment decision ourselves to decide whether or not it’s a skin in the game project.

Gustas Germanavičius

How do you select the ones you have skin-in-the-game yourself?

It always has to have a proper risk-reward ratio. If it’s a high-risk project we always expect to have high returns in order for us to invest, usually we are always looking for low risk, medium or high returns projects or some lower risk lower returns projects for diversification.

In order to have a well-balanced portfolio it has to be mixed with both loans and buy to let projects, the way I personally look at this it’s like having stocks and bonds, bonds are the buy-to-let projects which help to reduce the risk. Here’re some additional thoughts.

Gustas Germanavičius

What if a project missed the funding goal?

Nothing happens. The investors’ capital is returned to their wallet. So the regular approach.

Gustas Germanavičius

Minimal investment is about 50€. What if the platform the project comes from has a minimal invest of 100€ and there is a gap at the end. Do you invest more of your own money?

Yes, we are always investing our personal money. At this stage me & Audrius already have 30,000 Euros invested through EvoEstate already. When we have skin in the game project, we are investing at least 1000 euros per deal.

I think, the low number of deals at this stage is mainly due to the summer. In comparison we had 19 projects in July. We are integrating few platforms now and I believe with September the deal-flow should increase.

The platforms are in charge of the recovery process, however, we always represent our clients and in such situation, we would act on their behalf. In case of misconducts we would also be able to use our legal power.

I think this is a marketing trick. Those funds or guarantees would not have enough funds to cover a default.

We will not introduce it as with EvoEstate we believe that the truth is the essential foundation for positive outcomes. Real Estate P2P already has underlying assets (mortgaged property) which could be used to recover investors capital.

Yes, we are actually testing it privately and hope to open it in a period of weeks.

Our plan for 2019 is to complete the product. That means we have the secondary market, make it liquid and have 17 partner platforms in total. Next milestone is to have all the Spanish platforms available on EvoEstate.

Why I invest in EvoEstate?

What is my blog's name again? Exactly Invest diversified! And that's what it's all about. EvoEstate is a great way to diversify even further. It opens up the possibility to invest in other projects of platforms that I didn't know until now and also offers projects from previously foreign real estate markets. In addition I find the skin-in-the-game projects very interesting, especially the descriptions. All in all, I will increase my investment at EvoEstate significantly in the future. At the moment, I am only invested in three projects with a total of 215 Euro.

If you want to try out EvoEstate, you will receive a starting bonus of 15 Euro with the links in the blog post.

About new projects on Twitter and Instagram

On my own behalf, I would like to mention that I also present new projects on Twitter and Instagram, in which I invest myself. So just follow me :).

Thank You for the interview

You’re welcome 🙂