Hello everyone! Yesterday I already published an abridged version on Instagram, today I’m publishing the full interview with Indemo* and CEO Sergejs Viskovskis. I’m also taking a closer look at the new platform in my P2P portfolio. Enjoy reading!

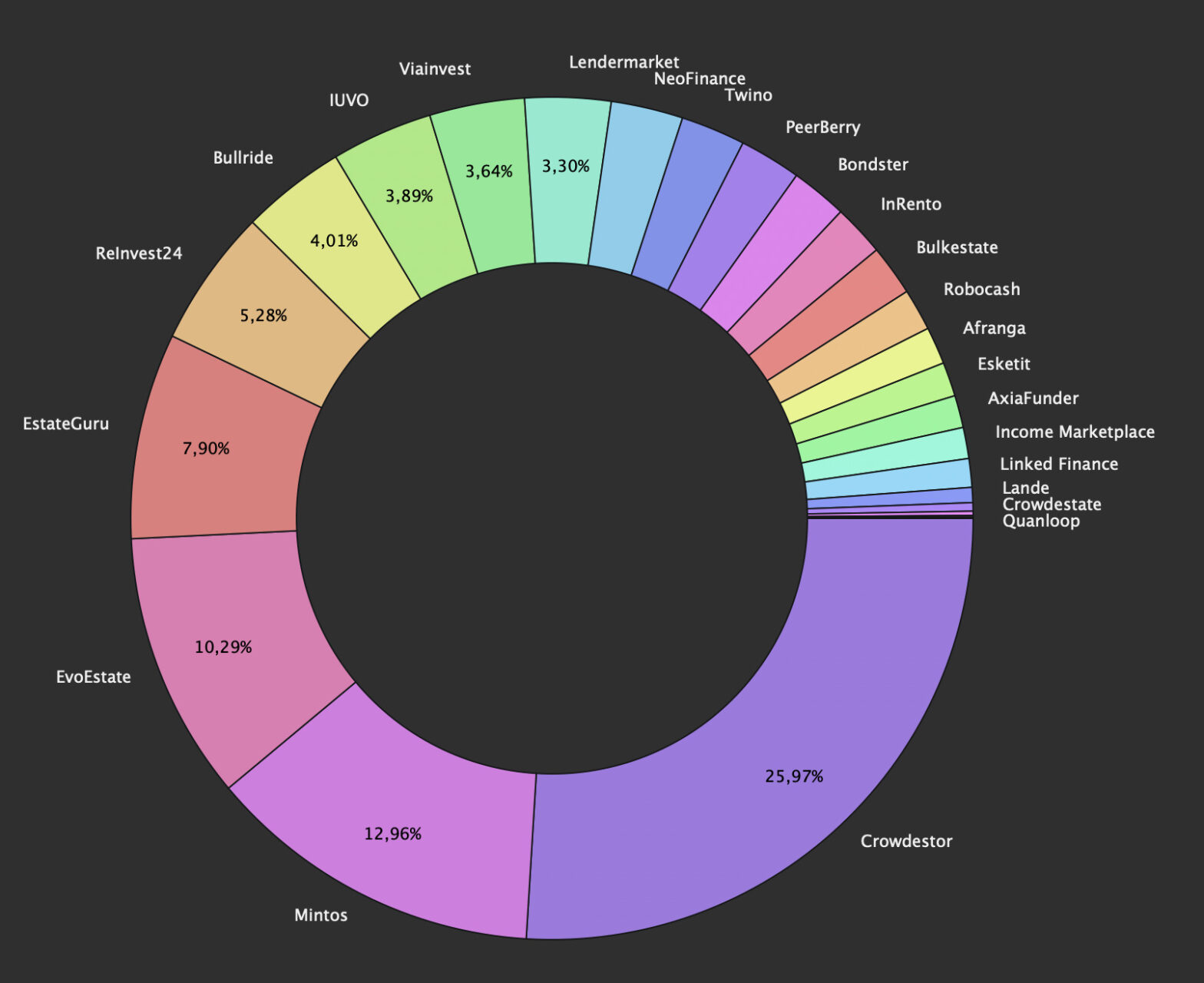

P2P portfolio update July 2023

Hello there, interest enthusiasts! Today, we’ve got another P2P portfolio update July 2023, letting you in on the latest happenings in the world of P2P lending. Surprisingly, July brought in a bit more cash flow than expected. In the following blog post, we’ll dive into the reasons behind this. Enjoy the read!

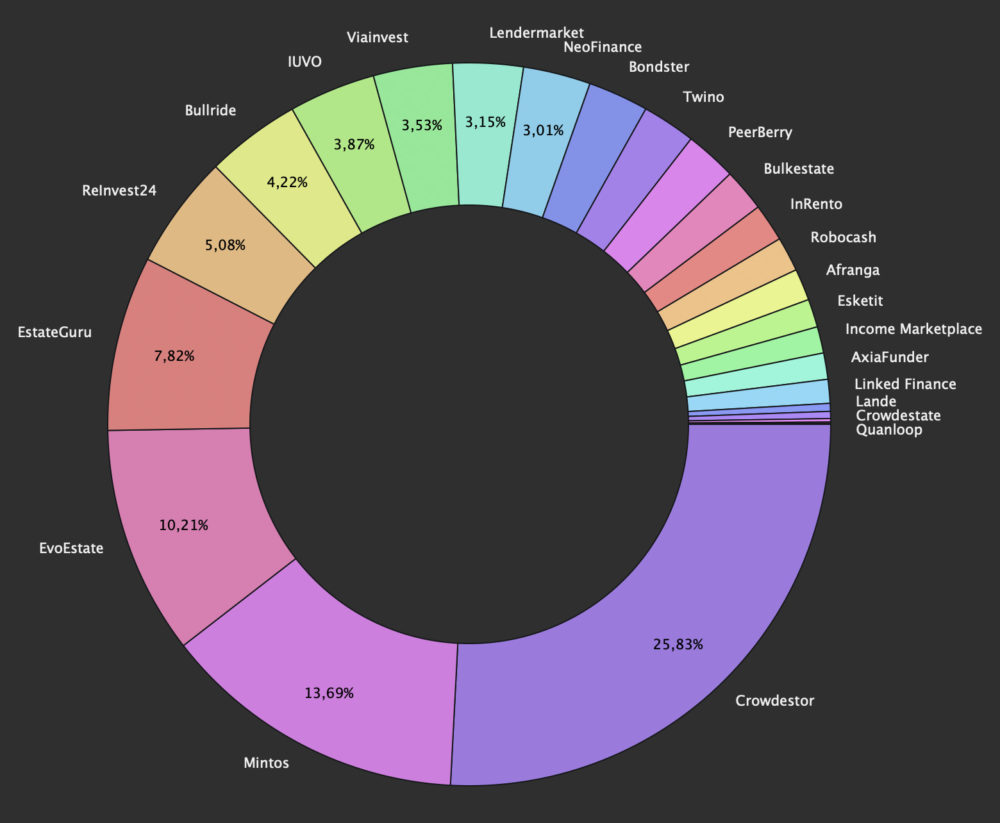

P2P portfolio update June 2023

Hello everyone! It’s been an unusually long time without anything to read in the P2P sector. But that changes now. With today’s blog post, I’m bringing you the P2P portfolio update June 2023. Enjoy reading!

My history with Debitum Network

Hello again! In today’s blog post, ‘My History with Debitum Network’, I’ll share my past experiences with the platform and discuss why I withdrew my investments. But that’s not the end of the story! Stay tuned as I reveal my plans to reinvest and explore the exciting changes happening at Debitum Network. Let’s dive in!

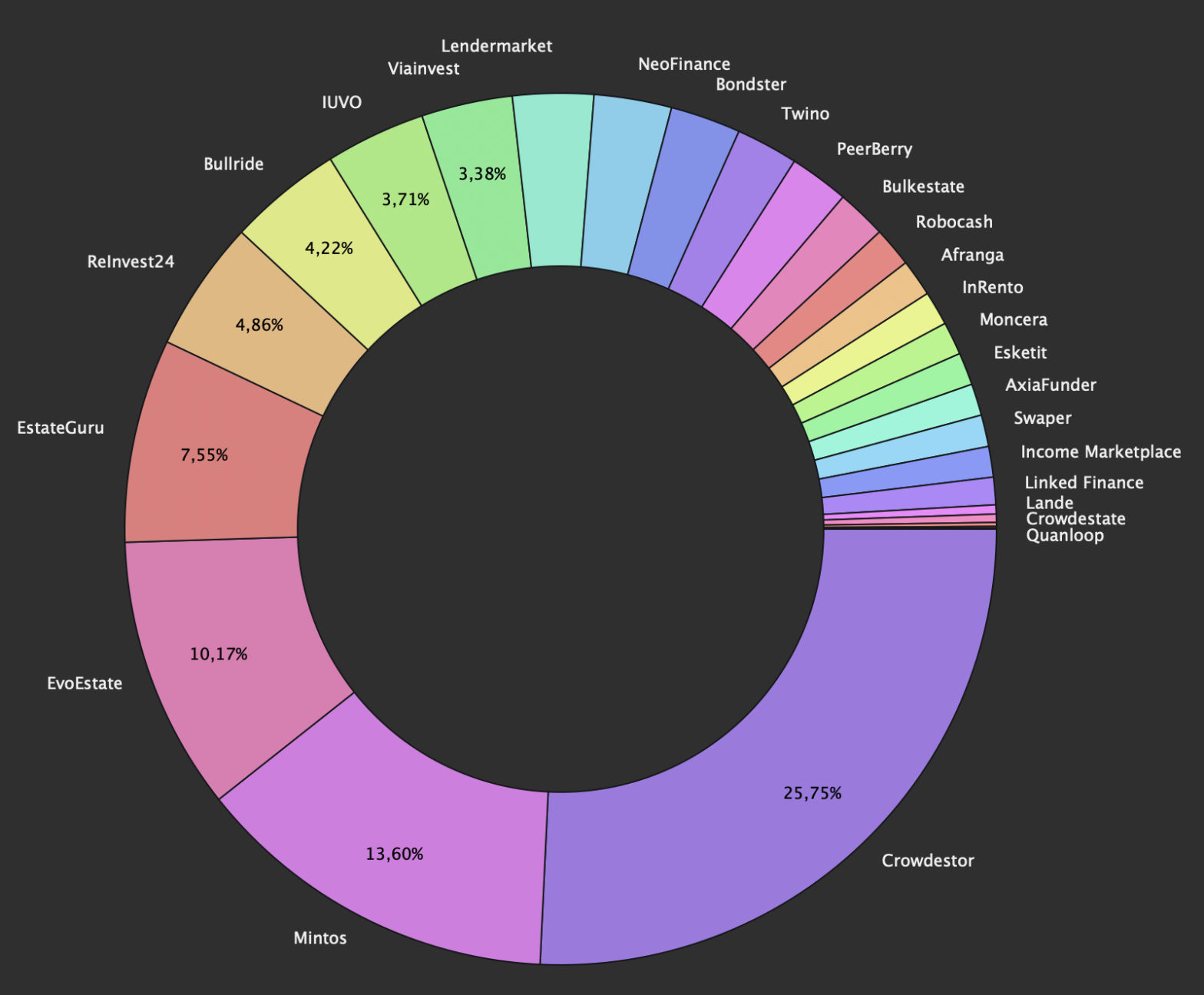

P2P portfolio update November 2022

Hello dear readers! With great strides, we are approaching the end of this crass year. In October, unfortunately, there was not enough time for an update, but the P2P portfolio update November 2022 I publish today. I am currently setting the course for 2023 as far as P2P is concerned. Have fun reading!

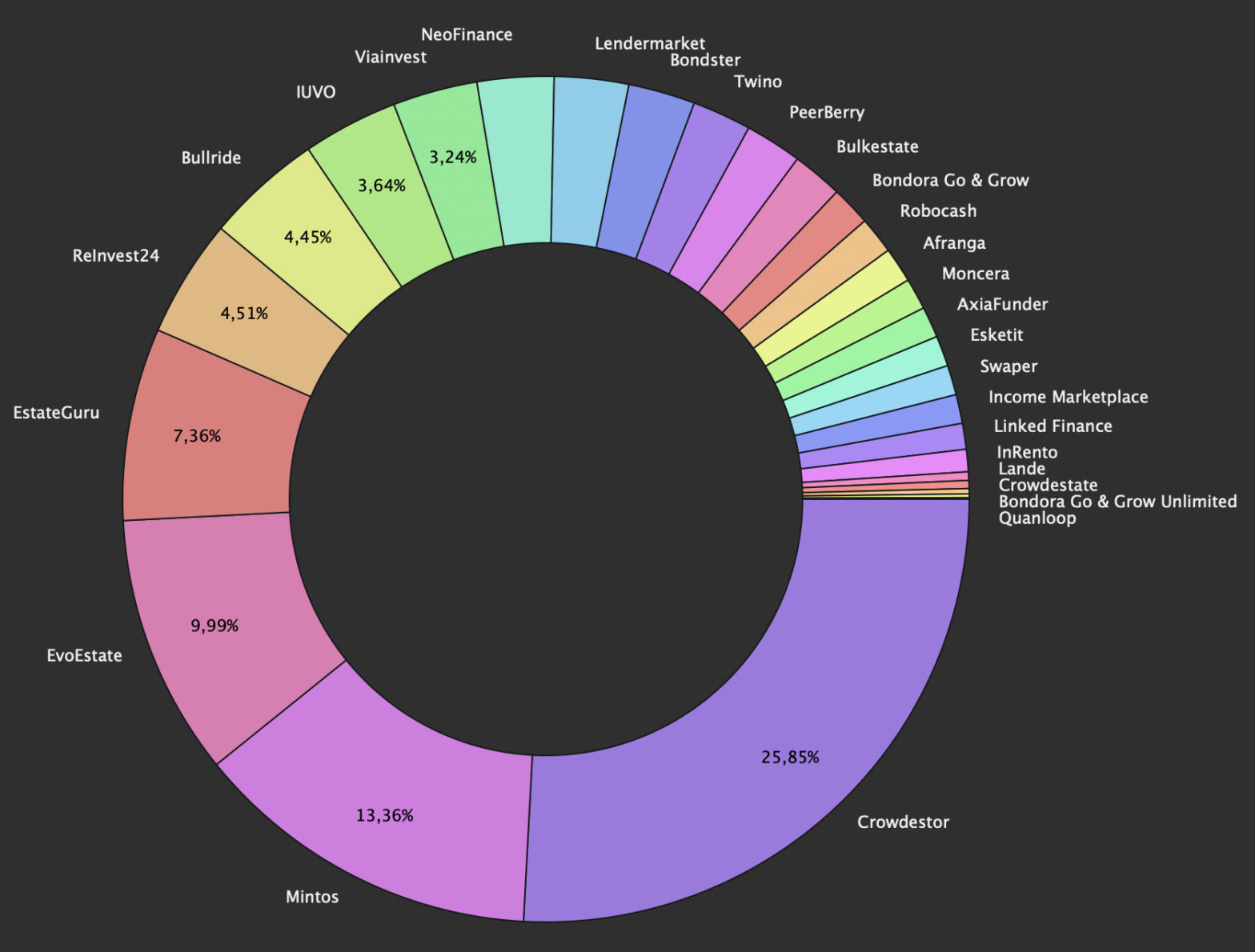

P2P portfolio update September 2022

Hello everybody! Once again I would like to welcome you to an inventory of my P2P portfolio, namely the P2P portfolio update September 2022. Last month there were quite a few outflows, as I wanted/needed to fill the money bin a bit and also opportunities are increasingly opening up on the stock markets. Have fun… Continue reading P2P portfolio update September 2022

Interview and review with Reinvest24

Hello again! In today’s blog post “Interview and Review with Reinvest24” I would like to talk a bit about the Estonian P2P platform. I’ve been invested there for 3 years now, and a lot has happened in that time. I also asked CEO Tanel Orro for a short interview. Have fun reading!

Interview and review with hive5

Hello, dear P2P friends! In today’s blog post, I would like to introduce you to a new P2P platform after a long time. We are talking about hive5! In the context of “Interview and review with hive5” I took a closer look at the platform and asked CEO Ričardas Vandzinskas some questions. Enjoy reading!

P2P portfolio update August 2022

Hello dear readers! We are already in the middle of September and I still owe you the P2P portfolio update August 2022. As always, there is pure transparency for you, what has happened in terms of P2P with me. Enjoy reading and feel free to leave a comment!

P2P portfolio update May 2022

Hello P2P friends! In today’s blog post P2P portfolio update May 2022 we look back to the previous month. There are indeed some changes again. Have fun reading!