Welcome to 2022! I hope you've had a great start to the new year! In week 2, as usual, we take a look back at the dividends in December 2021 and their contribution to my monthly cash flow. Let's go!

Dividends in December 2021

In 2020, due to the crash, I was able to put together a nice portfolio, which not only, but already has some stocks that regularly pay me a nice dividend. I would also like to use this blog series to report on dividend increases, decreases and cancellations, and how I deal with them.

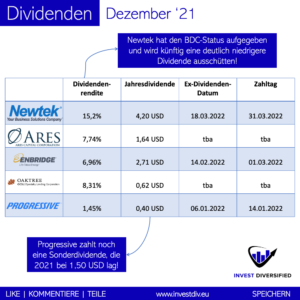

In December, several BDCs paid a dividend at once, and there was also a special dividend or two. This again provided lots of cash flow, to be exact I was paid 636,21 EUR. In total, there were 4.689 EUR in dividends last year. As always, the figures are neither gross, nor net, but somewhat mixed. For the US dividends, for example, 15% withholding tax has already been deducted. For dividends from UK companies, there is no withholding tax deduction.

- Newtek Business Services

First place this time goes to the former BDC Newtek Business Service (NEWT), which transferred me the equivalent of 78,75 EUR net. NEWT has shed its BDC status and will now continue to provide cash flow as a bank. Nevertheless, the dividend will be lower in the future. - Ares Capital

In second place is probably the best managed BDC Ares Capital Corp. (ARCC) with the equivalent of 63,29 EUR. It is currently trading at a 16% premium to NAV. - Enbridge

Rank 3 goes to Canada to Enbridge (ENB). The pipeline operator paid a dividend of 54,54 EUR. - Oaktree Specialty Lending

Oaktree Specialty Lending (OCSL) came in 4th place in December with 46,53 EUR net. The business development company's share price performance looks awful, but the legendary Oaktree has only been on board here for a short time too! - Progressive

Last but not least this time an insurance company. December saw the big dividend of the equivalent of 39,48 EUR from Progressive Corp (PRG). The quarterly dividend is very small with only 0,10 USD, but you will be compensated at the end of the year.

There are many other and smaller dividends, which you can see in the screenshot above.

Dividend increases

- Franchise Group increased its dividend from 0,375 USD to 0,625 USD per share (+67%)

- Broadcom increased its dividend from 3,60 USD to 4,10 USD per share (+13,9%)

- Stryker increased its dividend from 0,630 USD to 0,695 USD per share (+10,3%)

- Union Pacific increased its dividend from 1,07 USD to 1,18 USD per share (+10,3%)

- Amgen increased its dividend from 1,76 USD to 1,94 USD per share (+10,2%)

- CVS Health increased its dividend from 0,50 USD to 0,55 USD per share (+10%)

- American Tower increased its dividend from USD 1,31 to USD 1,39 per share (+6,1%)

- India Fund increased its dividend from 0,61 USD to 0,64 USD per share (+4,9%). In addition, a special dividend for capital gains of 0,80 USD per share was announced.

- Franklin Resources increased its dividend from 0,28 USD to 0,29 USD per share (+3,6%)

- Enbridge increased its dividend from 0,835 CAD to 0,860 CAD per share (+3%)

- W.P. Carey increased its dividend from 1,052 USD to 1,055 USD per share (+0.3%)

My broker(s)

I have several brokers for my stocks, but the majority are German ones, so European readers of my blog cannot register there. As you may know I'm very transparent about the income I receive if you use one of my * affiliate or referral links. Most of the time there is a bonus for you, but never ever costs! Degiro is my second largest broker. A while ago they did a fusion with the German broker flatex and it's now the biggest broker in Europe. You can trade already from 0,50 EUR directly on the NYSE or other US stock exchanges. Also, I trade European options there.

If you use my link* and register an account on Degiro you get a refund of 20€ transaction credit. You only need to spend 20€ transaction credit within 3 months. If you do so, and only then, I have also the possibility to get a refund.

I've been with the German broker Trade Republic for a year now and they expand to Italy in the Netherlands! My savings plans for individual shares and ETFs have been running there for a short time. Free of charge! Otherwise, the trade is also quite cheap with 1 € fee for buying or selling securities. As a bonus you get a share/fractional share between 10€ and 200€ after your first investment!

If you use my Trade Republic link* I receive the same share/fractional share.

About new projects on Twitter, Instagram and Facebook

On my own behalf, I would like to mention that I also present new projects on Twitter (kaph1016) and Instagram (investdiversified) in which I invest myself. Also, on Facebook I have a page. There are also a few insights into how I invest in other areas. So just follow me :). *Some links in my posts are affiliate or referral links. That means I get a little bonus. For each of those who use these links, however, there are no costs or other disadvantages. On the contrary, there is usually a start bonus or cashback. So if you use these links, you support my blog and for that I say thank you in advance!